Bitcoin has been consolidating since late November, struggling to establish a clear directional bias as the market searches for stability ahead of the next volatility wave. After failing to sustain momentum above the October 2025 highs, price action has shifted into a broad range, reflecting growing uncertainty among investors. While some market participants interpret this pause as a potential base for continuation, others remain cautious, pointing to historical bear market behavior for context.

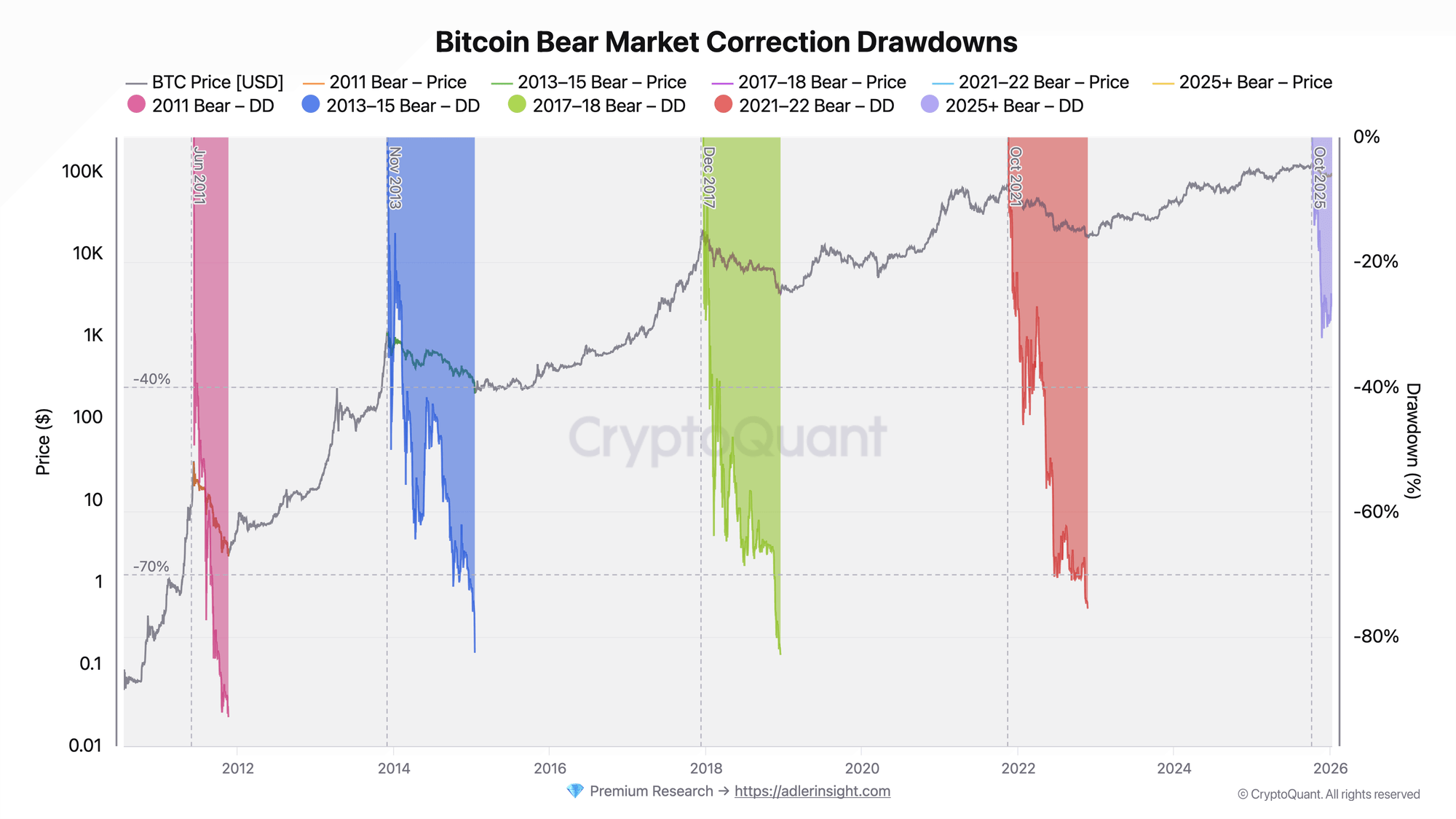

According to a report by top analyst Axel Adler, the current Bitcoin drawdown from the October peak remains historically shallow. The Bitcoin Bear Market Correction Drawdowns chart, which compares drawdown depth across cycles since 2011, highlights how different this cycle has been so far. In the ongoing 2025+ cycle, the drawdown stands at roughly −27%, with the maximum correction reaching about −33%.

