Merging of key meme resources generates a predictability of capital where a infrastructure development is more attractive than a pure play on speculation.

As Bitcoin trades near $90,500 and Ethereum holds around $3,100 at the time of writing, traders are evaluating which meme coins possess sustainable value drivers beyond social media momentum. Pepeto ($PEPETO) enters this environment with exchange architecture designed to capture volume from the broader meme ecosystem, positioning itself to absorb capital rotating out of saturated tokens.

Trading at $0.000000176 in its presale stage, Pepeto has attracted $7.15M from buyers recognizing the structural advantage of owning the infrastructure layer rather than individual meme tokens. The community of the project has over 100K members, knowing that the platforms which allow trading memes are usually more effective than the assets they host at the time of consolidation.

Merging Forces Quality Differentiation

Once the meme coins enter sideways price action, traders will start examining utility distinguishing features between viable projects and hype activity cycles. The capital outflows towards assets with no clear use cases occur due to the investor seeking tokens whose accrual of value relies on a narrative momentum other than a narrative momentum. The advantage of this filtration process has traditionally been extended to platforms that create organic demand based on volume of transactions.

The Volume of Exchange Generates Natural Demand

Pepeto’s architecture routes all exchange activity through its native token, creating buy pressure correlated with platform adoption. In contrast to meme coins that are based on community purchases only, the model creates demand as a result of each transaction conducted within the market. With 850 projects seeking listing permission, the quantity is growing outside the regular dynamics of meme tokens.

The platform integrates PepetoSwap, which eliminates trading fees entirely. This zero cost model eliminates obstacles that could deprive high frequency trading on rival trading platforms. Regular users of the site who buy and sell a number of stocks daily save considerable sums of money in comparison with other fee-based systems and this makes them popular to those who engage in trading on a regular basis. Increased swap activity translates directly into $PEPETO token utility.

