Experts believe that advances in quantum computing pose a long-term security threat to crypto users and the digital economy. In the future, attackers with sufficiently powerful machines could exploit exposed cryptographic keys used to authorize transactions across blockchains.

BMIC (BMIC), an upcoming Web3 project, aims to secure the future of cryptocurrencies through its quantum-resistant wallet and security ecosystem. It’s the first quantum-secure decentralized platform for storage, staking, and transactions.

In this BMIC price prediction article, we analyze the new project, discuss its key features, and forecast its performance through 2030.

Key Takeaways

BMIC (BMIC) is a quantum-secure crypto platform featuring wallets, staking systems, and payments all protected with signature-hiding smart accounts.

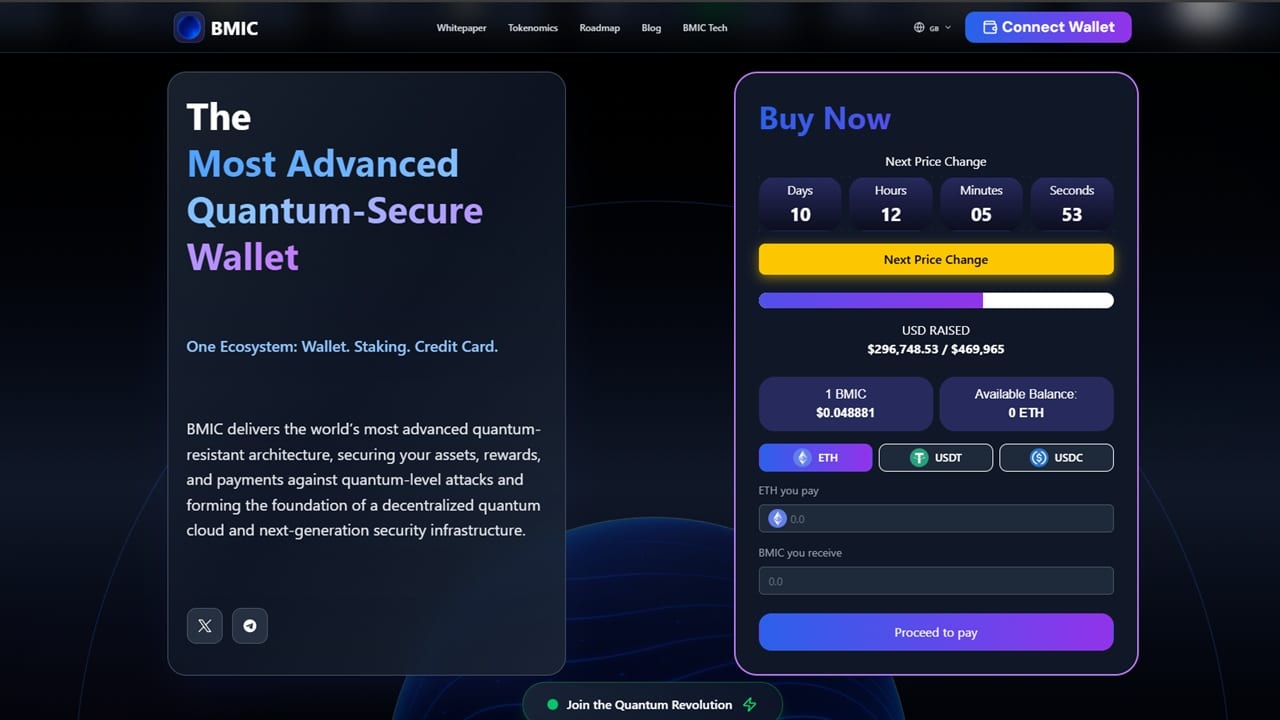

The BMIC token presale has already raised nearly $300,000, with BMIC currently priced at $0.048881 per token.

The project never exposes public keys on the blockchain, eliminating the primary vulnerability that quantum-powered attackers would try to exploit.

In addition to its quantum-resistant wallet, BMIC shields token staking and crypto card payments with post-quantum cryptography.

By the end of the decade, BMIC could average $1.550 if the project establishes itself as the leading quantum-resistant crypto brand and achieves global adoption.

BMIC Price Prediction Overview

Priced at $0.048485 per token in its presale launch, BMIC quickly raised nearly $300,000, suggesting investors recognize the project’s long-term potential. Here’s an outline of our BMIC price forecast for 2026, 2027, and 2030:

2026: While the team has not announced an official token launch date, we expect BMIC to go live on exchanges by 2026. By this time, our projections show that the token could average $0.2000, especially after the public release of the BMIC quantum-resistant wallet.

