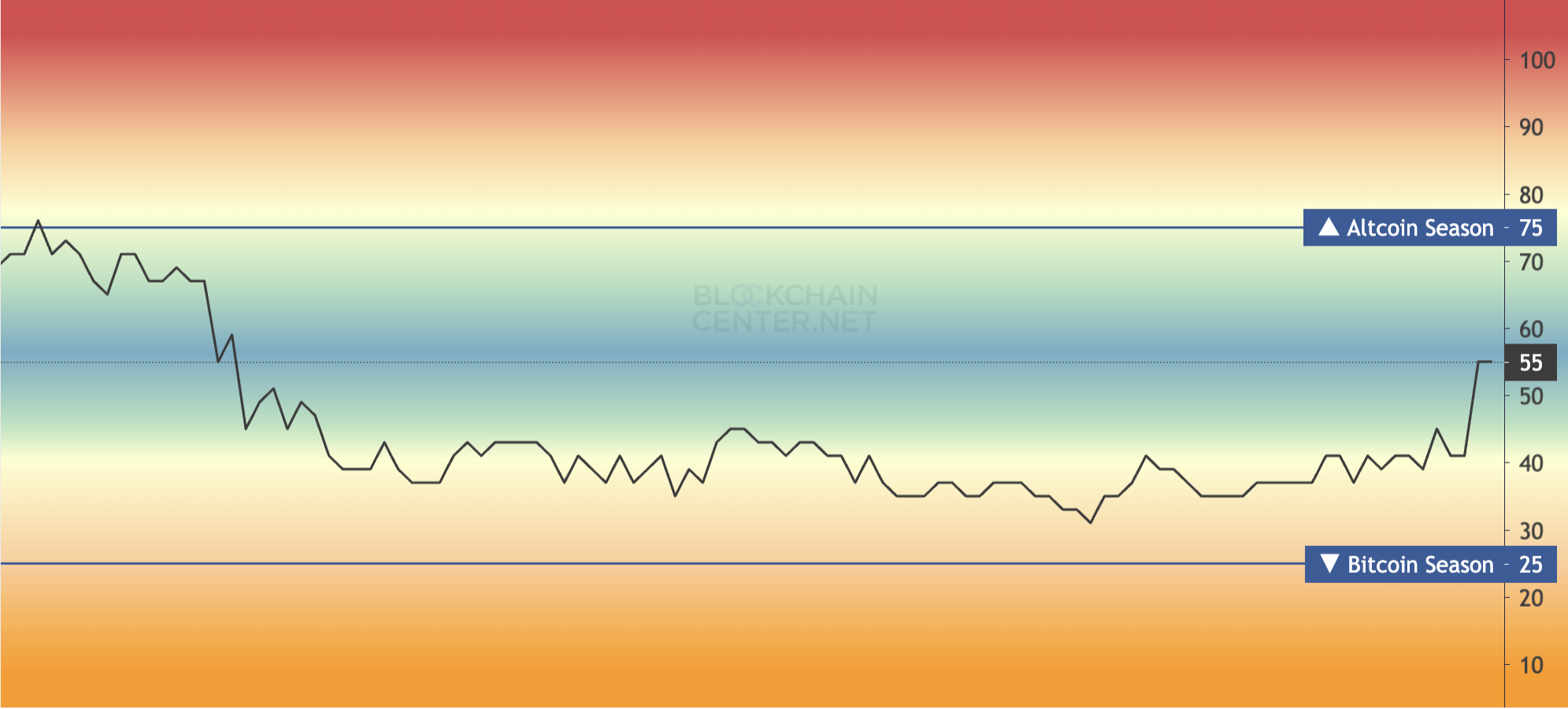

The Altcoin Season Index has climbed to 55 in early January 2026, reaching its highest level in around three months.

While this does not yet signal a full altseason, analysts suggest that momentum is building, potentially setting the stage for a broader altcoin rally.

Altcoin Season Index Surges to 3 Month High

The Altcoin Season Index measures periods when alternative cryptocurrencies outperform Bitcoin. Specifically, it considers an altcoin season to occur when at least 75% of the top 50 non-stablecoin cryptocurrencies outperform Bitcoin over a 90-day window.

The current reading of 55 points suggests rising altcoin strength. Yet, it falls short of confirming an official altcoin season.

Altcoin Season Index. Source: Blockchaincenter.net

That said, market watchers are pointing out key signals that support the possibility of an upcoming altcoin season. In a recent post, an analyst said the OTHERS/BTC index has bottomed and is now showing signs of a breakout. According to the analyst, similar conditions in past cycles preceded major altcoin rallies.

Simon Dedic, founder of Moonrock Capital, noted that the altcoin market is currently behaving exactly as expected. He added that momentum is likely to intensify toward the end of Q1 and into mid-Q2, potentially setting the stage for a broader breakout and accelerated price action.

“The liquidity and business cycles aligning will only accelerate this. 2026 will be the return of altseason,” Dedic said.

