A Research Report on VVV’s Utility, Tokenomics, and Competitive Edge vs. OpenAI

Abstract

The Venice Token (VVV) represents a paradigm shift in AI infrastructure, merging cryptocurrency with decentralized, privacy-first machine intelligence. Designed by Venice.ai, VVV enables stakeholders to access uncensored AI inference (text, image, code) via a staking model, eliminating per-request fees and centralized control. This report analyzes VVV’s mechanics, tokenomics, and competitive advantages over traditional APIs like OpenAI, positioning it as a critical experiment in democratizing AI resources.

1. Introduction: The Case for Decentralized AI

1.1 Venice.ai’s Mission

Launched in May 2024, Venice.ai emerged as a privacy-focused alternative to centralized AI platforms (e.g., ChatGPT, Gemini). Its core tenets:

Data Sovereignty: Interactions occur client-side; no data is stored or monetized.

Censorship Resistance: No content moderation, enabling unrestricted AI outputs.

API Expansion: By November 2024, Venice released an API for developers and AI agents, offering text, image, and code generation.

1.2 The Birth of VVV

To address the limitations of pay-per-request models and centralized infrastructure, Venice introduced VVV — a crypto token enabling stake-based access to AI inference.

2. Core Innovations of VVV

2.1 Staking for Zero-Cost Inference

Venice Compute Units (VCUs):

Each VCU = $0.10 of inference credit across models.

Stakers claim a pro-rata share of daily VCU capacity (e.g., 1% staked VVV = 1% of VCUs).

Negative Marginal Cost: Stakers earn yield from token emissions, potentially offsetting costs if VVV appreciates.

2.2 Decentralized Architecture

Privacy: No data retention; interactions are browser-based.

Uncensored Outputs: Unlike OpenAI, Venice imposes no content policies.

2.3 Tokenomics Aligned with AI Growth

Supply: 100M genesis supply, 14M annual emissions (14% initial inflation, decreasing).

Distribution:

50% Airdropped: 25M to Venice users (active Oct–Dec 2024), 25M to Base blockchain AI communities (Virtuals, Luna, aixbt).

35% Treasury, 10% Team (vested), 5% Liquidity.

Staking Yield: Emissions distributed based on API demand (“Utilization Rate”).

2.4 Agent-Centric Design

AI Agent Incentives: 25% of airdrop allocated to autonomous agents/protocols.

Secondary Markets: Agents can resell VCU allocations, fostering an inference economy.

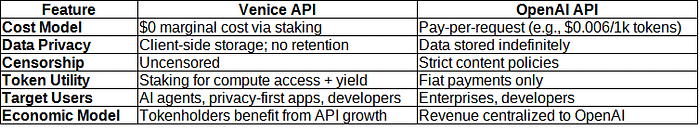

3. VVV vs. OpenAI API: Key Differences

Press enter or click to view image in full size

4. Unique Value Propositions

4.1 For AI Agents

Predictable Costs: Perpetual access to inference via staking, avoiding volatile per-request fees.

Autonomy: Operate indefinitely using staking yields to offset costs.

4.2 For Developers

Privacy-First Apps: Build medical, legal, or controversial AI tools without surveillance risks.

Scalability: VCU capacity grows with Venice’s infrastructure, increasing staked VVV value.

4.3 For Crypto Communities

Token Incentives: Aligns with Web3’s decentralized ethos; stakeholders govern inference resources.

5. Challenges and Risks

5.1 Token Volatility

VVV’s value hinges on API demand and crypto market dynamics. Price swings could disrupt agent budgeting.

Extreme volatility of crypto markets and VVV could deter potential developers from using the Venice API.

5.2 Regulatory Scrutiny

Decentralized AI models may face challenges from regulators targeting crypto and AI governance.

5.3 Scalability Demands

Venice must continuously expand GPU/TPU resources to meet VCU growth expectations.

5.4 Adoption Hurdles

Competing with entrenched APIs (OpenAI, Anthropic) requires proving reliability and developer traction.

6. Conclusion: A New Era for AI Infrastructure

VVV pioneers a tokenized future where AI inference is a public good governed by stakeholders, not corporations. By combining staking mechanics, privacy, and uncensored access, Venice challenges the surveillance-driven status quo.

Strategic Implications:

AI Agent Economies: VVV could underpin autonomous agent ecosystems requiring low-cost, persistent compute.

Regulatory Precedent: Success may pressure regulators to rethink decentralized AI governance.

Market Disruption: If scalable, VVV’s model could erode OpenAI’s dominance in sensitive/niche sectors.

7. Future Research Directions

Long-Term Viability: Monitor VCU adoption rates and token inflation impacts.

Agent Economies: Study how VVV-enabled inference markets reshape AI agent development.

Regulatory Landscape: Track global policy responses to decentralized AI models.

VVV’s experiment is a bold step toward separating AI from centralized control — a critical milestone in the evolution of machine intelligence.