The Solana blockchain is facing a pivotal infrastructure test this weekend as developers deployed an “urgent” security patch across the network’s validators.

On January 10, Solana Status announced the immediate release of validator client v3.0.14.

Over Half of The Network Validators Still Run Old Software

While official communications framed the release as a proactive measure to enhance “stability,” the update’s deployment pattern bears the hallmarks of a critical security intervention.

“Validators! If you have not patched your node, upgrade to 3.0.14 as soon as possible,” Tim Garcia, the Solana Validator Relations Lead at Solana Foundation, said.

However, the specific root cause of the urgency remains undisclosed. This forces the market to trust that the new release resolves any potential threat.

Still, validator data from Solanabeach indicates a dangerous lag in adoption of the new software.

As of press time, the vast majority of the network’s secured value remains exposed to the older software.

Approximately 51.3% of the network’s stake is still managed by validators running the outdated v3.0.13 client. Only 18% of the stake has migrated to the new, secure v3.0.14 version.

In a Proof-of-Stake system, such sluggish response times to “urgent” upgrades introduce a window of heightened vulnerability.

Meanwhile, this operational friction comes amid broader capitulation of the network’s infrastructure providers.

The total number of active validators, which process transactions and secure the ledger, has fallen by 42% over the past year. The count has dropped from a peak of 1,364 validators to just 783, according to Solana Compass data.

This contraction not only centralizes control among fewer entities but also suggests that the economics of running a Solana node are becoming untenable for smaller operators.

Solana DEX Volume Soars

Despite these indicators, Solana’s adoption metrics remain paradoxically high within the crypto industry.

DeFiLlama data shows on-chain activity remains robust, with decentralized exchange (DEX) volumes surging 23% this week to top $35 billion. This is the network’s highest weekly volume since the first week of last November.

Furthermore, Solana continues to dominate the landscape, processing 8 times more daily transactions than any other chain for the past six months.

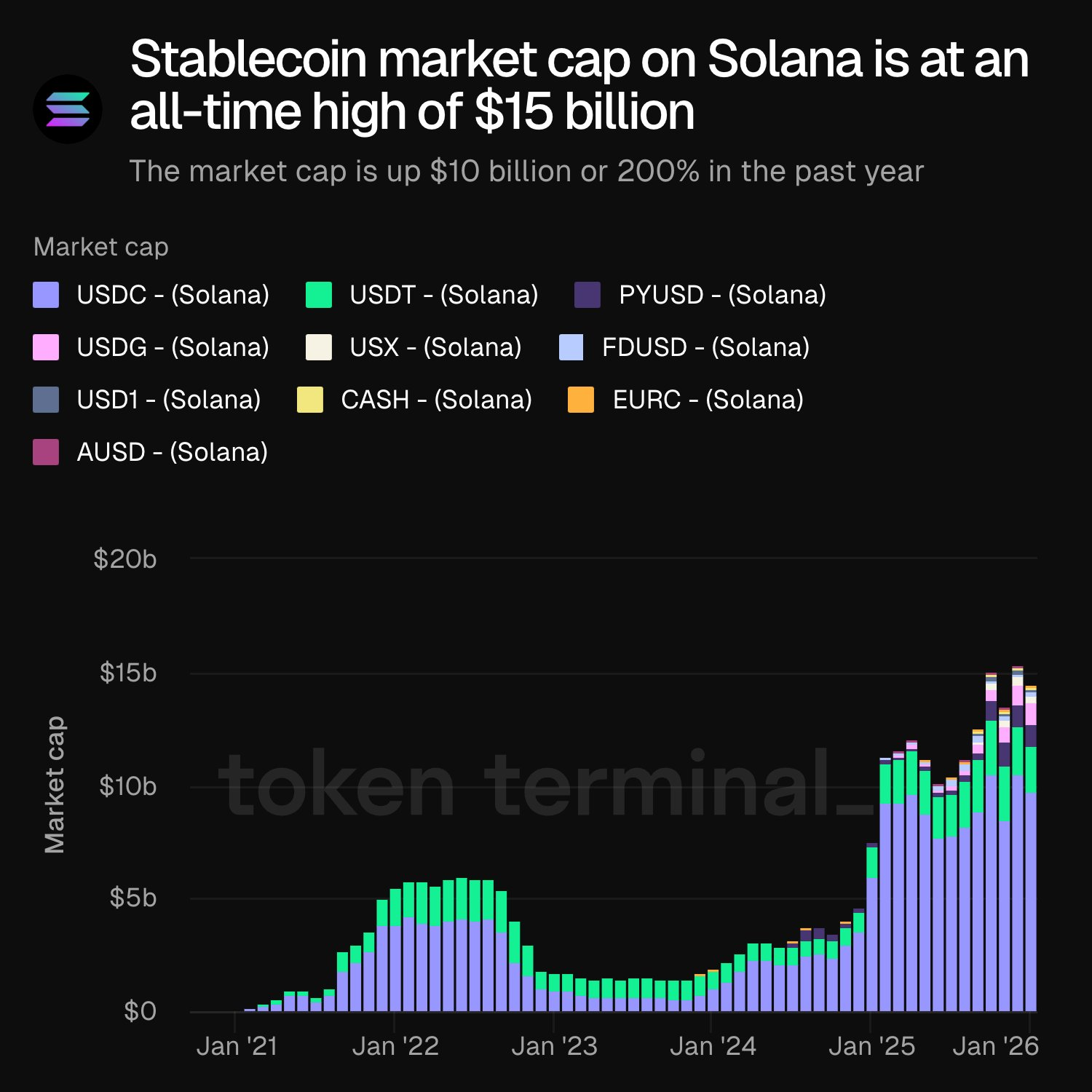

Solana Stablecoin Market Cap. Source: Token Terminal

Data from Token Terminal reinforces this growth, showing that stablecoin usage on Solana has risen roughly 200% over the past year. The network is now carrying a new all-time high of about $15 billion in stablecoin liquidity.