HIGHLIGHTS

MyShell token (SHELL) price surged 45% amid the Binance HODler airdrop listing announcement.

Binance airdrop eligible candidates to receive 25M SHELL tokens now, with another 25M token distribution after six months of listing.

Experts believe SHELL could reach $1 amid AI and Web3 hype, but market trends and investor sentiments also matter.

MyShell, a decentralized AI consumer layer designer that connects AI agents and associates, has recently launched its token, SHELL. Interestingly, it has received the Binance HODLer airdrop listing, pumping the MyShell token price by 45% moments after the announcement. As the token kicks off in the market with hype, investors are eyeing the $1 milestone. Let’s discuss the listing details and SHELL’s further price action.

MyShell Token Price Hit ATH on Binance HODLer Airdrop Listing

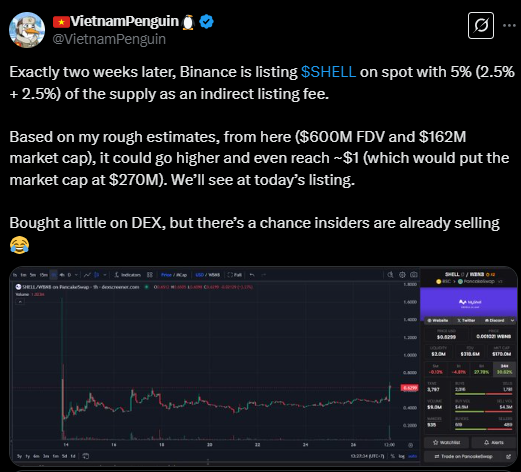

The Binance team announced the SHELL listing just a few hours ago, and moments after that, the MyShell token price began to pump. Within a few hours, the token surged from $0.47 to an ATH of $0.6816 after a 45% surge. Additionally, it reached a market capitalization of $184.2M and a trading volume of $100.9M at its peak.

According to the Binance listing announcement, the SHELL token will be listed for trading on February 27, 2025, at 13:00 UTC. This marks MyShell token as the 10th program on the Binance HOLDler airdrop. The exchange has announced the listing with trading pairs like BTC, USDT, USDC, BNB, FDUSD, and TRY.

More importantly, BNB holders who subscribed to the Simple Earn (Flexible and Locked) or On-Chain Yield products between February 14 and February 18, 2025, could access the HODLer SHELL airdrop. 25M SHELL tokens, or 2.5% of the total supply, are allocated to this most awaited crypto airdrop, and another 25M are scheduled for distribution after six months of listing.

These events could have a significant impact on the SHELL price.

Will MyShell Token Price Hit $1?

The SHELL price has consolidated slightly from the prime and currently trades at $0.6126. Despite the drop, it is 30% up today and 46% over the week. Considering its performance and investor demand, some experts believe in its potential to attain $1.

SHELL is trending due to its status as an AI token in the current market. Additionally, the ongoing exchange listings would boost investor confidence with increased visibility and credibility.

Meanwhile, the hype is building, around 27% of the token’s supply (270 M) is in circulation. Experts believe that it will likely grow with developments in the AI and Web3 sectors. More importantly, investor sentiments would play the most significant role in the MyShell price rally to $1.

The token might achieve this target if its bullish momentum continues and market trends favor its growth. However, as it is already experiencing consolidation and the Binance HODLer airdrop will release millions of tokens, it might experience increased volatility.

More importantly, investors’ selling sentiments could crash the price. Investors must carefully analyze all the possibilities and trade accordingly.

What’s In There For You?

The Binance HODLer airdrop listing has positioned the MyShell token for investors’ attention, and its price surged 45% right after the announcement. With SHELL’s involvement in the AI and Web3 industries, its token price is anticipated to witness significant rallies. However, that entirely depends on crypto market trends, investors, sentiments, etc.

At the same time, the token possesses high volatility due to its recent launch and airdrop distribution. Investors must not jump into trading under FOMO and must do further research before doing so.