The Artificial Superintelligence Alliance price prediction is one of the most popular topics among beginners in the AI-crypto space. Many new investors want to know if FET has long-term potential or if it is simply another short-term trend. This guide explains everything in simple language, so you can understand how the project works and what may influence its price in the future.

At the moment, FET trades around $0.28. The token saw a monthly low of roughly $0.2 on November 5, followed by a strong rebound to a monthly high of $0.43 on November 8. These quick moves show that FET remains highly volatile, which is normal for early-stage AI projects. Still, the growing interest in AI infrastructure keeps many investors focused on its long-term value.

In this article, you will learn what the Artificial Superintelligence Alliance is, how the technology works, and what drives the demand for the FET token. You will also see expert FET price predictions for 2025–2050, technical analysis for beginners, and simple explanations of the project’s main features.

If you want to know whether Artificial Superintelligence Alliance can grow in value and how analysts view the future of FET price prediction, keep reading. This guide will help you form your own opinion and make more confident decisions.

| Current FET Price | FET Prediction 2025 | FET Price Prediction 2030 |

| $0.28 | $4 | $18 |

Artificial Superintelligence Alliance (FET) Overview

The Artificial Superintelligence Alliance (FET) is a decentralized initiative focused on the development of advanced AI systems, including artificial general intelligence (AGI) and artificial superintelligence (ASI). The project was created through the merger of three major decentralized AI platforms: Fetch.ai, SingularityNET, and Ocean Protocol. This alliance launched formally in June 2024 and operates primarily on Ethereum, with additional deployments on Cardano, BNB Chain, and the Fetch.ai network. Although the project plans to adopt the ASI name fully, FET remains the main trading token for now.

The idea behind the alliance is simple. Each founding project brought a specific strength. Fetch.ai contributed autonomous AI agents and decentralized infrastructure. SingularityNET offered a global marketplace for AI services. Ocean Protocol focused on secure data sharing and monetization. By merging, the alliance aims to accelerate the creation of powerful AI tools that run on-chain and remain open to the public, not controlled by a single corporation.

Fetch.ai was founded in 2017 by three British entrepreneurs: Humayun Sheikh, Toby Simpson, and Thomas Hain. Sheikh was an early investor in DeepMind. Simpson worked in AI development at DeepMind. Hain is a machine-learning expert from the University of Sheffield. Their project raised six million dollars in a Binance IEO in March 2019, selling out in ten seconds, and launched its mainnet in early 2020.

SingularityNET was created by Dr. Ben Goertzel and a team of AI researchers. Their goal was to build a decentralized marketplace where developers could publish and monetize AI tools without central control. Ocean Protocol, founded by Trent McConaghy and Bruce Pon in 2017, focused on building a secure data-sharing network that allows owners to earn from their data without giving up control.

The merger was announced in May 2024. The technical process began on June 11, 2024, when AGIX and OCEAN were temporarily merged into FET. The full transition completed on June 13, 2024. Today, the Artificial Superintelligence Alliance combines the expertise of all three teams to offer a unified ecosystem built for scalable, transparent, and open AI development.

FET Price Statistics

| Current Price | $0.28 |

| Market Cap | $650,955,653 |

| Volume (24h) | $145,323,902 |

| Market Rank | #86 |

| Circulating Supply | 2,360,385,008 FET |

| Total Supply | 2,714,384,547 FET |

| 1 Month High / Low | $0.43 / $0.2 |

| All-Time High | $3.45 Mar 28, 2024 |

FET Price Chart

CoinGecko, November 14, 2025

Artificial Superintelligence Alliance (FET) Price History Highlights

2019 — Launch and Early Trading

FET entered the market in February 2019 through Binance Launchpad, starting with an ICO price of $0.0867. It opened trading at around $0.33, which created high expectations. However, the market environment was strongly bearish. By the end of the year, the token collapsed to $0.0374. This drop mirrored the wider crypto downturn and showed how early projects struggled to hold value during a difficult market phase.

