A newly teased feature called Smart Cashtags, revealed by X’s head of product Nikita Bier, suggests the platform is moving beyond passive market commentary toward becoming a real-time gateway for tracking, and potentially trading, stocks and crypto assets.

Initial sentiment on X (formerly Twitter) suggests that the Elon Musk-led social media platform may be preparing to turn financial conversations into something far more actionable.

Smart Cashtags: Everything X Users Need to Know

Highlighting X as the best source for financial news, Bier noted that hundreds of billions of dollars have already been deployed based on information users read on the platform.

Smart Cashtags, he said, are designed to formalize that influence. Instead of generic $TICKER mentions, users will be able to tag exact assets or even specific smart contracts. From the timeline, tapping a cashtag will surface the asset’s real-time price alongside all related mentions across X.

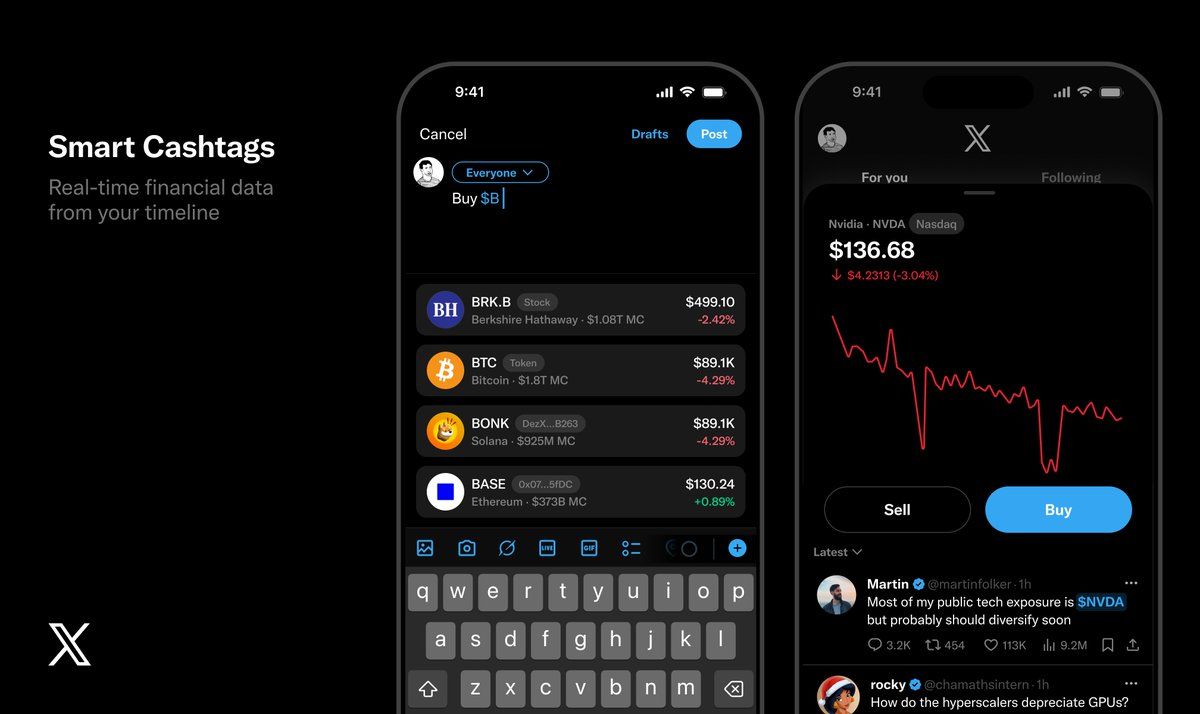

That shift matters because it reframes X’s role from social amplifier to financial infrastructure. The feature’s mockups show examples such as:

Traditional equities, such as Berkshire Hathaway’s $BRK.B

Crypto tokens, including the Solana-based meme coin $BONK

These are all rendered with live price data embedded directly into posts.

A public release is targeted for February 2026, following a feedback-driven iteration phase.

The crypto-native design has drawn particular attention. Bier confirmed that the API powering Smart Cashtags will be “almost real-time for anything minted on chain.”

This raises the possibility that smaller-cap tokens and newly launched DeFi assets (often absent from mainstream data providers) could appear alongside blue-chip stocks.

Users quickly pressed for details on whether the backend might pull from decentralized data sources, with Bier’s response reinforcing that on-chain coverage is a priority.

Turning X From a Market Megaphone into a Trading Gateway

What has truly fueled speculation, however, is what comes next. Screenshots shared alongside Bier’s announcement show buy and sell prompts attached to certain assets, prompting analysts to question whether X plans to integrate trading directly.

Smart Cashtags UI mockup displays auto-complete asset search with real-time prices and market caps, alongside a detailed trading page for NVDA showing chart, buy-sell buttons, and mention feed (Nikita Bier)

Analyst AB Kuai Dong said the viral post sparked widespread belief that X could become an entry point for both stock and crypto trading. This could be achieved through partnerships with Coinbase, Base, and traditional brokers.

“…Currently, the English-speaking community speculates that it will likely collaborate with Coinbase and stock brokers. Twitter provides the entry point, while Coinbase and Base APP, along with traditional stock brokers, provide the specific underlying trading support,” explained analyst Kuai Dong.

In this model, X (Twitter) would handle discovery while regulated platforms execute trades.

Others see a more ambitious trajectory. Kuai Dong suggested Elon Musk could ultimately build an exchange or internal matching system himself, noting that X Money has reportedly been in preparation for nearly a year.

Users echoed those ideas, asking whether future iterations might support self-custodial wallets, DEX integrations, or region-specific broker connections that redirect trades to a user’s preferred provider.

Industry builders are already circling. Solana figures openly invited X to explore Solana-centric infra.

Meanwhile, crypto analysts argued Smart Cashtags could collapse the entire trading funnel—from discovery to execution—into a single tap. Crypto researcher Kryll highlighted that every asset mentioned becomes a potential conversion point once the price context is embedded directly into social discussion.

X’s Financial Expansion Meets Regulation

However, the rollout comes amid intensifying regulatory scrutiny against X, which faces:

Extended EU retention orders tied to algorithmic transparency

An ongoing French investigation into alleged algorithmic bias, and

A recent €120 million ($140 million) fine under the Digital Services Act.

Against that backdrop, Musk’s pledge to open-source X’s recommendation algorithm, updated every four weeks, appears aimed at signaling transparency just as the platform deepens its financial influence.

In the meantime, Smart Cashtags remain a feature preview. However, combined with X Money, crypto-native data, and trading speculation, they revive questions on whether this is another step toward an everything app, where conversation, markets, and money converge inside a single feed.