The best way to tackle a complex problem is to provide a simple solution. While there are no simple solutions in the blockchain industry, Celer Network has found a way.

The project addressed scalability and interoperability issues. Its approach makes it worth looking deeper into the network, features, and tokens.

WHAT IS CELER NETWORK?

Celer Network is a blockchain platform for decentralized applications. It supports Layer-2 solutions on top of existing chains and offers high transaction capacity (TPS) at a low cost.

Celer supports 11 wallets, 43 chains, and 174 tokens. Its main features include State Guardian Network (SGN), cBridge, and Layer2Finance.

CORE TECHNOLOGY

The core technologies behind Celer Network are state channels, sidechains, and Rollups.

A state channel network is a generic framework combining state channels, including optimized off-chain messaging protocols and on-chain contracts.

Sidechain allows running a separate decentralized network to ensure higher efficiency.

The ecosystem of Celer Network includes dApps and cryptoeconomic models. The latter represents a staking system focusing on security, liquidity, and connectivity.

The Celer Network team also released CelerX. It was the first mobile application capable of accessing dApps on top of Layer-2.

TEAM AND INVESTORS

A group of Computer Science PhDs founded Celer Network in 2018. Their names are Mo Dong, Junda Liu, Xiaozhou Li, and Quingkai Liang.

The team includes developers, designers, marketing, and operating specialists.

Celer’s prominent investors include Broslyn Capital, Cognisa Capital, Papership Capital, Elysium Venture Capital, BlockVC, Consensus Lab, INBlockchain, Chain Capital, MW Partners, and others.

THE CELR TOKEN

CELR is the token of the Celer Network. It ensures the economic security of the Celer Inter-Chain Message when staked on the State Guardian network.

CELR has several specific use cases. Firstly, the token holders can use it for creating liquidity pools. It is common to use CELR in Liquidity Backing Auctions. These auctions provide liquidity to the users outside the main blockchain for interest.

Secondly, CELR is vital for system security. A share of CELR tokens supports the safety stake and connectivity.

Users running nodes on the network and off-chain service providers are paid in CELR.

CELER’S KEY PRODUCTS

STATE GUARDIAN NETWORK

State Guardian Network is a scalable and efficient sidechain based on the Tendermint BFT consensus. SGN minimizes usability stemming and eliminates the state channel security risks.

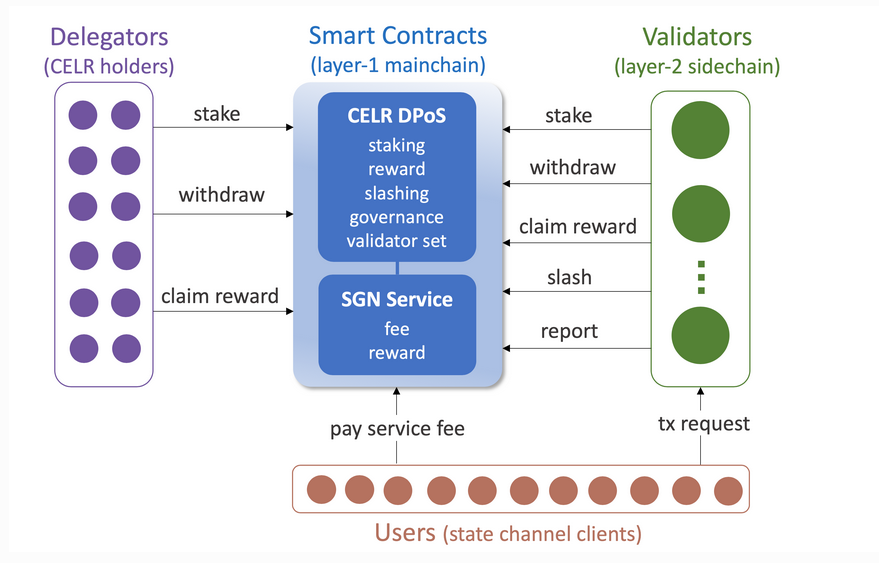

SGN consists of four components:

Delegators

Smart Contracts

Validators

Users

Source: Celer.Network

Delegators stake CELR and receive service fees as well as SGN block rewards. The process allows voting on validators and governance proposals.

