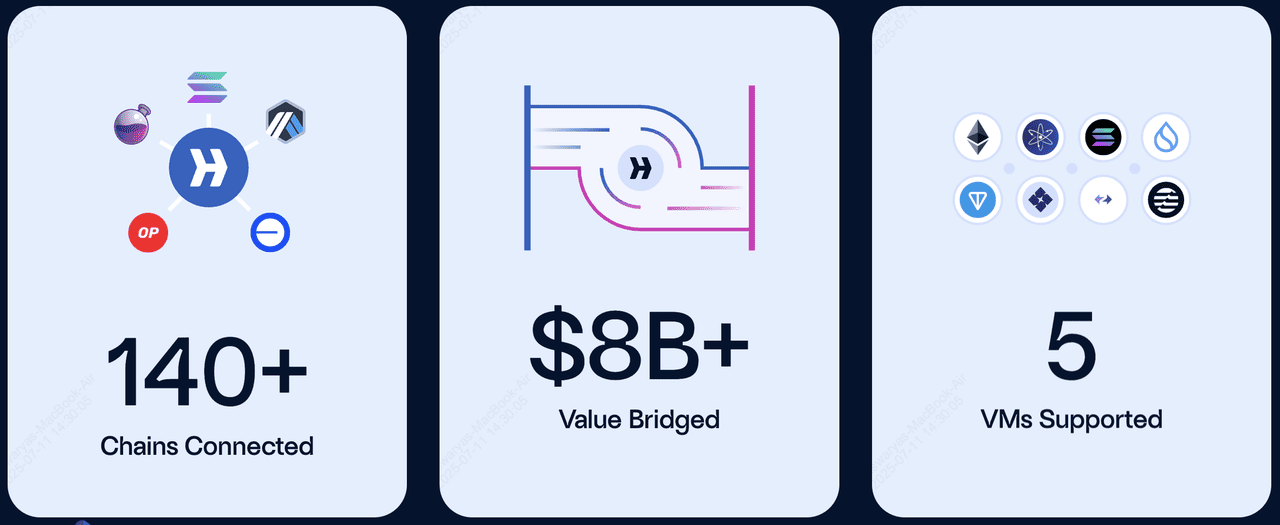

Hyperlane is rewriting the playbook for blockchain interoperability. As one of the fastest-growing cross-chain protocols, it enables seamless communication between over 140 blockchains. The numbers are impressive: $8.2 billion in total value bridged, support for five virtual machines, and an active validator set securing interchain messages. With its modular security model and liquid staking token (stHYPER), Hyperlane is becoming a key player in the multichain future.

In this guide, you’ll learn all about Hyperlane, its core components, HYPER tokenomics, and how to stake HYPER tokens to earn rewards, and participate in its ecosystem.

What Is Hyperlane?

Hyperlane is an open, permissionless interoperability protocol designed to connect different blockchains. Unlike traditional bridges, it allows developers to send arbitrary data, including tokens, smart contract calls, and messages, across chains. This flexibility supports the creation of interchain decentralized applications (dApps) that work seamlessly across Layer 1s, rollups, and app-chains.

Launched by Abacus Works in 2022, Hyperlane stands out for its modular architecture and customizable security framework. Developers can tailor security settings using Interchain Security Modules (ISMs), ensuring the right balance between speed, cost, and decentralization for their applications.

With support for Ethereum, Solana Virtual Machine (SVM), CosmWasm, and more, Hyperlane’s VM-agnostic design enables wide applicability in the evolving multichain ecosystem.

In June 2025, Hyperlane community developers unveiled hyperlane-mcp, a tool that bridges AI agents like large language models (LLMs) to Hyperlane’s cross-chain messaging infrastructure. This innovation allows AI agents to deploy contracts, transfer assets, run validators, and manage workflows across multiple blockchains using natural language. By leveraging Hyperlane’s permissionless design and modular security, hyperlane-mcp gives agents a clean interface to interact with multiple chains as if they were one unified system.

Why Hyperlane Matters for Web3

Hyperlane addresses one of blockchain’s biggest pain points: fragmented ecosystems. Its permissionless and modular design empowers developers to build interoperable DeFi platforms, enable cross-chain NFT marketplaces, and support multichain governance and DAOs. By connecting over 140 blockchains and facilitating nearly 9 million interchain messages, Hyperlane is becoming the backbone of a truly interconnected Web3.

The HYPER token offers multiple ways to participate, from staking and governance to earning rewards via HyperStreak. As the protocol expands to new chains and introduces upgrades like trustless ISMs, Hyperlane could define how decentralized apps communicate in the multichain world.