By contrast, previous bear markets were far more severe: the 2011 cycle collapsed by −92%, both the 2013–2015 and 2017–2018 cycles saw drawdowns near −82%, and the 2021–2022 bear market bottomed around −75%.

This relative resilience may point to a structural shift in Bitcoin’s market dynamics. The growing presence of spot ETFs and institutional capital could be dampening volatility and reducing the magnitude of corrections. Still, Adler cautions that the current bear phase is relatively young. As a result, it remains too early to conclude that Bitcoin has definitively entered a new regime where deep drawdowns are no longer part of the cycle.

Bitcoin Still Trades Above Long-Term On-Chain Fair Value

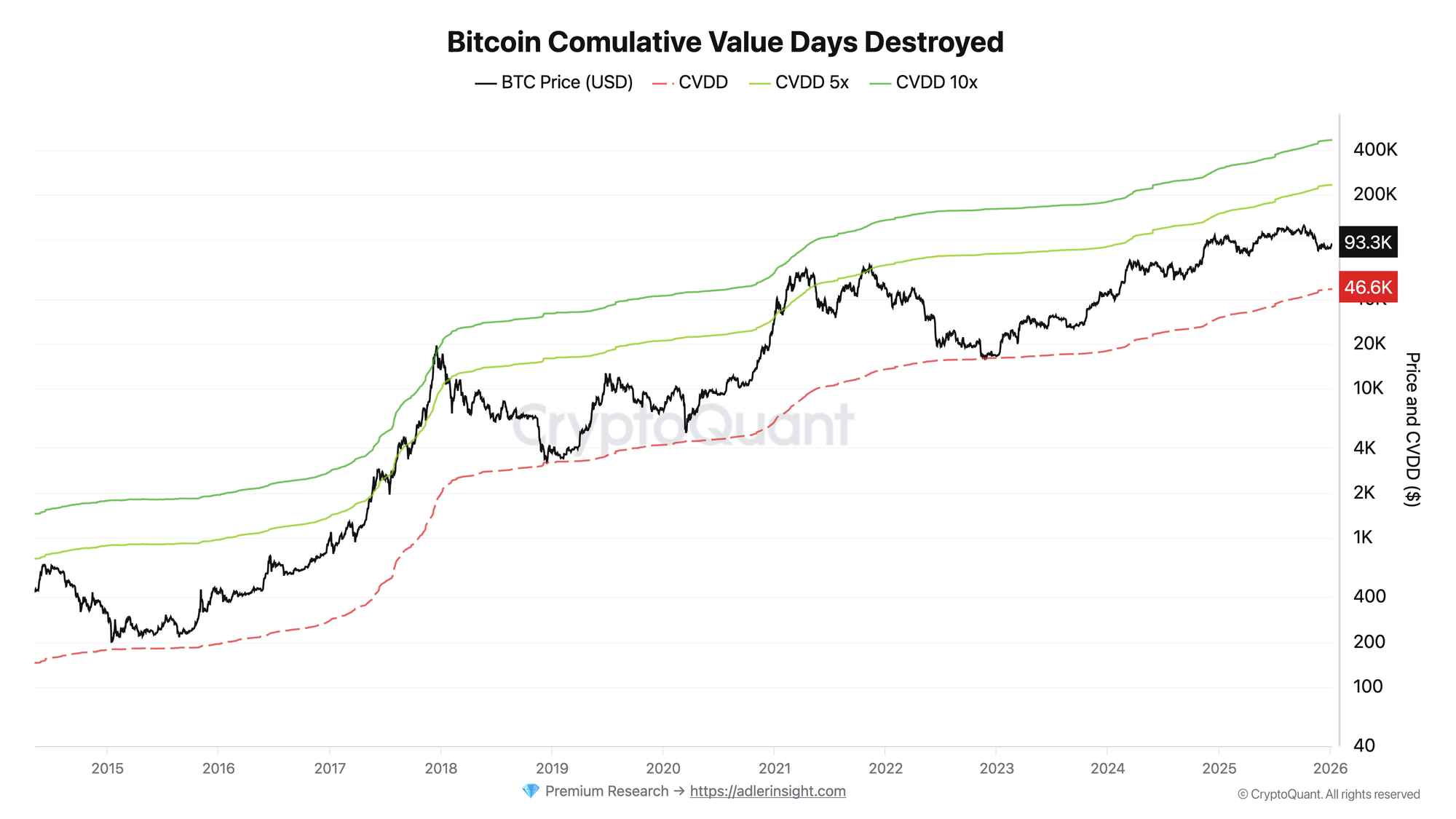

Adler further explains that the Bitcoin Cumulative Value Days Destroyed (CVDD) model offers critical context for evaluating where the market currently sits within the broader cycle. CVDD is a long-term on-chain valuation framework derived from “destroyed” coin days, which captures periods when older, long-held coins are spent. Historically, this behavior has been closely associated with major market transitions and macro bottoms.

The CVDD chart plots Bitcoin’s price against several valuation bands, including the base CVDD level and its 5x and 10x multiples. At present, Bitcoin is trading near $91,000, which places it at roughly 2x above the base CVDD, currently estimated at around $46,600. This zone has historically aligned with bear market bottom formation phases rather than full capitulation events. In past cycles, deep undervaluation and panic selling typically occurred when the price approached or briefly dipped below the base CVDD level.

The fact that Bitcoin remains well above this fundamental support suggests that the market has not yet entered a true capitulation regime. Instead, long-term holders appear largely intact, and selling pressure from older coins remains relatively contained. As Adler notes, the base CVDD level continues to act as a long-term structural floor for the asset.

