Ethereum is facing a critical moment as on-chain staking data and price action send mixed but important signals to the market.

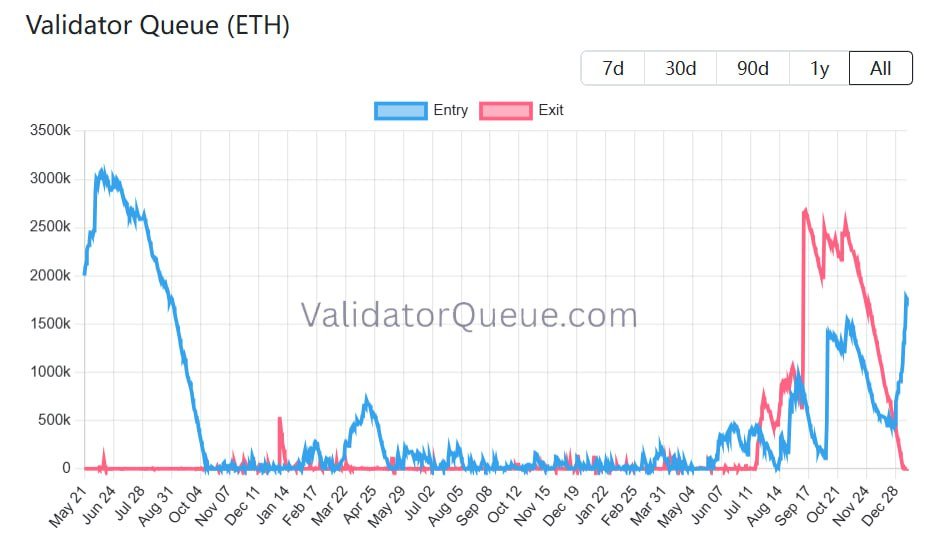

According to ValidatorQueue data, the Ethereum Beacon Chain staking entry queue has surged to around 1.759 million ETH, worth roughly $5.5 billion.

Key Тakeaways

Ethereum’s staking entry queue has reached its highest level since August 2023, signaling strong demand from long-term participants.

The exit queue falling to zero suggests limited immediate sell pressure from unstaking.

Price action remains fragile near $3,000, with a breakdown risking a move toward $2,700.

This marks the highest level of staking demand since late August 2023. At current rates, new validators are now facing a waiting period of about 30 days and 13 hours before their ETH is officially activated. At the same time, the exit queue has dropped to zero, meaning no validators are currently waiting to withdraw their staked ETH.

This combination points to a notable shift in sentiment among long-term holders. A rising entry queue alongside a cleared exit queue suggests that more investors are locking ETH into staking rather than positioning to sell.

With fewer validators leaving the network, near-term sell pressure from unstaking appears limited, which strengthens the longer-term supply picture even as price volatility persists.

Staking data signals growing long-term conviction

Historically, spikes in the staking entry queue tend to reflect increased confidence in Ethereum’s future returns, both from yield and potential price appreciation.

The fact that the exit queue is fully cleared reinforces this view, as it shows a lack of urgency among validators to unlock liquidity. In market terms, this reduces one potential source of selling pressure and can act as a stabilizing force during periods of price consolidation.

Price action tests a key technical zone

Despite supportive on-chain signals, Ethereum’s short-term price structure remains under pressure. Trader Merlijn The Trader described the current setup as a “real test,” with the $3,000 level acting as a crucial psychological and technical threshold.

ETHEREUM IS WALKING INTO A REAL TEST.

Bears want a failure back below prior resistance

and a reload toward $2,700.As long as $3K holds,

this is a test not a breakdown. pic.twitter.com/Q06l65RTYG— Merlijn The Trader (@MerlijnTrader) January 10, 2026

Bears are watching for a failure below prior resistance, which could trigger a move back toward the $2,700 area. As long as $3,000 holds, however, the move is seen more as a test of support than a confirmed breakdown.

Taken together, Ethereum appears to be at a crossroads. Long-term participants are increasing their commitment through staking, while short-term traders remain cautious as price hovers near a key decision zone. The next directional move is likely to depend on whether buyers can defend current levels while broader market conditions remain supportive.