For developers and users looking to engage in the next wave of blockchain innovation, Hyperlane provides the tools and infrastructure to build across boundaries.

Core Features of Hyperlane

1. Permissionless Deployment: Any blockchain can deploy Hyperlane’s Mailbox contracts without needing approval. This supports rapid adoption and network effects.

2. Mailbox Smart Contracts: The Mailbox acts as an on-chain messaging interface for sending and receiving interchain messages. It verifies message validity using ISMs and coordinates communication across chains.

3. Interchain Security Modules (ISMs): ISMs are plug-and-play security filters that validate cross-chain messages. Developers can:

• Use default ISMs for standard security

• Configure pre-built ISMs

• Compose multiple ISMs for layered security

• Build custom ISMs from scratch

This modular approach lets projects choose the level of trustlessness and cost-efficiency that fits their needs.

4. Warp Routes for Token Bridging: Hyperlane’s Warp Routes provide slippage-free, burn-and-mint bridges for ERC-20, NFTs, and native tokens. Each route can have its own security setup, ensuring robust token transfers.

5. Interchain Gas Payments (IGP): IGP contracts allow users to prepay gas fees on destination chains, simplifying cross-chain transactions.

How Does Hyperlane's Cross-Chain Interoperability Work?

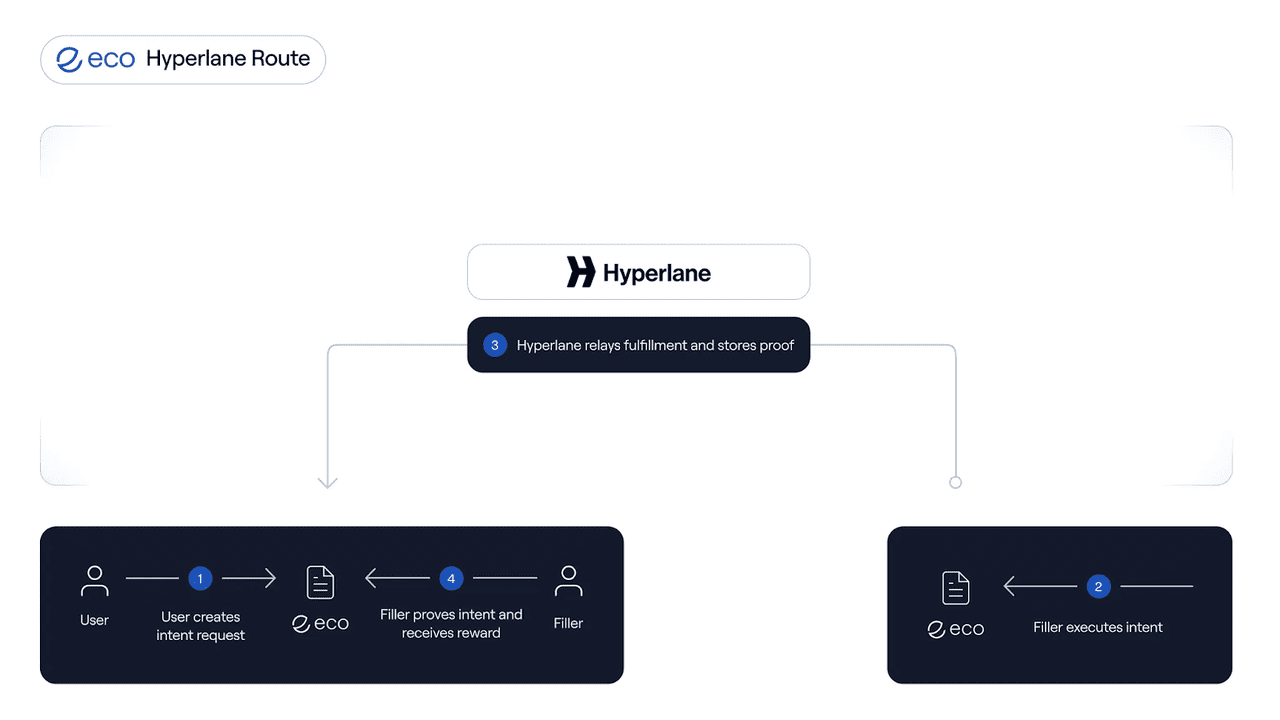

How Hyperlane Route works | Source: Hyperlane blog

Hyperlane enables cross-chain messaging through its innovative Mailbox smart contracts. Each supported blockchain hosts a Mailbox contract, which acts as the gateway for sending and receiving interchain messages. When a developer sends a message from one chain, it passes through the source Mailbox, is verified by validators using Interchain Security Modules (ISMs), and is delivered to the destination chain’s Mailbox.

