Bitcoin held above the $90,000 level on Friday after the latest US labor market data showed slower hiring but no sign of a sharp economic downturn.

The report removed one key downside risk for crypto markets. However, it did not yet create the conditions for a fast move back toward $100,000.

Labor Data Eases US Recession Risk

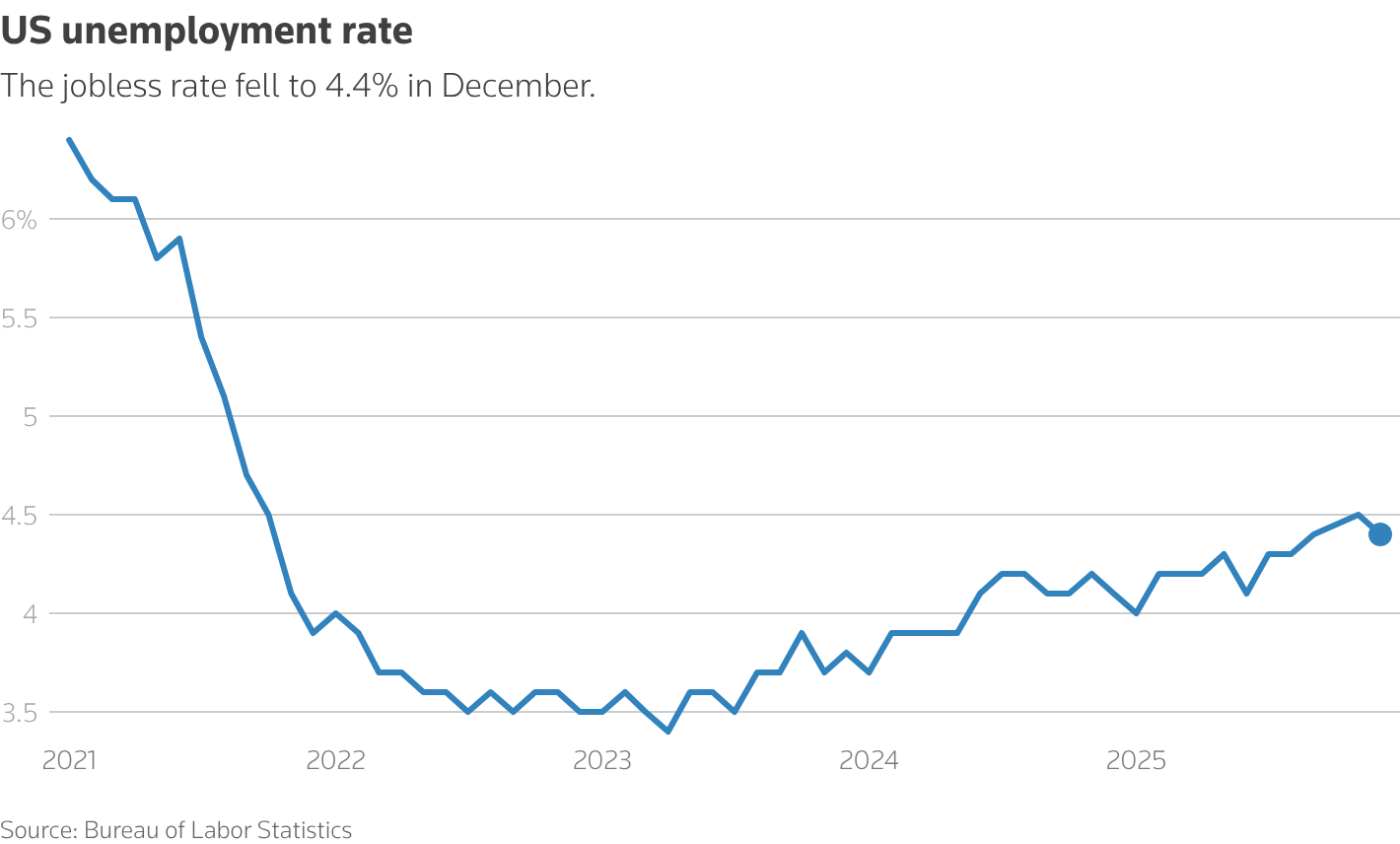

The US economy added 50,000 jobs in December. That was one of the weakest monthly gains in years. At the same time, the unemployment rate fell to 4.4% and wage growth stayed firm at 3.8% year over year.

US Unemployment Rate Falls. Source: Reuters

Markets read the data as a cooling labor market, not a collapsing one. That kept risk assets stable, including Bitcoin, which has traded between $89,000 and $92,000 through the session.

The weak payroll number reduced fears of an overheated economy that could force tighter monetary policy. It also reduced the risk of a sudden growth shock that could trigger broad market selling.

That matters for Bitcoin. Over the past year, sharp drawdowns in crypto have followed signs of either runaway inflation or a rapid economic slowdown. Friday’s data showed neither.

Unemployment fell only slightly, while job growth slowed. That combination suggests the economy is losing momentum but remains stable. This supports a “soft landing” outlook rather than a recession.

As a result, Bitcoin avoided the type of risk-off move that would have pushed it back toward the low-$80,000s.

“With Bitcoin already up over 7% in the opening days of 2026, the path of least resistance is toward the $100,000 psychological milestone. If unemployment continues to hold steady while inflation cools, we expect a definitive breakout of the $100k and a retest of the $110,000 psychological milestone that once served at an all-time high. This level is crucial as it being a previous all-time high makes it serve as a crucial resistance level bitcoin must move higher than in order to instill confidence in investors that high prices are on the table.” Matt Mena, Crypto Research Strategist at 21shares.

Why Bitcoin’s $100,000 Still Looks Hard in the Near Term

While the report removed one downside risk, it did not unlock a new upside driver.

Wage growth at 3.8% remains high enough to keep services inflation sticky. That gives the Federal Reserve room to stay on hold rather than move quickly toward rate cuts.

Bitcoin has rallied fastest in this cycle when markets priced in falling interest rates and rising liquidity. Friday’s data did not reinforce that narrative.

Instead, it supports a longer pause in policy. That limits the odds of a rapid liquidity-driven surge toward $100,000.

Bitcoin’s path back to six figures now depends less on labor data and more on capital flows and interest rate expectations.

Sustained inflows into spot Bitcoin ETFs would provide the demand needed to push through the $95,000 resistance zone. A clearer signal that the Fed plans to cut rates would also help.

For now, the jobs report keeps Bitcoin stable above $90,000. It removes the threat of a sudden macro shock. But it does not yet provide the spark needed for a clean breakout to $100,000.