On-chain data show a significant amount of Shiba Inu still held on exchanges, putting the SHIB price at risk of a decline due to sell-offs. This comes amid a positive increase in net flows, indicating that more coins are flowing into exchanges, likely to offload them.

SHIB Price At Risk With 82 Trillion Shiba Inu On Exchanges

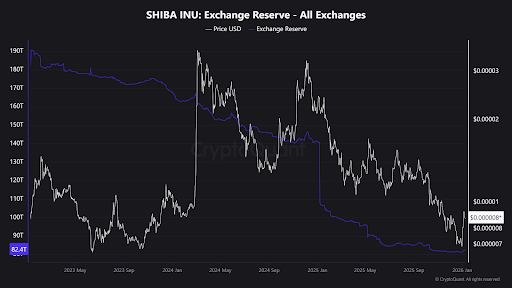

CryptoQuant data shows that the Shiba Inu exchange reserve is at 82 trillion coins. This indicates higher selling pressure, especially as the value has risen from around 81 trillion at the start of the year. Amid this development, the SHIB price has trimmed some of its year-to-date gains, with the meme coin dropping from a high above $0.000009 just as the exchange reserve rose.

Another bearish indicator for Shiba Inu at the moment is the exchange netflow. Further data from CryptoQuant show that the exchange netflow has turned positive, indicating that more coins are being deposited into exchanges than removed. As such, the meme coin is likely currently facing more selling pressure than buying pressure, putting the SHIB price at risk of a decline.

Notably, the Shiba Inu exchange netflow turned positive just as the SHIB price reached its yearly high above $$0.000009. The recent bearish sentiment in the broader crypto market has likely contributed to these sell-offs for SHIB, with the Bitcoin price dropping back to $90,000 after rising above $94,000 at the start of the year.

Activity in the Shiba Inu derivatives market also paints a bearish picture for the SHIB price. CoinGlass data shows that trading volume has dropped by just over 5%, to $203 million. SHIB’s open interest is also down over 7%, dropping to $108 million. However, a positive is that most traders are still bullish on the meme coin, with the long/short ratio above 1.

An Increase In SHIB Whale Transactions

A positive for the SHIB price is that whales still appear to be bullish on the meme coin. On-chain analytics platform Santiment recently pointed out a 111% spike in Shiba Inu’s whale transactions. Thanks to this development, SHIB ranks among the tokens with a market cap of at least $500 that have seen an increase in whale transactions above $100,000.

Meanwhile, CryptoQuant data show that the number of daily Shiba Inu active addresses has climbed since the start of the year and has remained above the 3,000 threshold. This is a positive as it indicates that attention is now returning to the SHIB ecosystem, which could positively impact the SHIB price once the crypto market rebounds again.

At the time of writing, the Shiba Inu price is trading at around $0.000008752, down in the last 24 hours, according to data from CoinMarketCap.