2020 — COVID-19 Crash and All-Time Low

The global pandemic created extreme pressure on all markets. In March 2020, FET hit its historical low of $0.007972. This level became a key reference point for future analysis. Despite the deep crash, the token recovered modestly and ended the year at $0.0518. Investors began returning to undervalued assets, and FET benefited from the broader rebound.

2021 — Massive Bull Run and First Rally to $1+

The year 2021 changed everything for FET. Crypto markets surged, and AI tokens gained attention. FET grew over 839% during the year, rising from about $0.053 to $0.502. The token even touched $1.20 during its peak months. This was the first time FET gained recognition as a high-potential AI asset.

2022 — Strong Correction and Return to Bear Market

After the explosive gains of 2021, 2022 reversed the momentum. FET dropped from $0.5229 to $0.0916 — a fall of over 82%. The token briefly hit $0.65 but could not sustain the rise. The entire crypto market faced a broad correction, and FET followed the trend.

2023 — Strong Recovery and Renewed Interest

FET returned with force in 2023. The token jumped from $0.0913 to $0.671 by year-end. Investors began buying undervalued assets again, and interest in AI technology rose. Monthly movements showed rapid growth early in the year, consolidation during mid-year, and a strong finish driven by rising demand and market optimism.

2024 — New All-Time High at $3.45 and Growing Volatility

In 2024, FET reached its all-time high of $3.45 on March 28. The surge came after major ecosystem updates, including the $100 million Fetch Compute announcement. But the second half of the year brought turbulence. Sharp corrections followed strong monthly gains. The token closed the year far below the peak, showing rising volatility across the AI sector.

2025 — Crisis, Collapse, and Internal Conflict

2025 turned into the most dramatic year for FET. The token started at $1.31 and fell to about $0.28 by mid-November. A major collapse came in October, when FET lost over 60% in one month. The drop was triggered by a global market shock and a severe internal conflict: Ocean Protocol exited the Artificial Superintelligence Alliance after converting hundreds of millions of tokens without approval. This caused inflationary pressure and a loss of trust. By November, FET stabilized slightly, but market confidence remained low.

Artificial Superintelligence Alliance Price Prediction: 2025, 2026, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $0.27 | $8.63 | $4 | +1,330% |

| 2026 | $0.66 | $12.09 | $6 | +2,050% |

| 2030 | $1.45 | $35.85 | $18 | +6,300% |

| 2040 | $82.41 | $350.65 | $200 | +71,000% |

| 2050 | $185.37 | $488.25 | $300 | +107,000% |

Artificial Superintelligence Alliance (FET) Price Prediction 2025

DigitalCoinPrice experts believe that in 2025 FET may rise to $0.67 (+125%) at its peak, while the lowest projected level is $0.27 (-5%).

PricePrediction analysts remain more bullish. They expect the token to reach $0.6469 (+120%) at its minimum and climb to $0.6765 (+130%) at its yearly high.

Telegaon remains the most optimistic. According to their estimates, FET could jump to $4.14 (+1,300%) at the low end in 2025, while the highest projection for the year sits at $8.63 (+2,800%).

Artificial Superintelligence Alliance (FET) Price Prediction 2026

DigitalCoinPrice forecasts point toward a minimum of $0.66 (+130%) and a potential high of $0.79 (+170%) in 2026.

PricePrediction analysts expect stronger growth, projecting $0.9353 (+225%) at the low and $1.08 (+270%) at the high.

Telegaon predicts another massive breakout in 2026, with a minimum target of $8.66 (+3,000%) and a peak of $12.09 (+4,000%).

FET Coin Price Prediction 2030

DigitalCoinPrice forecasts show FET trading between $1.45 (+400%) and $1.68 (+480%) by 2030.

According to PricePrediction, FET could reach $4.33 (+1,450%) at its minimum in 2030 and shoot up to $5.23 (+1,750%) at the peak.

Telegaon analysts expect exponential long-term growth. Their 2030 forecast places the minimum price at $24.59 (+8,300%) and the maximum at $35.85 (+12,500%).

Artificial Superintelligence Alliance (FET) Price Prediction 2040

PricePrediction forecasts extremely high long-term valuations by 2040. Their minimum prediction is $277.46 (+95,000%), while the maximum could reach $350.65 (+120,000%).

