A Bitcoin miner from the network’s earliest days has emerged from dormancy to shift 2,000 BTC, a strategic profit-taking move valued at approximately $181 million.

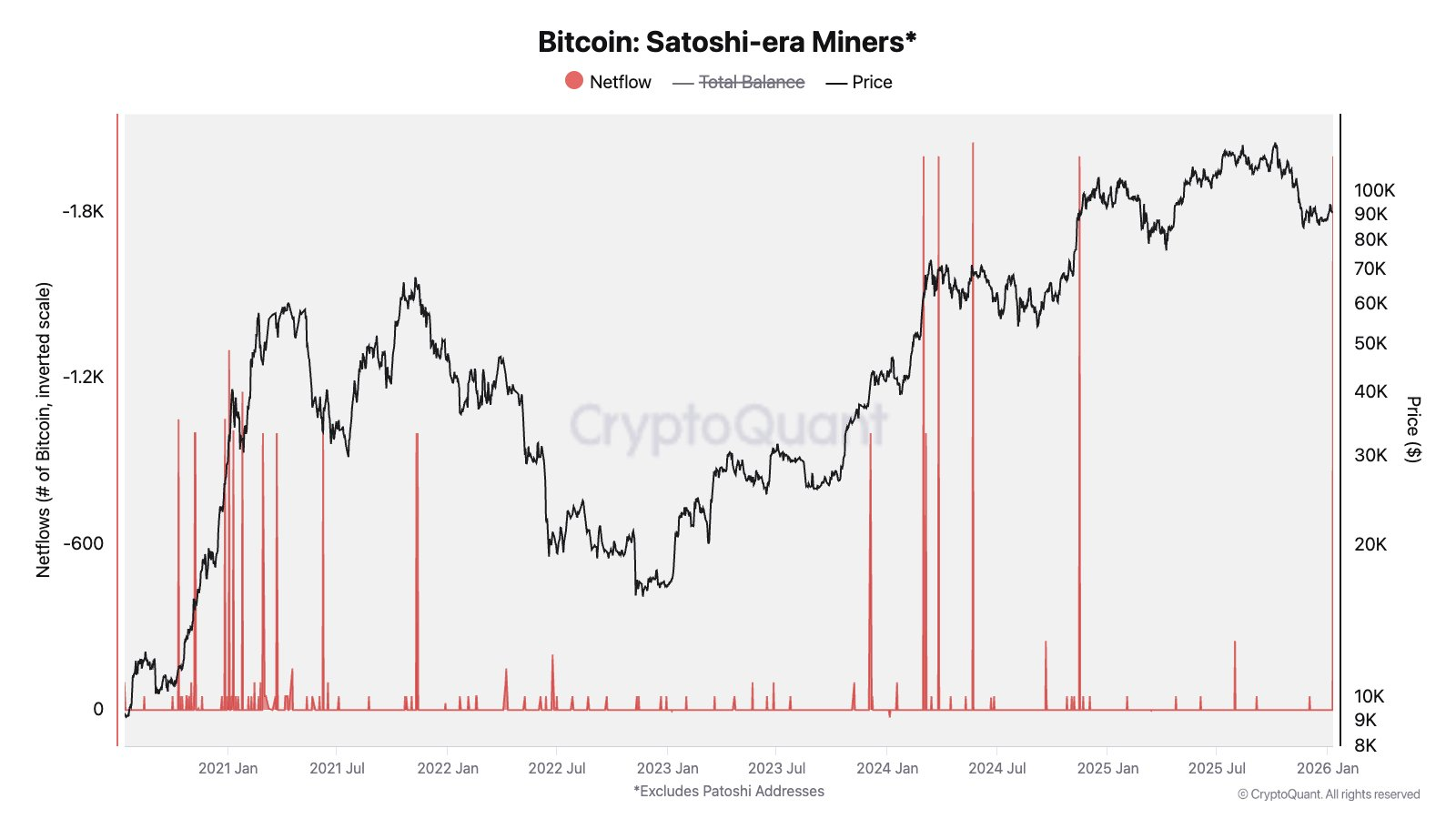

CryptoQuant’s Julio Moreno noted that this represents the most significant activity by a “Satoshi-era” whale since late 2024.

Bitcoin Absorbs $181 Million Satoshi-Era Sell Signal

Moreno highlighted the timing of the transaction and observed that “Satoshi-era miners [tend to] move their Bitcoin at key inflection points.”

Satoshi-Era Bitcoin Miners. Source: CryptoQuant

Adding technical context, Sani, the founder of TimechainIndex, confirmed that the funds originated from block rewards mined in 2010. Notably, the blockchain network had rewarded early miners of that era with 50 BTC in block subsidies.

The coins had remained untouched for more than 15 years across 40 legacy Pay-to-Public-Key (P2PK) addresses. They were later consolidated and transferred to Coinbase.

Typically, market analysts interpret transfers to centralized exchanges as a prelude to an open-market sale.

Meanwhile, this transaction is not an isolated anomaly but underscores a developing trend of “vintage” supply hitting the market.

Over the past year, wallets from the 2009–2011 era have been increasingly reactivated across the Bitcoin network. The activity reflects early holders moving to lock-in gains or update long-standing custody arrangements.

For context, Galaxy Digital had executed one of the largest crypto sales in history by helping a Satoshi-era investor to sell more than $9 billion in July 2025.

Crucially, the market has demonstrated remarkable resilience amid this selling pressure. Bitcoin successfully absorbed these large-scale “OG” supply shocks without suffering a breakdown in market structure.

This signals that while Bitcoin’s early adopters are moving to lock in generational wealth, the market’s liquidity remains deep enough to handle their exits.

However, despite the immediate sell-side pressure from legacy holders, long-term institutional forecasts remain bullish.

In a report released last week, asset manager VanEck projected that Bitcoin could reach a theoretical valuation of $2.9 million per coin by 2050. The firm’s thesis relies on the asset’s potential adoption as a global settlement currency.