XRP price has pulled back sharply after a strong start to the year. Since topping on January 6, the price has been down more than 14%. Even after the drop, XRP remains up roughly 11% over the past seven days, showing this move is more correction than a collapse.

What matters now is not the size of the dip, but who is selling, and who is absorbing it.

Selling Pressure Builds as Volume Weakens Beneath Rising Price

From December 18 through January 9, XRP’s price trended higher. During that same period, On-Balance Volume (OBV) trended lower.

OBV tracks whether volume is flowing into or out of an asset. When price rises, but OBV falls, it signals that real buying power is weakening and that sellers are quietly active during rallies.

XRP Faces Sell Pressure: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

More importantly, OBV is now drifting toward a descending trendline that connects its lower lows. If OBV breaks below that trendline, selling pressure could intensify further.

This does not yet confirm a breakdown. It simply shows XRP is facing its first meaningful sell wave of 2026, likely driven by profit-taking after a strong run.

That leads to the key question. If selling is happening, who is doing that? And more importantly, who is absorbing that selling pressure now that a rebound has stabilized the drop, as XRP has been trading flat over the past 24 hours?

Long-Term Holders and Whales Absorb Supply During the Dip

On-chain data shows the selling is not coming from long-term conviction holders.

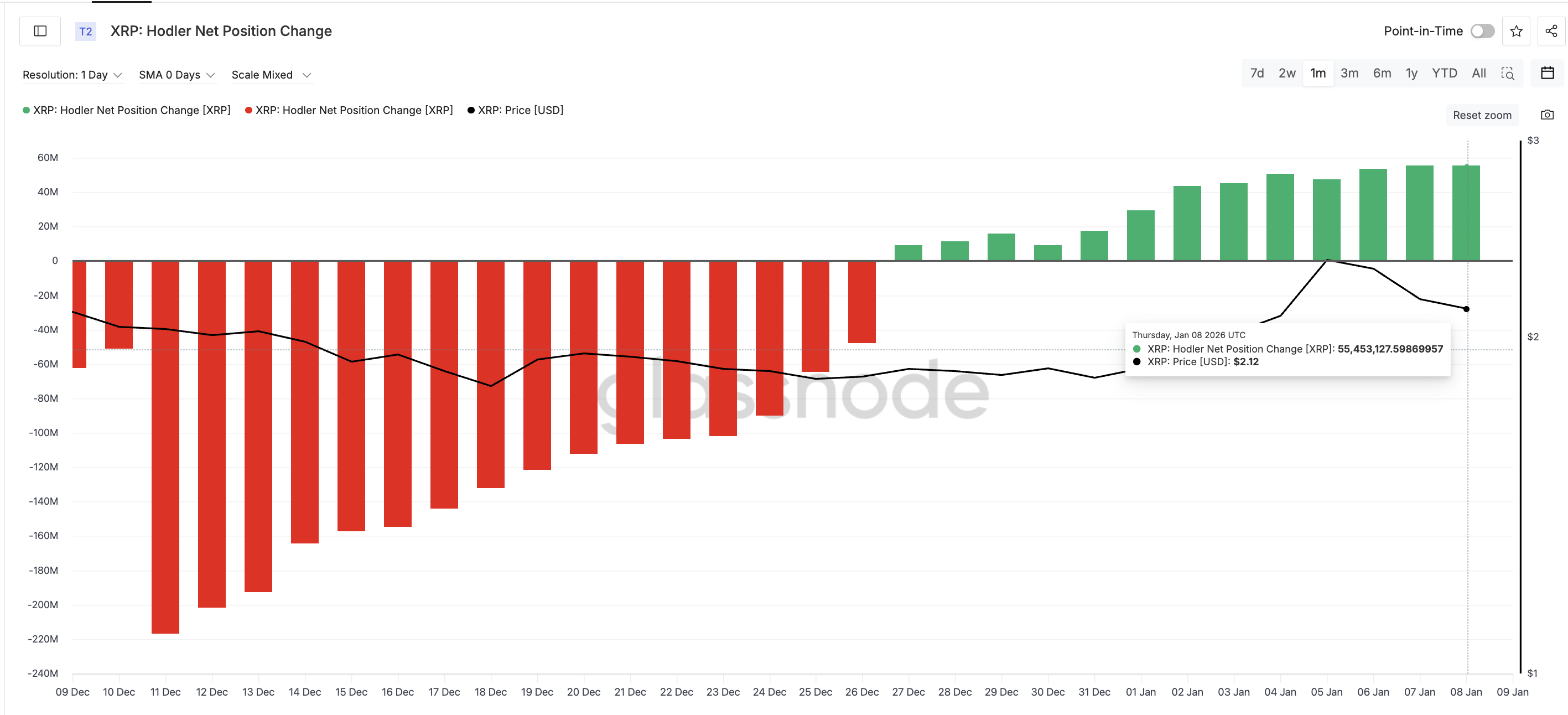

The Hodler Net Position Change metric tracks whether long-term holders are accumulating or distributing. Since January 5, long-term holders increased their XRP holdings from 47.4 million to 55.4 million XRP. That is an addition of roughly 8 million XRP, a 17% increase, during a period when the price was actively falling.

