Liquidity is what makes the crypto market actually work. When liquidity is low, trades become harder to complete, prices can shift suddenly and users often end up getting worse deals than they expected (slippage). On the other hand, strong liquidity allows trades to happen fast and at predictable prices, making the platform feel stable and trustworthy.

There are roughly 28.39 million tokens that exist in the crypto market. Due to this, most exchanges face the challenge of maintaining enough buyers and sellers on their own. Liquidity providers or LPs for short remove this problem by combining prices and trades from multiple sources into a single stream, so exchanges can always offer the best available prices.

Some providers, called market makers, simply post buy and sell prices on one exchange. Others, known as liquidity aggregators, work more like smart traffic controllers. They scan many markets at once and route trades to wherever the price is best. What matters most is not just how much trading volume exists, but how well that liquidity is spread across the order book. Deep, well balanced liquidity helps trades go through faster, with few price surprises, ultimately creating a better experience for users.

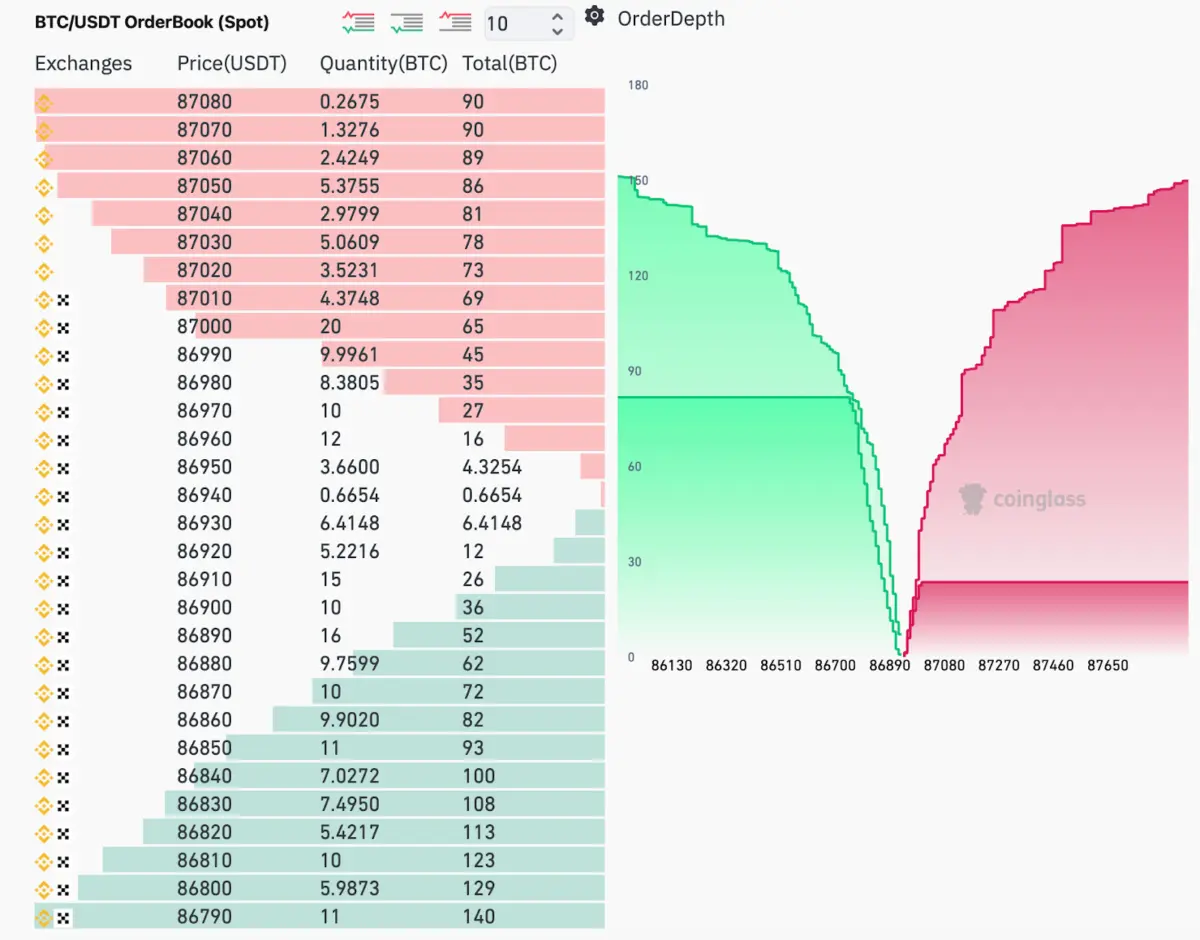

A market depth chart is a way to show how many people are willing to buy and sell at different prices. When there is high liquidity, there are plenty of buyers and sellers close to the current price, so even large trades can go through without causing fluctuations in price. When liquidity is low, there are fewer orders available leading to price slippage and failed or delayed trades.