2027: If BMIC can stick to milestone deadlines while maintaining ecosystem growth, our price prediction shows the token could reach $0.4500 by 2027. Key achievements include global partnerships, the implementation of decentralized governance, and the launch of the BMIC mainnet.

2030: BMIC aims to be the leading quantum-secure brand in Web3, which it can achieve in the coming years. Assuming that the project scales across industries and achieves global adoption, we could see BMIC reach an average price of $1.550 by the end of the decade.

| Year | Potential Low | Potential High |

| 2026 | $0.0950 | $0.2500 |

| 2027 | $0.1550 | $0.8500 |

| 2030 | $0.9250 | $2.250 |

BMIC Price History

BMIC launched on November 15, 2025, at an initial price of $0.048485 per token. Within a few days, the project secured over $100,000 in crypto capital and advanced to the next presale phase. As the presale progresses, the crypto’s price gradually increases. Currently, BMIC is in Phase 3, with the presale token priced at $0.048881.

The BMIC presale is structured across up to 50 phases. However, the team has not provided any information as to when the presale will end. During the token generation event (TGE), BMIC is expected to launch above $0.058182, the price of the last presale tier.

BMIC Price Prediction 2026

Despite the crypto market experiencing extreme fear over the last few weeks, BMIC has managed to rack up nearly $300,000. It’s a promising signal, reflecting early adopters’ confidence in the project and their willingness to support long-term security in the crypto space.

Increased activity in the BMIC presale also suggests a shift in investor appetite from hype-driven projects to more utility-based cryptocurrencies with real-world functionality. In early 2026, the project will focus on developing its core offering: quantum security.

According to the BMIC roadmap, the platform is set to launch an early-access version of its quantum-resistant wallet by Q3 2026. By then, BMIC would also have secured strategic partnerships with institutions such as banks, fintech firms, and exchanges to pilot-test its quantum-secure solution.

Towards the end of the year, we anticipate the BMIC token will launch on exchanges and gain broader public exposure. The roadmap states that by Q1 2026, the project will announce a listing deal with a top-10 centralized exchange (CEX). New cryptocurrency listings on major exchanges like Binance and Kraken expose tokens to millions of new traders, potentially driving significant price increases.

Given this, our BIMC price analysis shows the token picking up quickly in 2026 and reaching an average price of $0.2000. If the team can successfully release the public beta of its quantum-resistant wallet and attract even more users, we could see a further increase to $0.2500 for the crypto.

BMIC Coin Price Prediction 2027-2030

Our valuation thesis for BMIC in 2027 focuses on infrastructure development, with the project releasing new quantum-safe cryptography features in this period. A gradual implementation of the BMIC governance framework will ensure that more community-driven protocol parameters are in place by then.

One feature that could significantly influence the project’s long-term price action is its deflationary burn mechanism. A percentage of BMIC tokens used for its crypto wallet services will be permanently burned, reducing the supply and increasing token scarcity. Over time, this could help stabilize the price, especially as platform activity increases.

Additionally, BMIC will look to onboard more global partners to expand institutional adoption. To support this, the platform would need to complete its secure custody, digital identity, and compliance APIs by Q3 2027, as outlined in its roadmap.

With these developments, BMIC is expected to achieve an average price of $0.4500 in 2027. Aside from organic growth and infrastructure development, the price increase could be driven by increasing awareness of future quantum threats to cryptocurrencies. Given the greater demand for long-term quantum protection and BMIC’s status as a top choice, the token could reach a high of $0.8500.

From 2028 to 2030, our projections show significant growth potential for BMIC following its mainnet launch. This transitions the project from a simple, quantum-secure wallet to a full-stack DeFi ecosystem positioned to dominate the market.

After achieving enterprise-scale infrastructure, BMIC could continue expansion across high-value industries, such as insurance, finance, supply chain, and healthcare. The project’s fully developed Quantum Security-as-a-Service (QSaaS) model enables these institutions to integrate the technology without rebuilding their systems from scratch.