Telegaon’s long-range outlook is more conservative but still extremely bullish. They expect a minimum of $82.41 (+30,000%) and a high of $104.23 (+35,000%).

Artificial Superintelligence Alliance (FET) Price Prediction 2050

PricePrediction projects astronomical valuations by 2050, estimating a minimum of $420.10 (+150,000%) and a maximum of $488.25 (+175,000%).

Telegaon also expects FET to grow massively by mid-century, forecasting a low of $185.37 (+66,000%) and a maximum of $230.69 (+82,000%).

Artificial Superintelligence Alliance (FET) Price Prediction: What Do Experts Say?

Ainvest’s technical analysts released a comprehensive breakdown on November 9, 2025, highlighting several key levels. Their report shows that FET found support around $0.3308–$0.3324, while a cluster of lower-timeframe highs created resistance between $0.3482 and $0.3555.

The team noted that RSI remains oversold, yet weak volume divergence may signal a false rebound rather than a meaningful reversal. MACD also trends downward, reinforcing the bearish bias. They emphasize that FET trades below major moving averages, which suggests continued downside pressure. Ainvest concludes that any short-term bounce will likely remain limited unless the price breaks above $0.3518 with strong volume.

CoinPaper provided a broader medium-term outlook in their October 3, 2025 analysis. At that time, FET traded below $0.65 and faced heavy selling pressure. Despite this weakness, their long-term projection for 2025 remained bullish, placing the expected price range between $1.31 and $1.67, with an average target of $1.48.

The analysts noted that a breakout above the key $0.75 resistance level could unlock moves toward $1 and $1.5. However, losing support near $0.6 could lead to deeper decline. CoinPaper also highlighted that the 50-day moving average sits below the 200-day, confirming a short-term bearish trend. Still, they point out that a golden cross could shift momentum upward, especially with RSI near oversold levels and MACD showing early signs of convergence.

FET USDT Price Technical Analysis

Monthly indicators from Investing.com show a clear bearish trend for FET on the higher timeframe. The overall summary signals Strong Sell, which aligns with both technical indicators and moving averages. These readings suggest that market momentum remains weak, and buyers have not yet stepped in with enough strength to reverse the trend.

Investing, November 14, 2025

The technical indicator set is dominated by sell signals. RSI sits at 42, showing mild weakness, while Stochastic and StochRSI highlight downward pressure with oversold conditions. The MACD value of –0.092 confirms bearish momentum as both lines trend downward. Indicators such as ADX at 39 and CCI at –108 show strong trend strength in favor of sellers. Williams %R also sits deep in oversold territory, indicating exhaustion but not yet signaling a confirmed reversal.

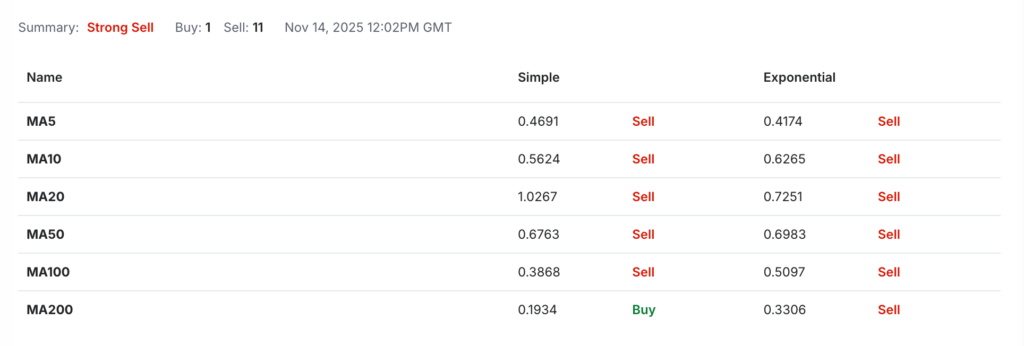

Moving averages paint an even clearer picture. Eleven out of twelve major simple and exponential moving averages signal Sell. Only the MA200 simple offers a Buy reading, suggesting that price still trades above its long-term baseline but remains below all medium-term and short-term averages. This pattern often reflects a market in deep consolidation after a significant downward move. The MA5, MA10, MA20, MA50, and MA100 all sit well above the current trading range, which confirms that momentum is still tilted to the downside.