HODLers Buying: Glassnode

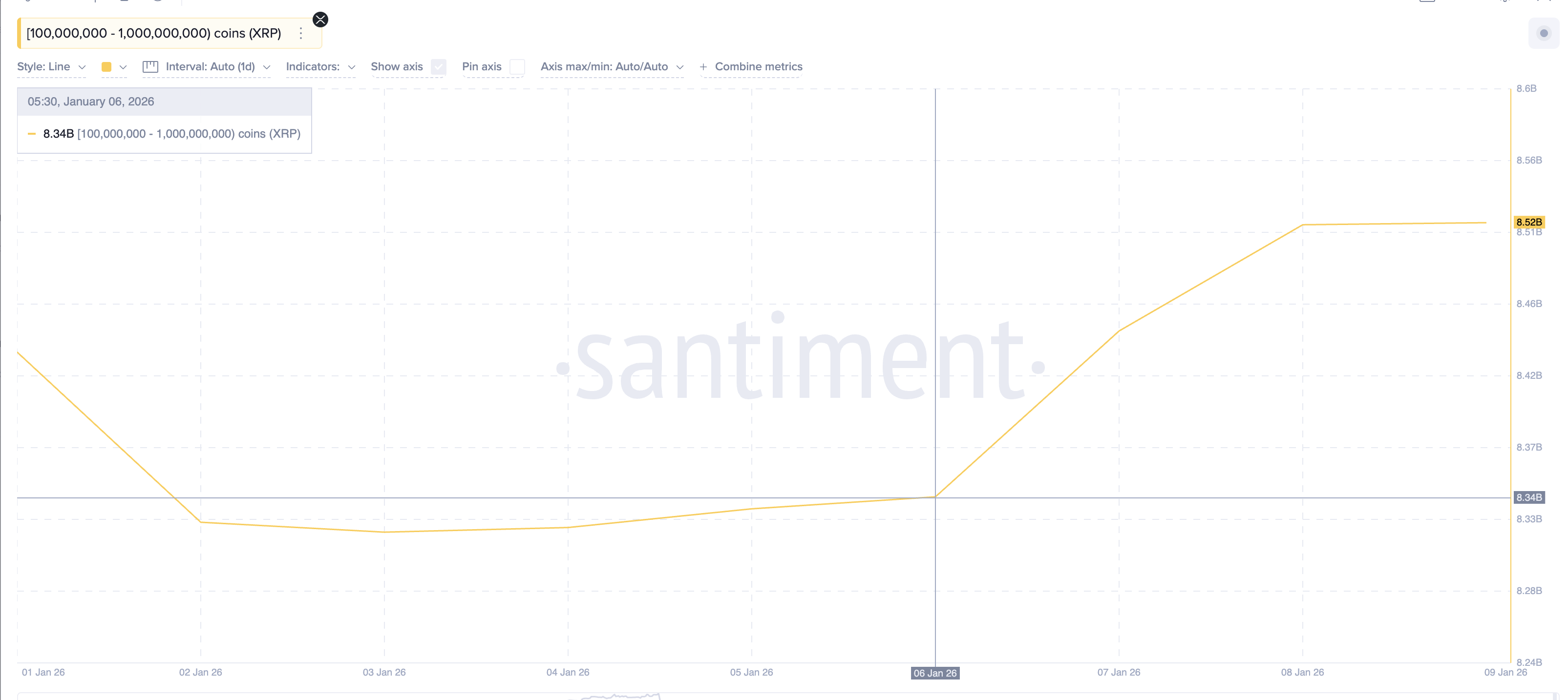

Large whales tell the same story. Wallets holding 100 million to 1 billion XRP increased their combined balance from 8.34 billion to 8.52 billion XRP since January 6.

Big Whales Accumulating: Santiment

That is an increase of 180 million XRP, nearly $390 million in buying pressure. This matters because it shows the sell wave is being absorbed by stronger hands, not triggering panic exits.

As long-term holders and whales are accumulating, the sell pressure is most likely due to the short-term players.

XRP Price Levels Above Which The Pressure Fades

Even with accumulation underneath, the price still needs to clear the supply above.

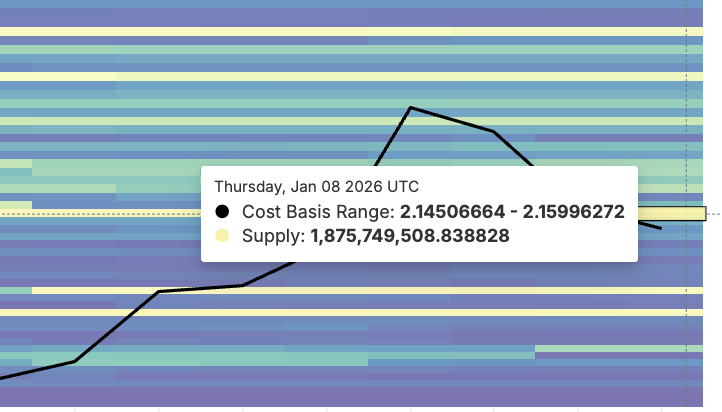

Cost-basis data shows the first major resistance sits near $2.15, where a large cluster of holders previously accumulated. A clean move above this level would signal that near-term selling pressure is weakening.