This system relies on:

• Relayers: Permissionless off-chain actors that move messages between chains.

• Validators: Entities who stake HYPER tokens to secure message verification and maintain network integrity.

• Interchain Gas Payments (IGP): Simplifies user experience by allowing gas fees on destination chains to be prepaid.

Hyperlane’s modularity means developers can configure security levels depending on their application’s needs, from default ISMs to fully custom solutions.

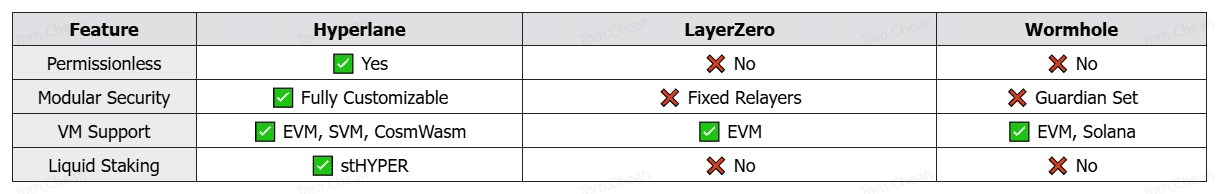

How Does Hyperlane Differ from Other Interoperability Protocols?

Hyperlane sets itself apart with its permissionless architecture and highly customizable security model. This means any developer can deploy Hyperlane on a blockchain without waiting for approvals or relying on centralized intermediaries. Unlike LayerZero and Wormhole, which depend on fixed relayers or centralized guardian sets to verify cross-chain messages, Hyperlane allows developers to choose their own security modules and validator sets.

Hyperlane's flexible model gives projects more control over how their cross-chain communications are secured and lets them adapt to different risk profiles and performance needs, making it especially beginner-friendly for builders entering the multichain space.

What Is the HYPER Token Utility and Tokenomics?

The HYPER token powers the Hyperlane ecosystem by aligning incentives and securing cross-chain operations.

Use Cases of HYPER Token

• Staking: Secures the protocol through delegation to validators.

• Governance: Enables token holders to vote on protocol upgrades and treasury use.

• Incentives: Rewards validators, stakers, and users who drive interchain activity.

• Liquid Staking (stHYPER): Lets users earn rewards while maintaining liquidity.

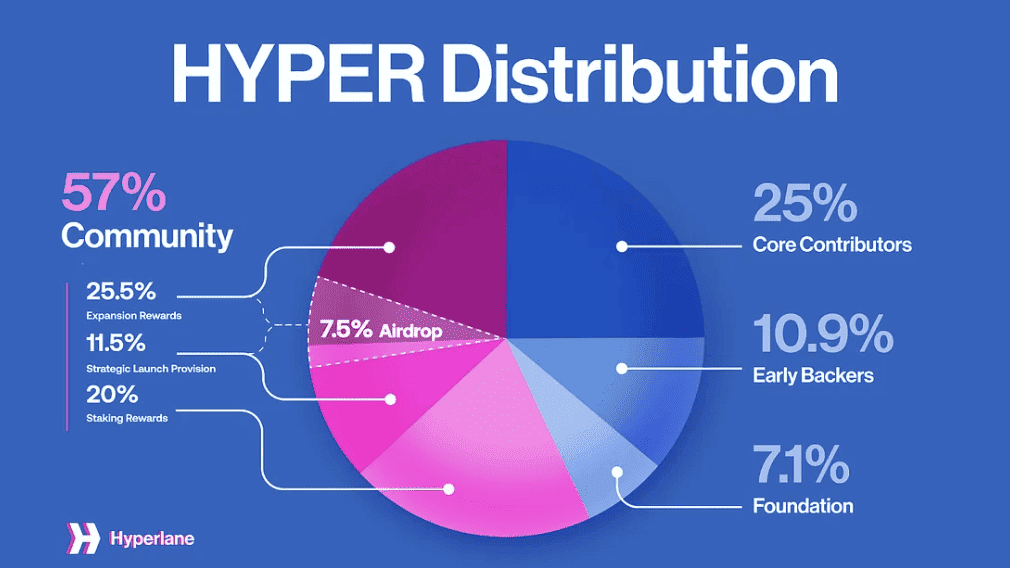

$HYPER Token Distribution

Hyperlane token distribution | Source: Hyperlane blog

The total supply is capped at 1 billion HYPER.

