In early 2026, while the altcoin market capitalization (TOTAL3) rebounded from $825 billion to over $880 billion, marking a gain of more than 7%, Pi Network (PI) remained stagnant around the $0.2 level. Exchange data has not shown any clear signs of a return to demand.

Meanwhile, the Pi Network community has reported growing losses among investors who pursued expectations tied to the GCV price.

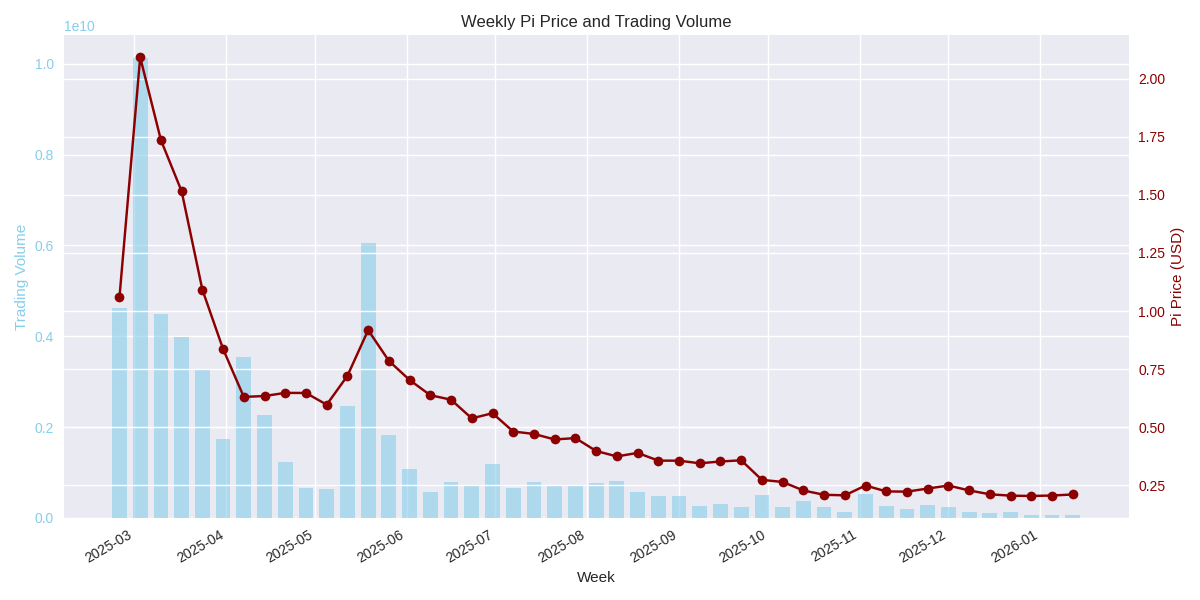

Pi Network’s Weekly Trading Volume Hits Record Lows

Data from CoinGecko shows that Pi’s trading volume has fallen to record lows. The weekly volume dropped sharply below $100 million, with daily averages of around $10 million.

By comparison, in March last year, Pi recorded more than $10 billion in weekly trading volume. The current figures represent a decline of over 99%.

Weekly Pi Price and Trading Volume. Source: CoinGecko.

The collapse in trading volume reflects weakening demand for Pi on exchanges. Thin liquidity increases the risk of large price swings, even with relatively small buying or selling pressure.

If prices rise under such low liquidity conditions, the move is unlikely to be sustainable. If prices fall, the same conditions make Pi vulnerable to sharp sell-offs.

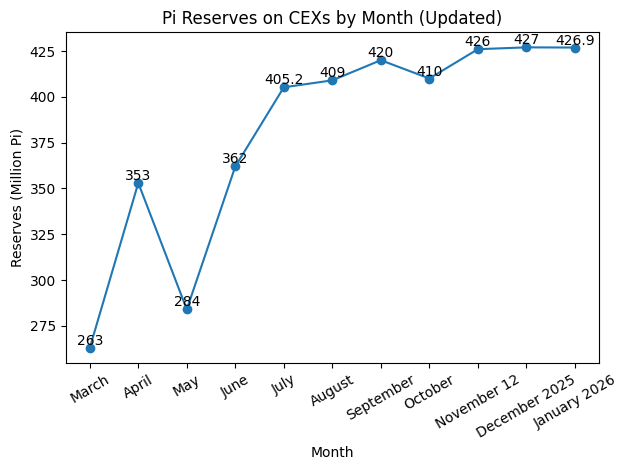

Additionally, Piscan data indicate that Pi reserves on centralized exchanges (CEXs) have not declined. Instead, they remain elevated.

Pi Reserves on CEXs by Month. Source: Piscan

On January 9, more than 1.3 million Pi tokens were transferred to exchanges, pushing total exchange reserves to 427 million Pi. Higher exchange balances increase selling pressure. Combined with thin liquidity, this dynamic significantly raises the risk of further price declines.

Pioneers Suffer Losses After Trusting the GCV Theory

One of Pi Network’s most distinctive features is its two-value system. Holders recognize both the market price on exchanges and the GCV (Global Consensus Value), a theoretical valuation.

Supporters promote GCV as a fixed price of $314,159 per Pi, derived from the mathematical constant Pi (π). They encourage users and merchants to accept Pi at this valuation.

However, recent community reports indicate that several investors have suffered severe losses by following the GCV narrative, while Pi’s market price has fallen more than 90% from its peak.

The Pi-focused news account r/PiNetwork highlighted at least two such cases.

One example involves Taufan Kurniawan, who invested 50 million Indonesian rupiah (approximately $3,200) to open a shop serving Pi users. He accepted payments based on the GCV price and expected substantial profits. When the market price collapsed, the business failed, leaving him with heavy losses.

“Merchants using GCV will be bankrupted by their inability to recover funds in the ecosystem. It’s already happening,” r/PiNetwork commented.

Pi’s prolonged price decline and weak liquidity are forcing Pioneers to make a difficult choice: continue holding and pursuing Pi’s long-term vision, or abandon the project altogether.