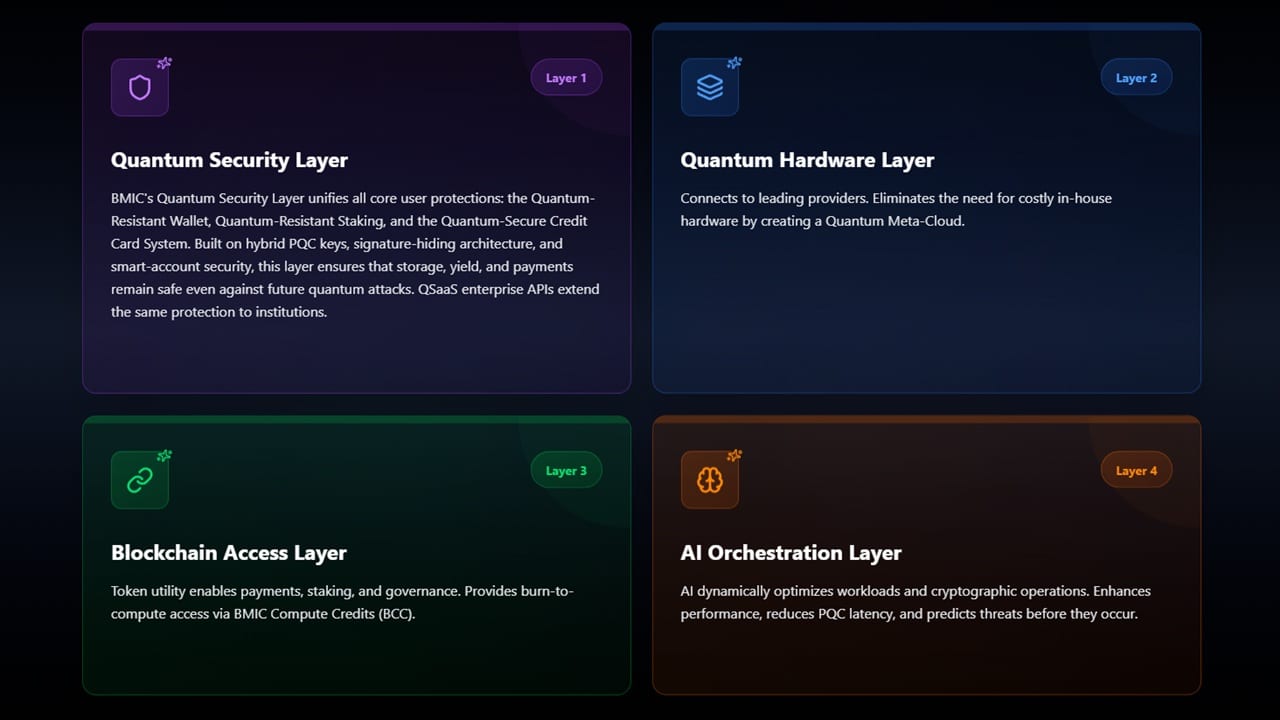

Further enhancing BMIC’s quantum protection is AI-powered adaptive cryptography, which it could adopt as early as 2027. It uses AI to optimize PQC performance and threat detection, future-proofing quantum security, and helping BMIC become more competitive with other emerging quantum-secure projects.

By 2030, experts predict that the total number of global crypto users will reach 1.3 billion from 560 million in 2025. At this point, many more people would likely be aware of the quantum computing threat, leading to many more users adopting quantum-secure platforms.

Assuming BMIC can establish itself as the market leader in quantum security, we expect the token to average $1.550 by the end of the decade. This valuation reflects BMIC becoming the global security standard, which would mean greater institutional adoption.

Our BMIC Price Prediction Methodology

Our BMIC price prediction model is rooted in a fundamental analysis of the project. Since it’s a presale token with no historical price action on exchanges, technical analysis for our model isn’t possible.

We considered BMIC’s core offerings, technology concept, and long-term goals in our price forecasts, which outlined possible future scenarios as the project develops. In addition, we factored in current presale performance and the potential impact of early adoption on future growth. Lastly, we considered current and future market conditions, including global crypto adoption and investor sentiment on the broader crypto market.

What Is BMIC?

While it’s still early, and quantum attacks are not powerful enough to pose a threat, BMIC offers quantum-proof protection for users seeking long-term security. The project implements PQC technology and protocols that hide digital signatures through protected wallets. In the future, BMIC plans on integrating AI for early threat detection and adaptive security.

Although quantum-level threats are not possible today, crypto users are still encouraged to protect their wallets against harvest-and-decrypt-later (HNDL) attacks. In these attacks, attackers first harvest encrypted data that cannot be cracked with today’s technologies. Once quantum computing is sufficiently powerful, the attackers could finally decrypt the data and obtain users’ private keys.

