TradingKey - Cryptocurrency's widespread adoption once again raises the question: with JPMorgan claiming the sell-off is nearing its end, does this signal an imminent surge for the crypto market?

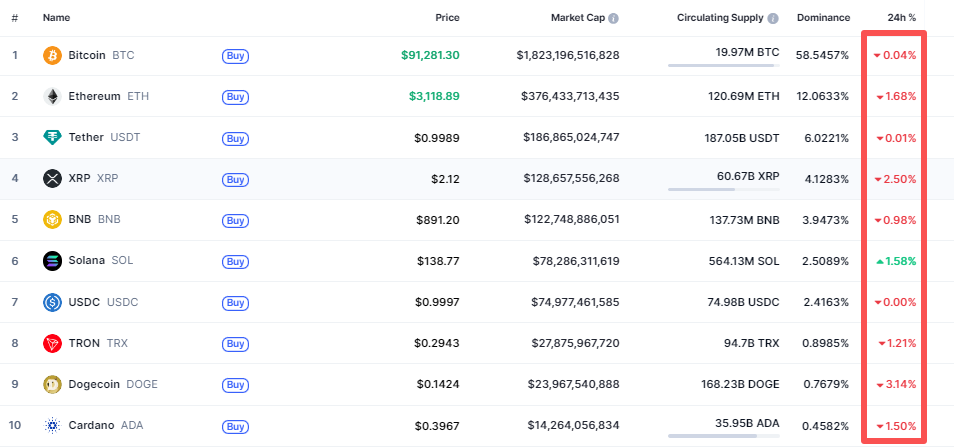

On Friday (January 9), the cryptocurrency market rally stalled, with its total market capitalization declining by nearly 1% to temporarily stand at $3.11 trillion. Concurrently, major cryptocurrencies generally fell, with Dogecoin (DOGE) falling over 3%, Ripple (xrp) dropping over 2%, Ethereum (ETH) and Binance Coin (BNB) decreasing by 1%; Bitcoin's price remained relatively stable, essentially flat; Solana (SOL) bucked the trend, rising over 1%.

Top 10 Cryptocurrencies by Market Cap: Price Changes, Source: CoinMarketCap.

From January 1st to 5th, 2026, the crypto market saw five consecutive days of gains, only to pivot to a continuous decline over the past three days. This abrupt shift dealt a heavy blow to bulls. In the past 24 hours, over 120,000 user positions were liquidated, with total liquidations exceeding $400 million, of which long positions accounted for over $300 million.

Crypto Market Liquidation Data, Source: Coinglass.

According to CoinDesk a January 8th report, JPMorgan stated in its latest analysis that "the crypto market sell-off may be nearing its end." In JPMorgan's view, the decline in the crypto market over recent months was not driven by market stress but rather by MSCI's announcement last October to remove DAT companies, causing pressure. However, MSCI announced on January 7th that it would not delist crypto-related companies for now, a move that alleviated market pressure. Nikolaos Panigirtzoglou, an analyst at the investment bank, noted that "outflows from Bitcoin and Ethereum ETFs began to stabilize in January."

Moving forward, cryptocurrency volatility could be influenced by three factors: the Federal Reserve, strategic cryptocurrency reserves, and geopolitics. Former U.S. President Trump stated in an interview with The New York Times that he has decided on his nominee for the next Federal Reserve Chair but did not reveal the specific individual. Whether it is Kevin A. Hassett, Kevin Warsh, or another candidate, all support Trump's stance on interest rate cuts, otherwise they would not have been his favored choice.

Currently, the U.S. is primarily building its strategic cryptocurrency reserves through confiscations, but it is highly probable that it will purchase Bitcoin (BTC) with actual funds in the future. Regarding this, Cathie Wood, founder of ARK Invest, stated, "As Trump seeks to maintain political influence and the crypto industry plays a driving role in elections, his administration may initiate purchasing activities." As of this report, the U.S. collectively holds 325,000 Bitcoins, and Wood believes this figure will increase to 1 million.

Top Ten Bitcoin Holders, Source: CoinGecko.

Recently, conflicts and unrest, such as the U.S. arresting Venezuela's president, Trump expressing interest in acquiring Greenland, and internal unrest in Iran, have unfolded globally. This environment of panic has spurred strong demand for safe-haven assets, with gold prices currently benefiting. As these conflicts escalate, a small portion of capital may also flow into the crypto market.