Pivot point levels provide additional insight into potential short-term moves. The central pivot sits around $0.3323, which acts as a balance point for monthly trading. Resistance levels appear at $0.5208, $0.8054, and $0.9938, each representing possible upside targets if buyers regain strength. On the downside, support lies between –$0.1408 and $0.0477 on the classic model, though these negative values indicate that price has moved far below traditional support ranges.

Overall, monthly technical analysis suggests that FET remains in a bearish phase. While some oversold indicators signal the possibility of a short-term bounce, the broader sentiment remains weak until the price can reclaim major moving averages and break above key resistance zones.

What Does the FET Price Depend On?

The price of FET depends on several key factors that shape both short-term movements and long-term value. Because the Artificial Superintelligence Alliance connects AI development, data markets, and decentralized infrastructure, many different forces influence demand. Understanding these elements helps beginners see why the token rises or falls during specific market conditions.

One of the most important drivers is overall market sentiment. When Bitcoin and Ethereum rise, liquidity flows into altcoins, especially assets linked to strong narratives like AI. When the market turns bearish, investors reduce exposure to higher-risk tokens, and FET often reacts faster than large-cap assets.

Another major factor is adoption and progress inside the Artificial Superintelligence Alliance. Strong development updates, partnerships, new AI tools, and infrastructure expansions usually support price growth. Announcements such as Fetch Compute integrations or new cross-chain deployments often create demand spikes because they demonstrate real utility. On the other hand, internal tensions or governance issues can weaken confidence.

Supply dynamics also influence price behaviour. FET had several token-merging events, and the circulating supply expanded during the ASI transition. Any future changes in supply, staking rewards, or ecosystem incentives may affect long-term valuation.

Small but important technical elements also shape price direction:

Network activity (AI agent usage, data marketplace activity, compute demand)

Staking participation and token lock-ups

Ecosystem growth across Fetch.ai, SingularityNET, and Ocean communities

Another factor is macroeconomic conditions. AI-related tokens often rise when AI investment, cloud demand, or GPU infrastructure spending increases globally. Negative economic news, regulation targeting AI, or uncertainty around technology trade can pressure prices downward.

Finally, investor expectations play a large role. High long-term forecasts from analysts influence retail sentiment, often amplifying price swings. When predictions align with strong technical support, rally potential grows. When sentiment weakens, FET becomes more sensitive to volatility.

Artificial Superintelligence Alliance Features

The Artificial Superintelligence Alliance offers a wide range of features designed to support advanced AI development on decentralized infrastructure. At the core of the ecosystem is the FET token, which will transition fully to ASI. This token powers every major component of the network, from AI agents to cross-chain communication. The alliance integrates decentralized physical infrastructure networks such as CUDOS, which supply additional computing power while keeping operating costs low. This design makes the system scalable and suitable for global AI use cases.

Interoperability is another major feature. The token operates natively on the Fetch.ai chain but also connects to Ethereum, Cardano, and other ecosystems. This setup allows users to move assets freely across chains while accessing AI models and tools from different networks. The alliance uses Cosmos-SDK and CosmWasm to build high-performance smart contracts capable of running advanced cryptography and machine learning logic directly on-chain.

FET also works as a layer-2 enhancement for Ethereum, providing a faster and cheaper environment for transactions. It functions as an interchain bridge as well, linking multiple ecosystems so AI agents and data applications can operate without restrictions.

A key component of the platform is its decentralized AI services marketplace. Developers can publish, sell, and integrate AI models, digital agents, and machine learning tools without relying on centralized companies. This structure encourages innovation and broad community participation.

The network’s Delegated Proof of Stake consensus mechanism supports energy efficiency and rewards users who secure the blockchain through staking. Looking ahead, the alliance is developing a dedicated AI-focused blockchain called ASI Chain. This new chain aims to optimize AI computing, data handling, and large-scale agent coordination.