Immediate Support: Glassnode

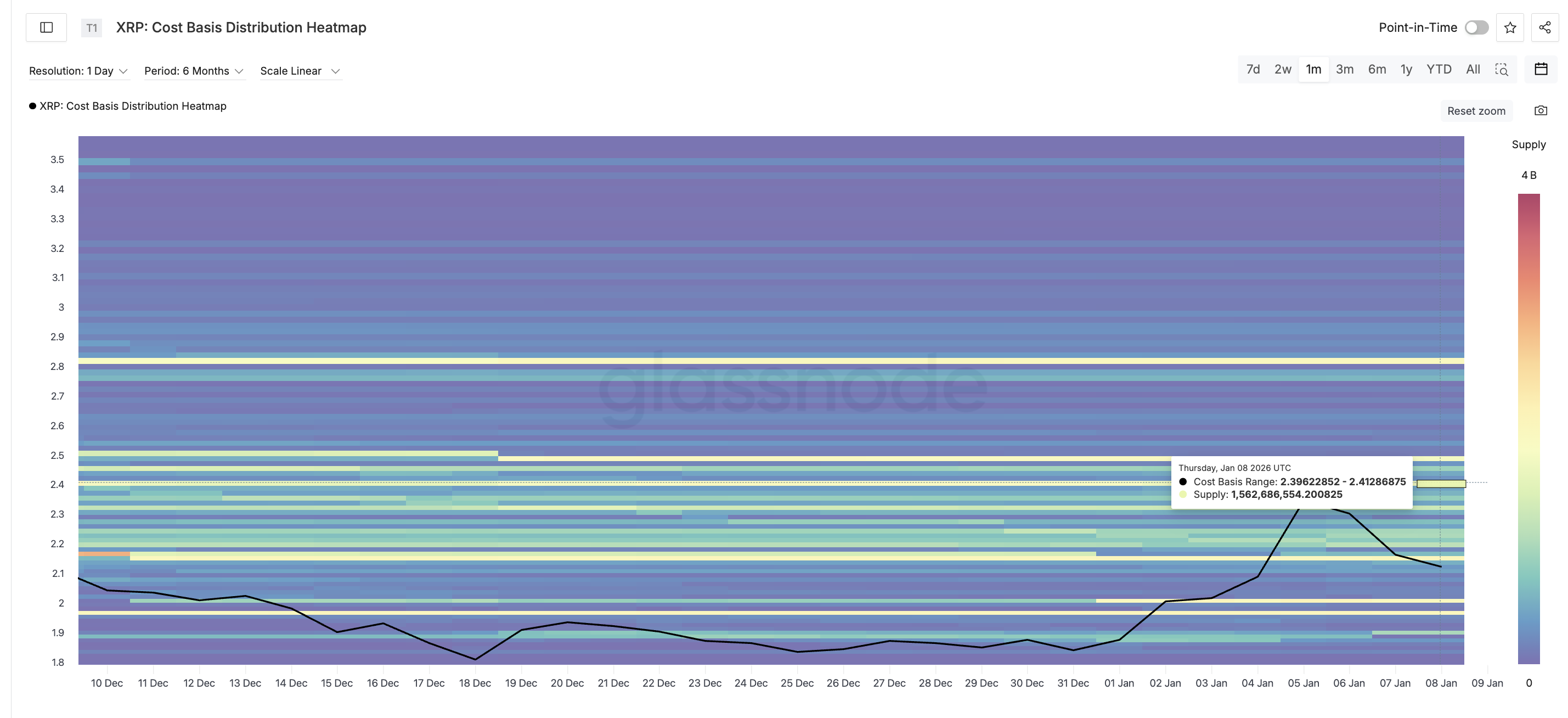

The next and more important level is $2.41. This zone marks where the most recent sell-off began and represents a heavy supply cluster as well.

Key XRP Clusters: Glassnode

The supply clusters align with the XRP price chart levels. The first near-term resistance is close to $2.15 ($2.149 to be exact). A daily close above $2.41 would significantly reduce downside risk and reopen the path toward $2.69.

On the downside, $1.97 remains the key support. Holding above it keeps the broader structure intact. A loss of that level would signal that selling pressure is no longer being absorbed.

XRP Price Analysis: TradingView

For now, XRP is in a controlled pullback phase. Volume shows selling pressure has arrived, but long-term holders and whales are actively buying into it. As long as accumulation continues and key support holds, this correction looks like a pause in the trend, not a warning.