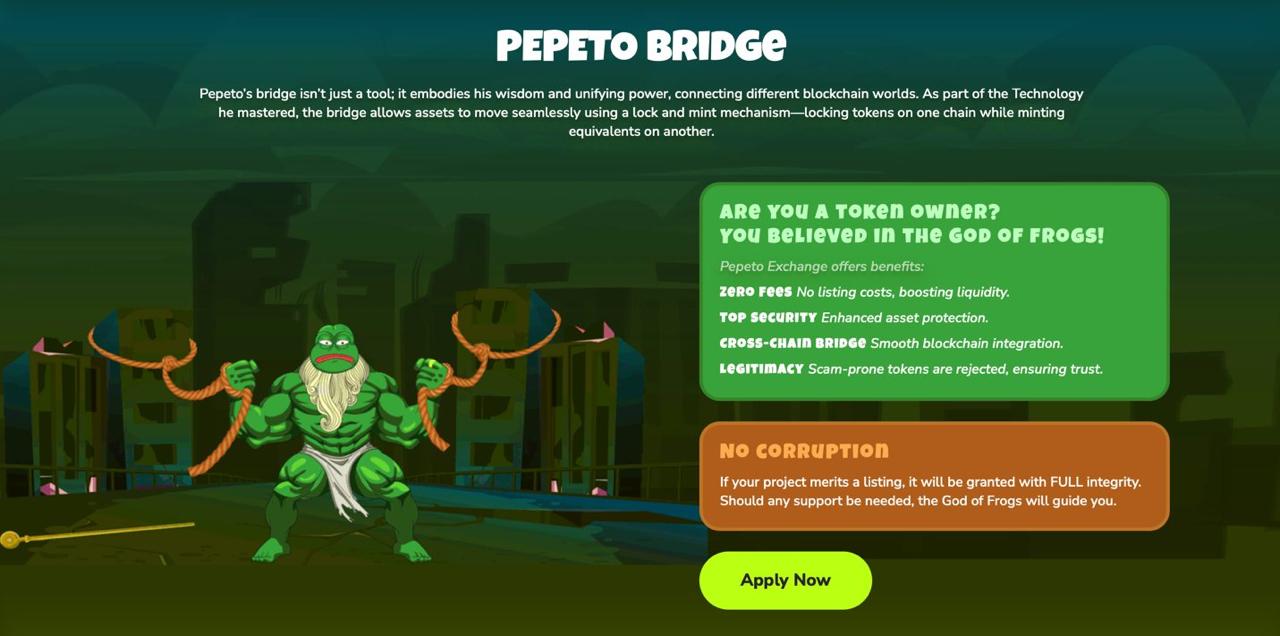

Cross-chain functionality arrives through the Pepeto Bridge, enabling seamless token movement between different blockchain networks. Meme ecosystems have a fragmentation problem where the pieces of assets are separated in fragmented chains that are not interoperable. Pepeto solves this by providing unified access regardless of origin blockchain, capturing bridging volume that competitors cannot address.

Staking Mechanisms Cut the Supply in Circulation

Participants locking $PEPETO tokens into staking contracts earn annual yields ranging from 216%. Such rewards give incentive to the behavior of holding and mechanically decrease the supply of secondary markets. Supply is limited by tokens that are determined to be held idle, so that, at the time the buying is heightened the price becomes more sensitive.

Built on Ethereum mainnet and verified through independent audits by SolidProof and Coinsult, the staking infrastructure operates with transparent security standards. Smart contract validation eliminates technical risk to participants in capital deployment stages, which is a concern and makes participation in new token launches generally restricted.

The Balance Multiple Objectives of Tokenomics

The 420T total supply is allocated to well-established buckets of allocation. Presale is allocated 30%, which equals the amount allocated to staking rewards. Marketing obtains 20% of the revenues to finance growth projects, whereas development takes 7.5% of the revenues to finance continued improvements of the platform. The liquidity pools are allocated 12.5% providing sufficient depth upon the opening of the public markets.

Being a part of the Presale

The interested buyers navigate to the official platform (https://pepeto.io/) after which the process of acquisition, which requires wallet connection, starts. The purchases of tokens are enabled with ETH, USDT, BNB, or traditional payment cards through Web3Payments integration. After confirmation of the transaction, the tokens bought are displayed in interrelated wallet addresses. A presale is accompanied by a $700K promotion giveaway that gives extra motivation to early attendance. Stage pricing goes up in predetermined times that are displayed on the countdown timers on the purchasing interface.

Infrastructure Discords Consolidation Capita

In crypto market news, meme coin consolidations are often followed by capital rotation into platforms that offer measurable utility beyond social hype. Pepeto is positioning as an infrastructure layer for the sector, with more than 850 meme projects applying for verified listings, creating trading volume that routes directly through the $PEPETO token regardless of which tokens trend next.

Early buyers benefit from stage-based presale pricing near $0.000000176, securing stronger cost bases before later tiers increase entry prices, while high-yield staking above 200% APYreduces circulating supply as adoption grows. Analysts say traders rotating profits from past cycles in DOGE, SHIB, and PEPE are increasingly drawn to ecosystem-wide platforms, where demand is tied to total meme market activity.

For investors searching for the best crypto presale to buy now ahead of the 2026 bull run, Pepeto’s exchange-first model offers asymmetric upside by capturing sector-wide growth instead of competing as just another meme token.

Summary

As Bitcoin hovers near $90,5K and Ethereum consolidates around $3,100 at the time of writing, meme coin traders assess which projects offer sustainable value beyond speculation. Pepeto emerges as infrastructure capturing volume from 850+ projects seeking verified exchange listings. The platform combines zero-fee swaps through PepetoSwap, cross-chain bridging capabilities, and exchange volume routing that creates inherent PEPETO token demand. Currently priced at $0.000000176 with $7.15M raised and 100K+ community members, Pepeto positions itself to absorb capital waves flowing from saturated meme tokens into utility-driven platforms.

Answer Box

Meme coin consolidation focuses capital into infrastructure platforms serving whole ecosystems. Pepeto absorbs this rotation through exchange architecture processing 850+ listing applications, presale pricing at $0.000000176, and staking yields between 216%. The model routes all platform volume through the $PEPETO token, creating demand mechanics independent of individual meme coin performance.