By combining liquidity from multiple sources, exchanges can create deeper and more balanced markets for users from the start. In 2026, exchanges increasingly rely on external LPs and aggregators rather than building in house so that users experience minimal mishaps when trading.

Faster Market Access & Reduced Infrastructure Overhead (ChangeNOW)

Why this benefit matters

New exchanges coming to market need liquidity quickly. Waiting to build a market making engine in house can take months but can also cost a lot. Estimates show that a centralized exchange minimum viable product can require around $500k to $1M up front and over a year of development. Syncing up with an existing provider’s API however gives instant depth. An API based integration with LPs gives exchanges deep order books from day one without amassing all that liquidity themselves. This approach cuts time to market by a lot.

How ChangeNOW fits this benefit

ChangeNOW works as one such aggregation platform. It connects multiple exchanges and trading pools and compares prices in real time. Partner platforms can route trades through ChangeNOW to access many markets at once without running its own full order books. ChangeNOW’s API handles the rate comparison and routing, so the partner can offer fast swap execution even for new token pairs or chains.

Operational Impact

Using an external provider lowers upfront costs and launch times can speed up launch times. Exchanges can add new tokens and networks fast, often within days, while avoiding the challenge of building and maintaining complex trading systems.

Trade-offs

The main trade off here is control. When using a third party provider, exchanges must rely on pricing and routing logic from the external party instead of being able to manage everything themselves. While this reduces customization, most growing platforms find the speed, cost savings and operational simplicity worth the trade-off.

Improved Trade Execution & Tighter Spreads

Why it matters

High liquidity directly translates to better trade execution. This is a huge deal for the end user as they most often than not notice execution qualities first. When there are plenty of buyers and sellers, price stay close to the market rate and trades don’t cause sudden price jumps. The opposite is true when liquidity is weak. Prices can change and trades can take longer to fully execute. These hiccups can add up and create a poor trading experience. From a retention point of view, this becomes a very critical area to focus on.

LP benefits

By combining liquidity from multiple sources via an LP, exchanges can offer deeper markets and more stable pricing. If activity slows down in one source, the aggregator can simply route orders elsewhere automatically. This helps absorb market volatility and ensures users always get fair, competitive prices. Over time, fast and reliable execution builds trust, supports larger trades and allows the platform to scale without sacrificing user experience.

Scalability across assets, chains and regions

Why it matters

Most crypto exchanges frequently list new tokens on multiple networks to their users. The task of managing strong liquidity for each asset is operationally complex as it would require massive capital expenditure and coordination. LPs address this by providing a plug and play depth for a wide range of assets. ChangeNOW for example already support 900+ coins across many networks. In effect, a partner exchange can add new trading pairs by routing trades into the existing shared pools of these liquidity networks.

Liquidity Provider Advantages

The result is much smoother scaling. Exchanges can support more assets, handle higher trade volumes and enter new regions without worrying about thin markets. By working with global liquidity networks rather than local, exchanges can grow faster while maintaining a consistent trading experience.

Risk Management & Reduced Counterparty Exposure

Trusting a single exchange or market maker for liquidity can be risky. Outages, technical glitches or sudden withdrawals by a single provider can stall all trading. Partnering through multiple LPs through an aggregator though dramatically decreases this single party risk.

As an aggregator draws from multiple sources, if one platform experiences downtime, orders get routed to another LP automatically. What’s important is that aggregation also simplifies the whole process of dealing with multiple providers.

Faster Go-To-Market & Better User Retention

Crypto investors now expect exchanges to have sleek UI/UX. Gone are the days of clunky and complex crypto trading apps. Today, the biggest tier 1 exchanges are prioritizing a smooth experience for their users. With the competition out there, first impressions really matter for new exchanges. If users face failed trades or unexpected prices during their first few transactions, they are unlikely to return. As mentioned earlier, liquidity and UX go hand in hand.

By integrating with LPs, exchanges offer active markets to their users without having to wait to build their own trading volume. This means fewer failed trades, predictable prices and a smoother onboarding experience. All of these factors are what investors look for in an exchange and they are extremely crucial during a launch.

With time, a platforms reliability supports user retention. Trust is built when users see their trades go through without any challenges.