XRP price prediction models are being re-evaluated as the token continues its strong rebound into 2026. Trading around $2.09, XRP is consolidating after a 25% rally from December lows, fueled by over $1.3 billion in spot ETF inflows and a record 57% reduction in exchange-held supply.

With XRP still 37% below its all-time high of $3.65 from July 2025, analysts now debate whether institutional momentum can push the price toward $4, or if structural headwinds will cap upside closer to $2.50 for the most promising crypto.

ETF Inflows Reshape XRP Market Dynamics

One of the defining developments behind the recent XRP move is the unprecedented pace of ETF inflows. Since mid-November, seven U.S.-based spot XRP ETFs have absorbed approximately $1.3 billion, marking 43 consecutive trading days of positive flows and zero outflows – a pattern unmatched even by Bitcoin or Ethereum during the same period.

This volume has removed hundreds of millions of XRP from circulation, with ETF issuers now controlling nearly 793 million XRP.

If monthly inflows average $483 million, as they did in December, projections suggest that ETFs could lock away up to 2.6 billion XRP by year-end – about 4% of total supply. Analysts say this demand-side absorption is increasingly relevant for XRP price prediction models in 2026.

Supply Squeeze: 57% Decline in Exchange Balances

On-chain data supports the bullish thesis. Exchange balances dropped from 4 billion XRP to around 1.7 billion in 2025, marking a 57% decline – one of the sharpest annual reductions on record. This suggests that retail and institutional investors alike are opting for cold storage or ETF custodial positions for the next 1000x crypto.

With only 60.67 billion XRP in active circulation (out of a 100 billion max supply), the available float for active trading is becoming constrained. Traders now watch for a feedback loop between ETF demand and tightening exchange supply, a key dynamic that could drive price moves without requiring speculative retail participation.

Technical Structure and Institutional Narrative

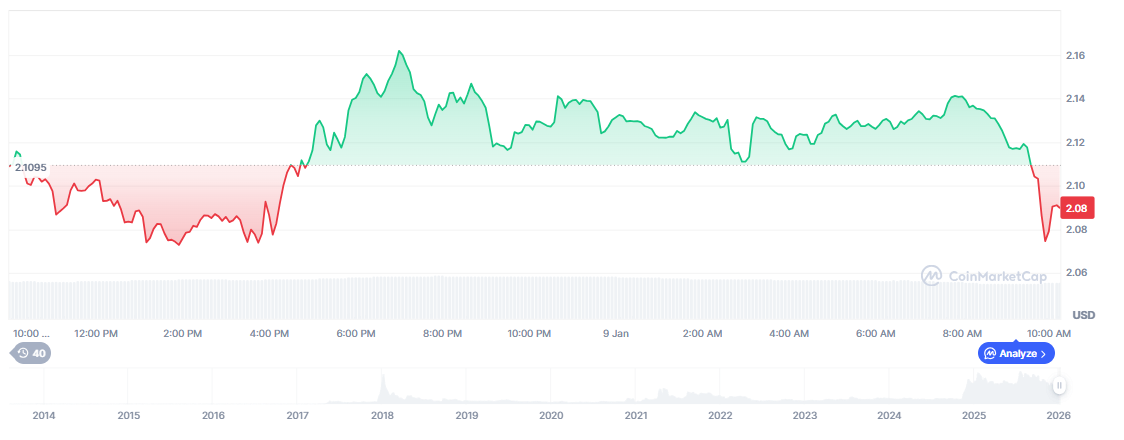

Technically, XRP broke key resistance at $2.00 in early January, briefly touched $2.40, and now consolidates near $2.09. Despite the pullback, the XRP price prediction conversation remains anchored on institutional behavior.

Analysts are weighing Standard Chartered’s $8 target, which assumes $8 billion in ETF flows by the end of 2026, against more conservative models averaging $3.90.

For bullish scenarios to play out, XRP must maintain inflow velocity while gaining further traction as a cross-border settlement asset.

Partnerships like Ripple’s RLUSD rollout in Japan, and potential integration with banking rails, are seen as long-term catalysts. Still, large supply overhangs and weak on-chain fee capture remain structural limits for upside.

Regulatory Signals and Macro Tailwinds

Multiple macro and regulatory forces add nuance to the XRP price prediction landscape:

Senate CLARITY Act markup in January 2026 could reduce compliance friction for banks interacting with digital assets.

Federal Reserve policy shifts remain a wildcard. Dovish signals could drive risk-on rotation into assets like XRP, especially as real yields compress.

Bitcoin dominance is also in focus. Analysts note that prior XRP bull runs (2018, 2021, 2024) coincided with breakdowns in BTC.D. A similar pattern may be emerging again.

Each of these forces supports a scenario where XRP trades between $2.50 and $3.50, with spikes to $4.00 possible during risk-on periods – particularly if ETF flows remain above $300M/month.

Performance Gap and Sector Rotation

XRP’s January rally outpaced both Bitcoin (up 6%) and Ethereum (up 10%), reflecting token-specific momentum rather than a broad market surge. Analysts attribute this to the less crowded ETF trade, as XRP inflows were counter-cyclical during Q4 2025 when most digital assets saw outflows.

Crypto analyst Bird points to a familiar pattern in Bitcoin dominance breaking down, suggesting a potential trigger for XRP to enter a parabolic phase similar to 2018 and 2021.

While he stops short of giving an exact XRP price prediction, Bird notes the setup could be stronger than prior cycles, especially if dominance trends confirm.