Previously, BeInCrypto also highlighted three key signals that could point to a potential altcoin season in 2026. This included bullish divergences forming on weekly altcoin charts, a possible breakout in altcoin dominance outside the top 10 cryptocurrencies, and high altcoin trading volumes despite weak prices.

Joao Wedson, Founder and CEO of Alphractal, provided a different perspective, focusing on the mechanics of capital flow. His analysis suggests mini altcoin seasons arise about every 48 hours, with swings between Bitcoin and altcoin performance every 12 hours.

“In other words, sometimes BTC moves first, and only afterward do altcoins follow. This rotation is exactly how market makers are able to accumulate assets efficiently — rotating capital from BTC to Altcoins and back again,” Wedson explained.

Altcoin Season Speculation Fuels Discussion Around Leading Narratives

As expectations of an altcoin season persist, attention is increasingly shifting toward which sectors could take the lead if it unfolds. According to Kate Miller, meme coins could produce some of the biggest individual winners in the next altcoin season, although only a small number are expected to deliver outsized gains.

“Meme coins will make millionaires in the next Altcoin Season. But only a few of them will do more than a 100X,” she posted.

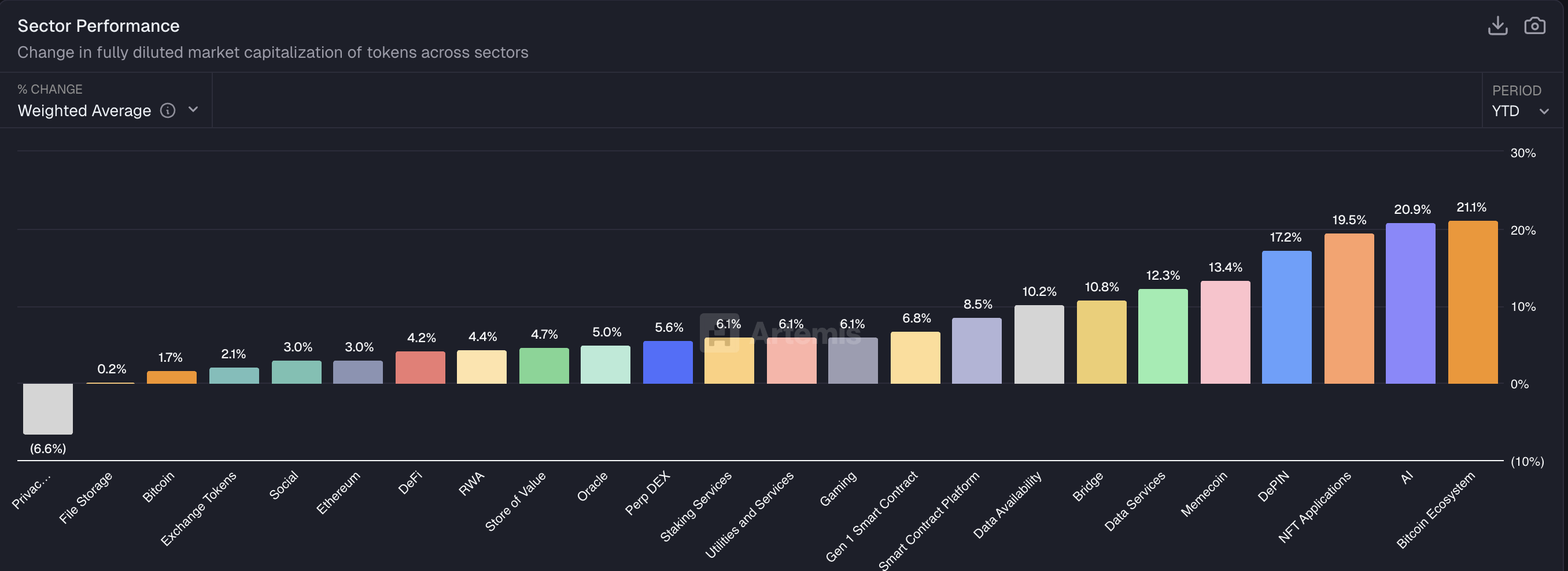

So far in 2026, meme coins have generally performed well, in line with the broader market’s early rise. Despite a recent pullback, the sector remains in positive territory, with most top tokens posting gains over the past week.

On the other hand, data from Artemis Analytics shows artificial intelligence tokens are leading among altcoins. The AI sector has emerged as one of the strongest performers so far this year, posting a year-to-date gain of 20.9% in weighted average fully diluted market capitalization. This places AI among the top-performing crypto sectors, trailing only the Bitcoin ecosystem.

Crypto Market Sector-Wise Performance. Source: Artemis

Finally, BeInCrypto’s analysis identified decentralized exchange (DEX) tokens as one of the strongest candidates to emerge as early leaders in the next altcoin season. DEXs are showing rising adoption, with their share of spot and perpetual trading volumes increasing relative to centralized exchanges.

At the same time, large investors have been accumulating major DEX tokens during periods of price weakness, signaling early positioning. Additionally, several leading DEX tokens are beginning to trade more independently from Bitcoin.