• Community: 57%

• Core Contributors: 25%

• Early Backers: 10.9%

• Foundation: 7.1%

HYPER vs. stHYPER: What’s the Difference?

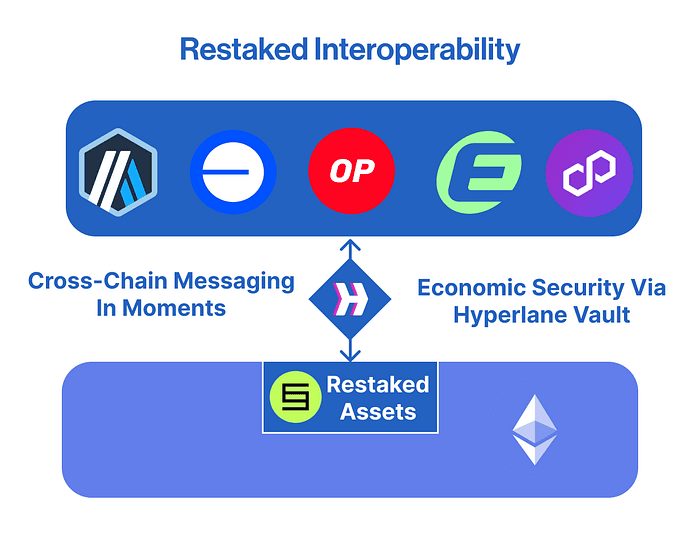

Hyperlane restaking | Source: Hyperlane blog

HYPER is the native token of the Hyperlane protocol, used for staking, governance, and securing cross-chain communication. When users stake HYPER in the Symbiotic vault, they receive stHYPER, a liquid staking token that represents their staked position and accrues rewards. While HYPER is tradable across multiple networks, stHYPER allows holders to earn passive income while maintaining flexibility in DeFi applications. As the protocol expands to new chains and introduces upgrades like trustless ISMs, Hyperlane could define how decentralized apps communicate in the multichain world.

For developers and users looking to engage in the next wave of blockchain innovation, Hyperlane provides the tools and infrastructure to build across boundaries.

How to Stake HYPER on Hyperlane and Earn Rewards

Hyperlane’s staking system is designed to secure the network and incentivize participation.

Step 1: Acquire HYPER

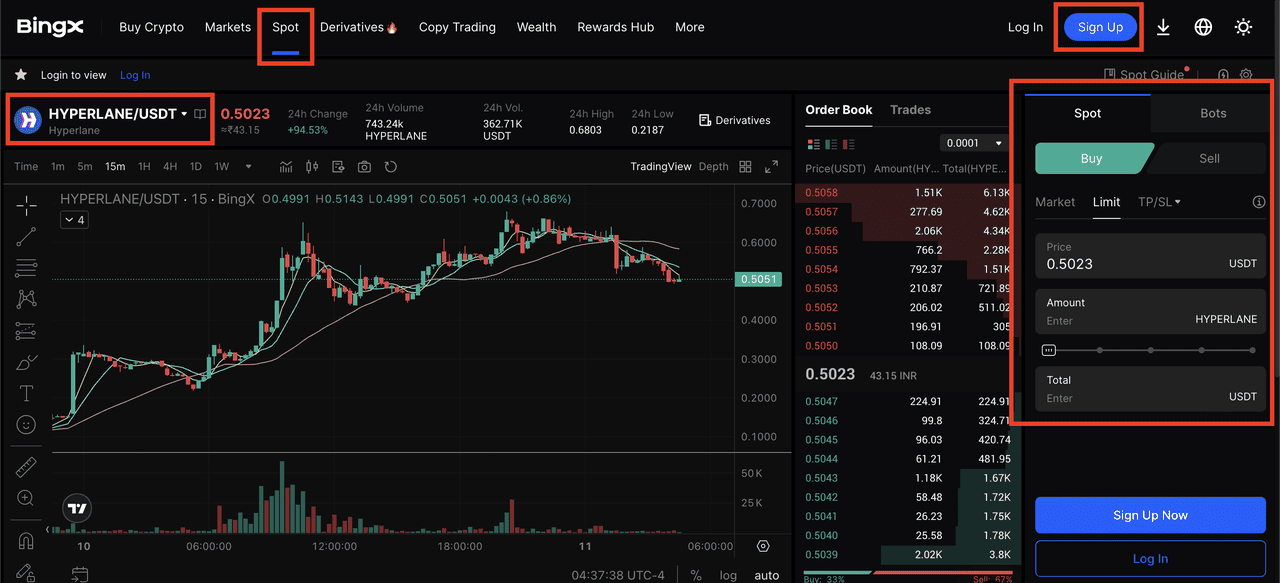

Buy HYPER on supported exchanges like BingX, to fund your self-custody wallet compatible with Ethereum or BSC. Visit BingX Spot Market, search for the HYPERLANE/USDT pair, and place a market or limit order to acquire HYPER tokens.