With BMIC, users aren’t limited to quantum-secure crypto storage. BMIC aims to develop a full-stack finance ecosystem that enables yield generation through crypto staking and on-chain transactions protected from quantum attacks. BMIC enables quantum-safe staking by introducing a system that eliminates public-key exposure, a first for long-term staking services.

Additionally, BMIC will be connected to the broader Web3 ecosystem with safe access to decentralized applications (dApps). It supports next-gen digital identity, with hybrid cryptographic signatures that are secure, yet flexible enough to adapt to the National Institute of Standards and Technology’s (NIST) future quantum security standards.

BMIC Crypto Use Cases

As a Web3 platform, BMIC’s primary use case is to protect users from future quantum threats and HNDL attacks. The BMIC token is the platform’s native crypto and serves as the economic foundation for the quantum-secure system.

BMIC token holders get access to advanced features in the quantum-resistant wallet. Additionally, developers and institutions can use BMIC to obtain quantum computing power in the Quantum Meta-Cloud, the project’s proprietary, decentralized network of quantum computing hardware.

In the Quantum Meta-Cloud, users burn their BMIC tokens to earn BMIC Compute Credits (BCC), which are used to run quantum workloads. A percentage of the BMIC platform revenue is also used to repurchase and permanently burn BMIC, further deflating the supply as user adoption increases.

Once the quantum-secure blockchain’s nodes are live, users can stake BMIC to support long-term sustainability and earn BMIC rewards for contributing to network security.

Token holders can also participate in the decentralized autonomous organization (DAO), enabling them to shape the platform’s future fees, upgrades, and integrations.

Where to Store BMIC Tokens?

Purchasing and storing BMIC tokens requires a decentralized wallet that can connect to Web3 services. You’ll need to connect the wallet to the official BMIC presale site and purchase the tokens using ETH, USDC, or USDT.

The presale supports hundreds of crypto wallets, but we recommend using Best Wallet to manage your BMIC holdings. It’s a secure, user-friendly wallet that supports over 60 blockchains and more than 1,000 tokens, with built-in onramping for easy fiat-to-crypto transactions.

Additionally, Best Wallet features an integrated launchpad that showcases early-stage projects that could be the next crypto to explode. The mobile wallet’s built-in decentralized exchange offers seamless swaps for existing tokens, and users can get transaction fee discounts by holding the native token, BEST.

What Drives the Price of BMIC?

For now, BMIC’s price is determined by the progression of its presale. At every new stage, the price gradually increases to reward investors who participated in earlier phases.

After the TGE, BMIC will go live on exchanges, allowing users to both buy and sell their holdings. At this point, many factors will influence the crypto’s price, including vesting schemes, macroeconomic conditions, investor sentiment, and market liquidity.

Long term, more fundamental factors like competition in quantum security, advances in quantum computing, and global crypto adoption could impact BMIC’s price.

Is BMIC a Good Investment?

We believe BMIC is one of the best cryptos to buy in 2026 as it addresses a real security problem in quantum computing, especially with the current HNDL cyber threat. Current quantum-resistant solutions may offer secure storage, but that’s where it ends. Meanwhile, BMIC secures the entire finance stack: storage, yield, and payments.

Furthermore, the project has several community-driven aspects. 50% of the total token supply is reserved for presale buyers, the largest allocation in the project’s tokenomics. Once the DAO goes live, every BMIC token holder can vote on the platform upgrades and help determine the future of the quantum-secure ecosystem.

Investors should also consider the token’s scarcity, as BMIC has a fixed total supply of 1.5 billion tokens. Combined with two token-burning mechanisms from quantum compute power extraction and revenue-based token buybacks, BMIC has the potential to retain and even increase value over time, provided sustained ecosystem activity.

BMIC Price Prediction: Conclusion

The sooner crypto users recognize the threat of quantum computing, the sooner they’ll need to seek secure, accessible options. BMIC is building the world’s first quantum-secure crypto finance platform offering protected token management, staking, and payments.

Despite being a newly launched crypto presale at a time when the market is extremely fearful, BMIC has already raised almost $300,000 in just a few weeks. Based on our projections, the token could reach 5x its initial price within the first year of the official token launch.

Our 2030 BMIC price forecast suggests that the crypto could average $1.550, assuming its entire ecosystem achieves individual and institutional adoption. However, do your own research before joining the presale, and invest only what you can afford to lose.