Taken together, the shallow drawdown profile and Bitcoin’s position above key CVDD valuation bands indicate that the ongoing correction is real but still consistent with an early-stage bear cycle, rather than a fully developed market bottom.

BTC Consolidates As Structure Remains Weak

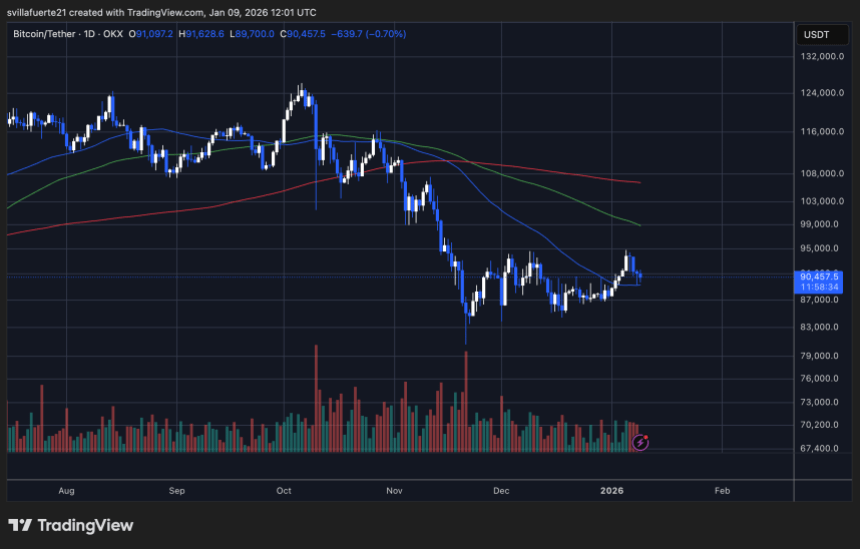

Bitcoin price continues to trade in a tight consolidation range after the sharp sell-off from the October highs, with the chart showing BTC hovering around the $90,000–$91,000 area. This zone has acted as a short-term equilibrium following the aggressive breakdown from above $100,000, but the broader technical structure remains weak. Price is still trading below the 100-day and 200-day moving averages, which are both sloping downward, reinforcing the idea that the dominant trend has shifted from bullish to corrective.

The recent bounce from the December lows near $86,000 lacked strong follow-through, suggesting that demand remains cautious rather than aggressive. While buyers have managed to defend higher lows in the short term, each upside attempt has been capped near the descending moving averages, highlighting persistent overhead supply.

Volume has also declined during the consolidation phase, signaling a lack of conviction from both bulls and bears.

From a market structure perspective, Bitcoin appears to be forming a basing pattern rather than initiating a reversal. Holding above the $88,000–$90,000 support zone is critical to avoid a deeper retracement toward the mid-$80,000s.

However, a sustained recovery would require a decisive reclaim of the $95,000–$98,000 region, where key moving averages converge. The current price action is best interpreted as consolidation within a broader corrective phase rather than the start of a new uptrend.

Featured image from ChatGPT, chart from TradingView.com