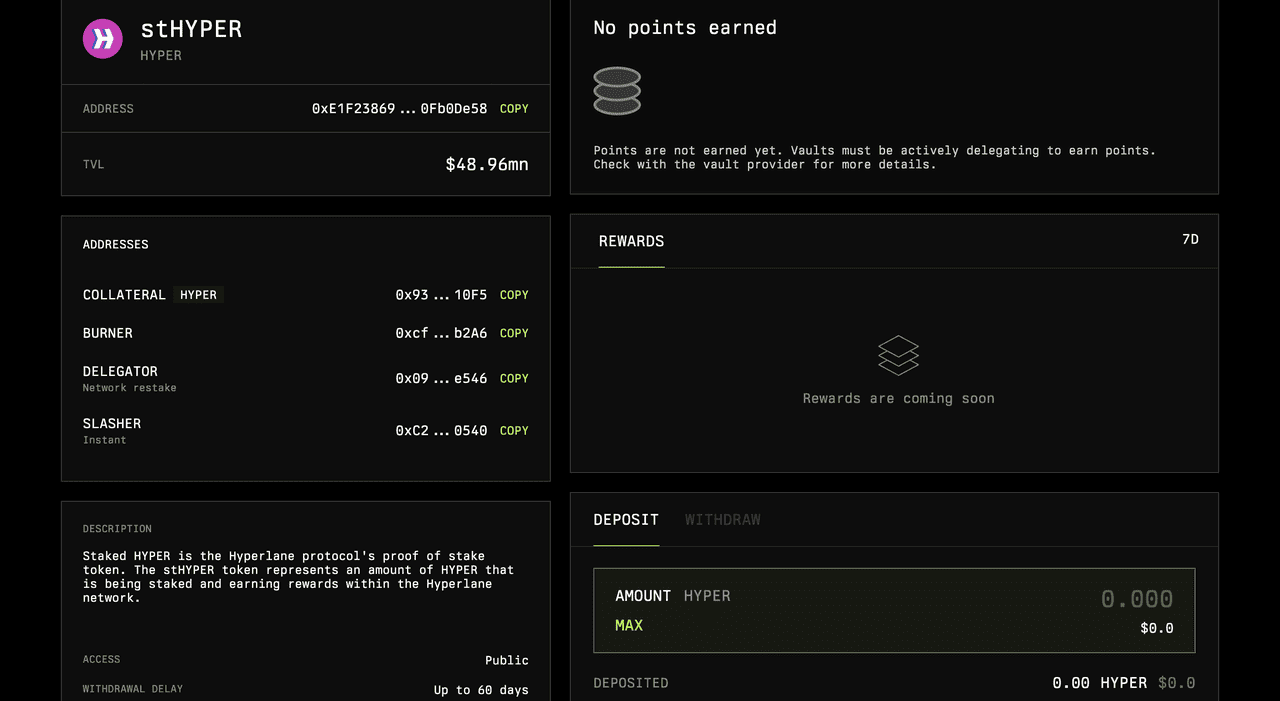

Step 2: Stake via Symbiotic

• Go to the Symbiotic app.

• Lock your HYPER tokens in the HYPER Vault.

• Receive stHYPER as a receipt token.

Step 3: Earn Rewards

• Rewards are distributed per epoch (~30 days).

• Holding stHYPER longer activates HyperStreak multipliers for boosted rewards.

Step 4: Unstake When Ready

• Initiate unstaking and wait for the current epoch to complete.

• Withdraw your HYPER manually from the vault.

Final Thoughts: Hyperlane’s Role in the Multichain Future

Hyperlane is shaping up to be a cornerstone of blockchain interoperability. With its permissionless design, customizable security, and a growing ecosystem spanning 140+ chains, it’s enabling a truly interconnected Web3.

The HYPER token offers multiple ways to participate, from staking and governance to earning rewards via HyperStreak. As the protocol expands to new chains and introduces upgrades like trustless ISMs, Hyperlane could define how decentralized apps communicate in the multichain world.

For developers and users looking to engage in the next wave of blockchain innovation, Hyperlane provides the tools and infrastructure to build across boundaries. However, like any cross-chain protocol, it carries risks such as smart contract vulnerabilities, validator misbehavior, and potential slashing for stakers. Users should approach with caution and only commit what they can afford to lose.