Smart contracts hold the CELR staking process. They enforce and specify the configuration of roles and fundamental rules. Smart contracts are also responsible for the network participants’ penalties, rewards, and fees.

Delegators elect validators on the mainchain contract. Validators run sidechains to offer SGN services.

Everstake is one of the CELR validators. Thus, it is possible to delegate CELR to Everstake. Here is a complete guide on how to stake CELR.

Users pay service fees to the mainchain contract as state channel clients. They also submit service requests to the sidechain.

CELER CBRIDGE

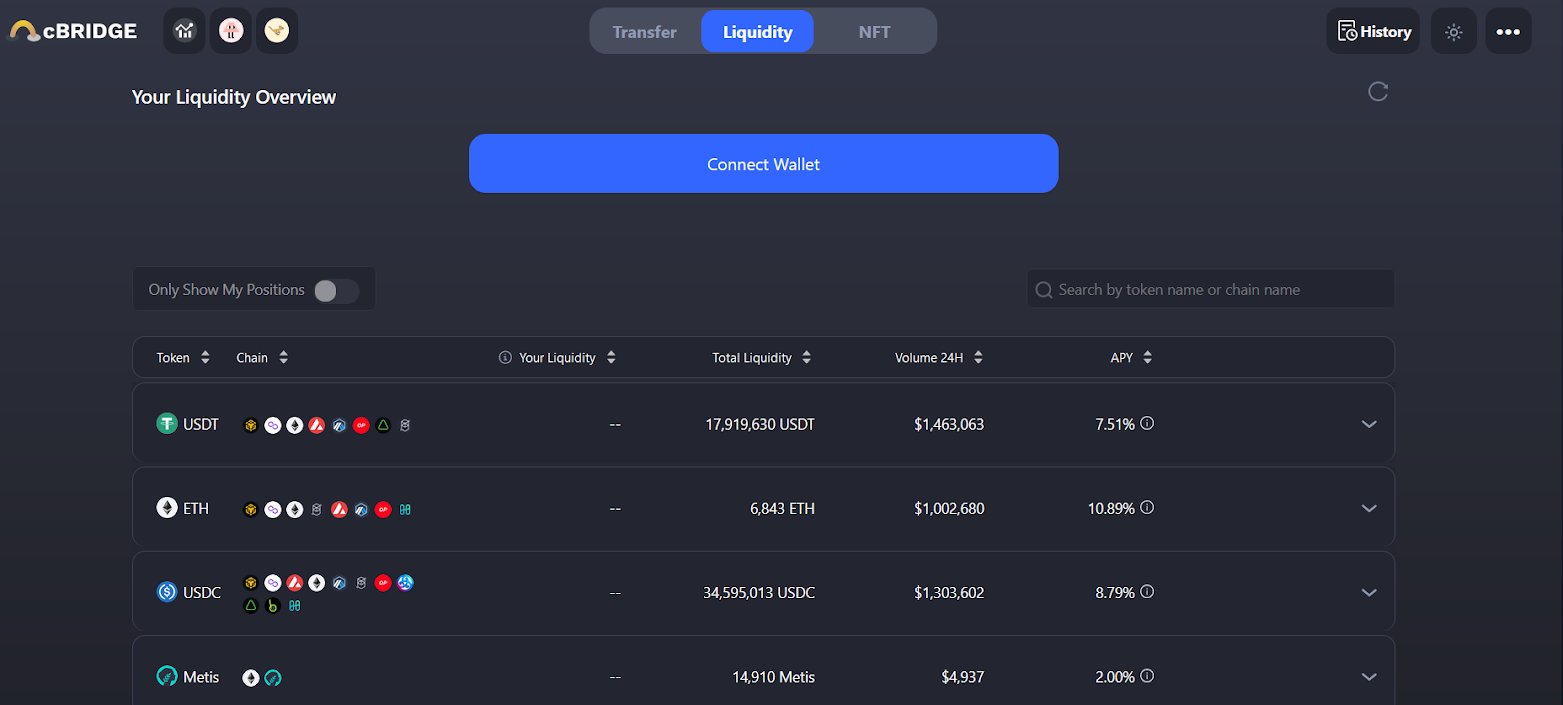

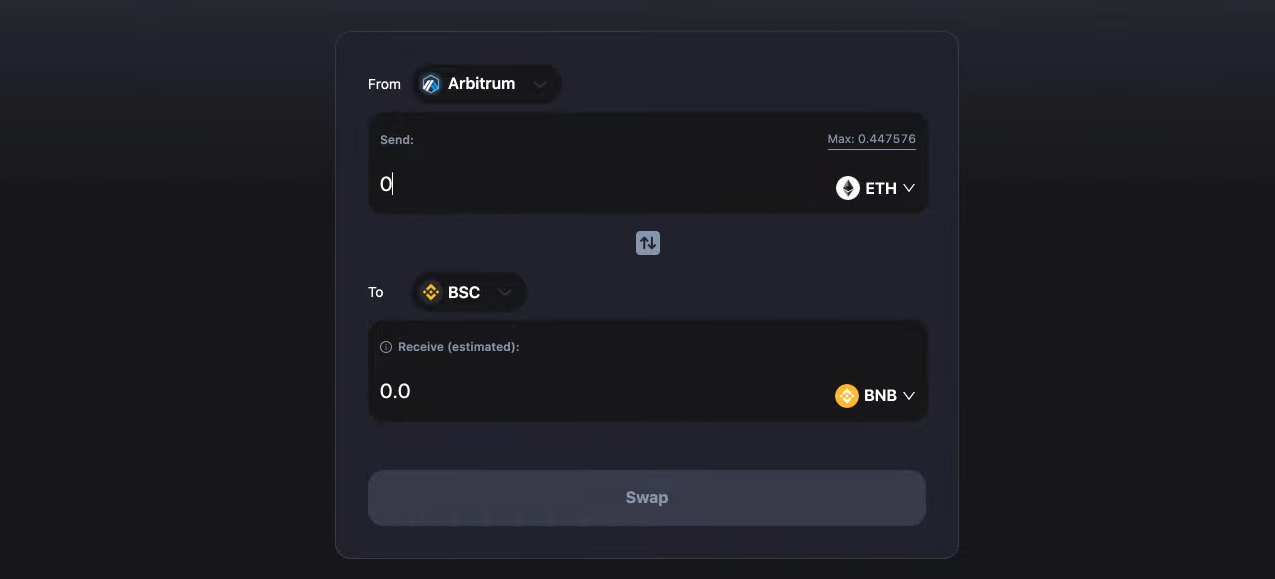

cBridge is a decentralized and non-custodial asset bridge supporting over 110 tokens over 30 blockchains.

cBridge has already processed over $11 billion in cross-chain transfers. The total number of unique users covered by the product reached 160,000.

In September 2021, Celer released cBridge 2.0. The update increased liquidity, made the bridge easier to use, and supported native gas token swapping.

LAYER2.FINANCE

Layer2.finance addresses the most significant challenges of DeFi. It lowers the cost of Layer-1 transactions with Layer-2 Rollups.

Celer calls this solution a “public transportation system” for DeFi.

CELER INTER-CHAIN MESSAGE FRAMEWORK

Celer Inter-chain Message Framework (Celer IM) improves the process of building and using dApps. Developers can build interchain-native dApps without deploying multiple isolated copies of smart contracts. Users benefit from a single-transaction UX and a diverse multi-blockchain ecosystem.

CONCLUSION

Celer Network includes a broad range of Layer-2 solutions that enable scaling and interoperability. These features are vital for dApps and smart contracts usability and development.

SGN provides the Layer-1 security, cBridge supports tens of chains, and Layer2Finance lowers the cost of using DeFi. The unique architecture of Celer makes it one of the most promising projects in the multi-chain world.

Feel free to contact our Celer Blockchain Manager on Twitter. Or, if you need any help with staking, you can book a call with the Manager, who will guide you through the process.