Cardano price is slipping back into focus after failing to follow through on a breakout attempt. ADA is down about 2% over the past 24 hours and has trended lower since January 6. Still, the damage remains contained. Over the past seven days, the ADA price has been broadly flat and has not flipped negative.

That balance is not accidental. Cardano is holding a bullish structure, and buying pressure has not disappeared. But underneath the surface, the type of buying has changed. That shift is now the main risk factor deciding whether ADA stabilizes or slides.

Bullish Wedge Holds as Momentum Signals Stay Supportive, for Now

Cardano continues to trade inside a falling wedge pattern that has been in place since early November. A falling wedge is generally bullish, as price compresses lower while selling pressure weakens. As long as the lower boundary holds, the breakout scenario remains valid.

This structure explains why ADA has defended the $0.383 support zone. That level previously acted as resistance and flipped to support after the January breakout attempt. Holding it has prevented a deeper pullback so far.

Momentum data initially supports this stability. The Money Flow Index, or MFI, measures buying and selling pressure using both price and volume. Between early November and January 10, ADA price trended lower, while MFI trended higher. That divergence suggests dip buyers are still active beneath the surface.

Bullish Pattern For ADA: TradingView

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

At face value, this looks constructive and helps explain why the price has not broken down despite being rejected at the upper trendline. But momentum alone does not reveal who is doing the buying. To judge whether this support is durable, holder behavior matters more than indicators.

Holder Shifts Reveal Weakening Conviction Beneath the Surface

On-chain data shows a clear divergence between long-term and short-term holders.

Long-term holders are increasingly distributing. The spent coins age band for the 365-day to 2-year cohort rose sharply on January 9. Activity from this group jumped from about 1.92 million ADA to 4.51 million ADA, an increase of roughly 135% in just 24 hours. That spike signals that older holders could be exiting positions rather than sitting through volatility.

Convinction Holders Could be Selling: Santiment

Spent Coins Age Band measures how long coins were held before being moved, showing which holder groups are actively selling.

Short-term behavior tells the opposite story. The 30-day to 60-day cohort has sharply reduced selling activity. Spent coins in this group fell from around 55.42 million ADA to 4.28 million ADA, a drop of nearly 92%. That decline indicates short-term participants could be absorbing supply instead of selling.

Short-Term Holders Have Slowed Down on Selling: Santiment

This shift reframes the earlier MFI signal. The rising MFI now likely reflects short-term dip buying rather than renewed long-term confidence. When conviction holders sell, and shorter-term traders step in, the price can stabilize temporarily, but that support is fragile because the short-term holders’ capital is typically speculative.

This mix raises risk because speculative capital replaces patient capital. Derivatives positioning, discussed next, reinforces that imbalance.

Derivatives Skew and Key Levels Decide the Next Cardano Price Move

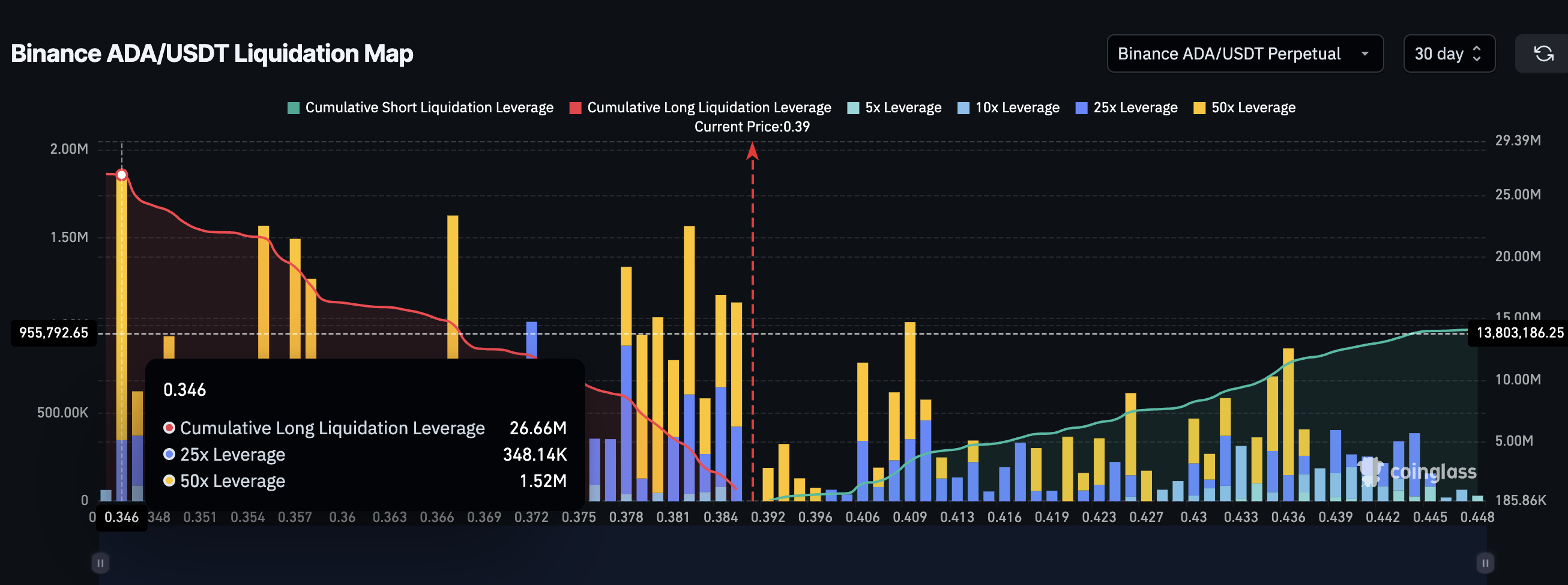

Liquidation data shows the market is leaning heavily one way. On Binance’s ADA-USDT perpetual market, cumulative long liquidation leverage stands near $26.66 million, while short liquidation leverage is closer to $14.11 million. That places long exposure roughly 89% higher than short exposure, signaling a strong bullish skew.

ADA Liquidation Map: Coinglass

While that bias may look positive, it also increases downside risk. If the price weakens as recently injected speculative capital is withdrawn, crowded long positions may unwind quickly, accelerating losses through forced liquidations.

From a price perspective, the roadmap is clear. To revive the bullish case, ADA needs a daily close above $0.437, which would break the otherwise weak descending trendline (only two touchpoints) and reopen the path toward the projected 49% upside, per the wedge’s target.

If the Cardano price fails to reclaim that zone, risk tilts lower. A break below $0.351 would weaken the wedge structure and expose $0.328 as the next major support. Losing those levels would confirm that recent stability was distribution, not accumulation.

Cardano Price Analysis: TradingView

For now, the Cardano price remains balanced on the surface but unstable underneath. The wedge is intact, momentum looks supportive, but long-term holders are selling, short-term buyers are stepping in, and derivatives positioning leaves little margin for error.

The next move will depend on how long the speculative capital remains interested.