The first trading week of January 2026 was a surprise of power in the large cryptocurrencies. At the time of writing Bitcoin holds around $92,000 with $1.83T market cap, showing resilience despite previous predictions of downturn.

Ethereum maintains around $3,100 at $377B, demonstrating solid fundamentals. XRP gained momentum to become the top-ranked and climbed to $2.25 with a volume of $136.62B trail by institutional ETFs.

Such a force has a trickle effect across crypto markets. Understanding why majors perform well and how that benefits emerging projects like Pepeto ($PEPETO) at $0.000000176 provides strategic advantage for positioning in 2026.

What Drives Bitcoin Strength

Bitcoin’s near $92,000 positioning comes from multiple converging factors. The institutional adoption is in full frenzied growth, according to CoinMarketCap. Spot Bitcoin ETFs accumulated substantial inflows during late 2025 and early 2026. There is continuous daily purchasing of BlackRock and Fidelity products. These are not speculative retail flows. They are the classic finance in the systematic collection of exposure.

Macroeconomic conditions favor Bitcoin currently. The policies of the central banks are an indication of possible reduction in rates in the year 2026. Historical patterns show Bitcoin performs well during rate-cutting cycles as investors seek assets independent of monetary policy. The 2024 halving effect remains in the negative pressure of supply. The decrease in the number of new coins, being in circulation, and the simultaneous increase in demand, produces positive supply-demand relationships.

The adoption of corporate treasury is on the rise. More companies follow MicroStrategy’s playbook, allocating portions of cash reserves to Bitcoin. This trend offers pressure in buying on a regular basis with no relationship with retail sentiment. The adjustments of the mining difficulty ensure the network in question is safe, whereas the profitability is decent enough to enable the operators.

Ethereum and Layer 1 Performance

Ethereum around $3,100 benefits from multiple catalysts. The Layer 2 scaling solutions develop well within a short time and ensure that main chain congestion is reduced, and more network is utilized. The interest on staking is also quite lucrative and securing large amounts of ETH. The DeFi protocols are on the move, and they are fueling the volume of transactions and charges.

Institutional interest in Ethereum grows as smart contract capabilities prove essential for tokenization and DeFi applications. The transition to the proof-of-stake eased overheads related to energy consumption, and ESG-oriented institutions became eligible. Most blockchain platforms have the highest activity of developers, which is indicative of a continued pipeline of innovation.

The rise of XRP to $2.25 shows that regulatory clarity will create value. The product launches of ETFs opened new affiliation avenues. Ripple has financial institution relationships that are growing. The use of cross-border payments is increasing, with traditional finance being motivated to realize the benefits of blockchain efficiency.

Pepeto Positioning for 2026 Bull Phase

Pepeto at $0.000000176 captures multiple advantages from strong major token performance. First, the presale timing positions Pepeto to benefit from increasing market-wide liquidity. The project has raised $7.14M during recent weeks as Bitcoin and Ethereum showed strength. The development of the community to 100K+ participants may be boosted as the general attitude in the market becomes more positive.

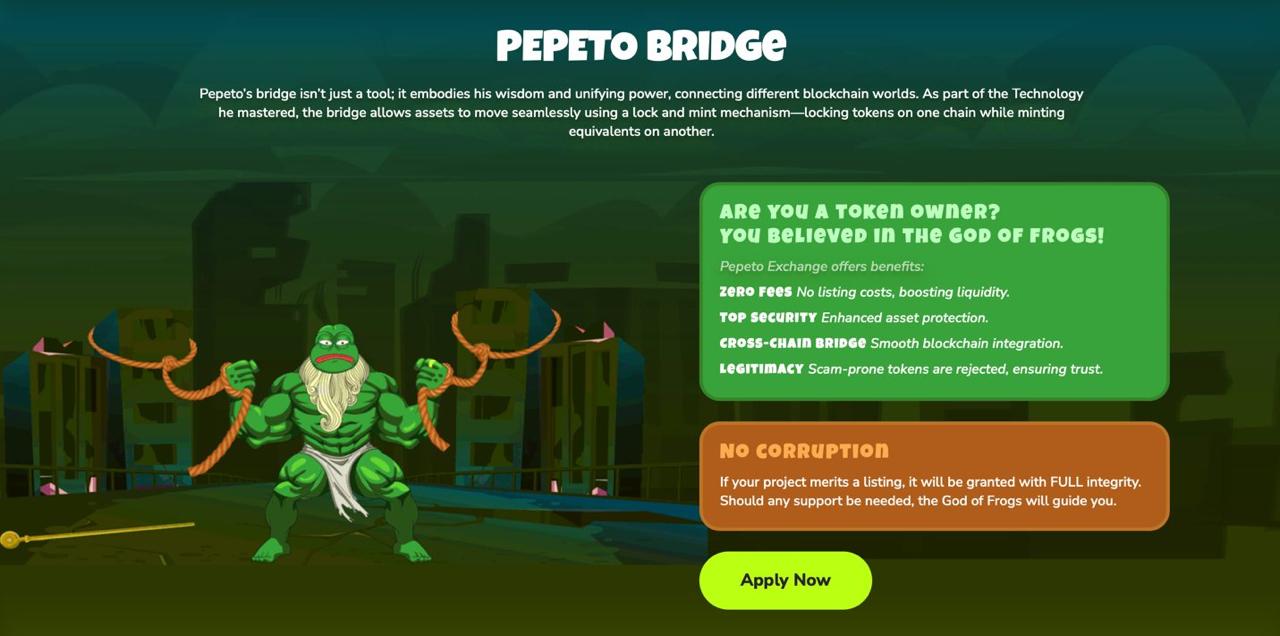

Second, the infrastructure elements respond to real-world requirements that appear because of DeFi and memecoin ecosystem development. PepetoSwap provides memecoin trading functionality exactly when that sector shows renewed interest. The cross-chain bridge addresses the issues that are becoming increasingly sharp as the many Layer 1s and Layer 2s fragment liquidity. The free exchange incentivises new memecoin issue at the optimal time when the creation of projects goes on a fever spurt during bull markets.

Thirdly, the 216% staking strategy provides holding behavior that is helpful in momentum phases. With the market frenzy, the less time the tokens are in staking, the less supply there will be, the demand will also be higher. This demand-supply imbalance enhances an appreciation of prices.

Operating on Ethereum provides automatic benefit from ETH’s performance. As Ethereum market cap and usage grow, ecosystem projects receive increased attention and liquidity access. Pepeto inherits these advantages without requiring separate infrastructure development.

Patterns in History in Favor of this Arrangement.

Past bull markets were indicative of the early-stage projects performing well during booms. PEPE launched during Bitcoin’s 2023 recovery and reached $2.78B. Dogecoin and Shiba Inuboth experienced explosive growth during periods when Bitcoin showed strength. The trend continues since capital pursues asymmetric opportunities in times of risk-on environments.

Pepeto’s combination of timing, infrastructure, and community growth mirrors what worked previously. The 850+ platform applications and $7.14M capital suggests that there is real momentum and not a mere conjecture. Majors accumulating and capital rushing to smaller projects will cause less memes that are riding the hype at the moment to outperform projects with true fundamentals.

Conclusion

Bitcoin’s strength alongside Ethereum and XRP creates favorable conditions for 2026. Major token performance is driven by institutional adoption, macro-economic factors and regulatory clarity. This strength is helpful in the fast-growing work because the liquidity will grow and the sentiment will be enhanced and the pattern of rotating capital will increase.

Pepeto at $0.000000176 positions optimally to capture these dynamics. With $7.14M raised, 100K+ participants, and 850+ platform applications, Pepeto demonstrates fundamentals supporting sustained growth. Infrastructure including PepetoSwap, bridge, exchange, and 216% staking addresses ecosystem needs emerging during bull phases. This is evidenced by the past performance that early-stage projects perform well when there is a big uptick in tokens. Pepeto’s combination of timing, utility, and community growth creates conditions for benefiting substantially from 2026’s strong start.