KEY TAKEAWAYS

BAT surges 60%, nearing major resistance around $0.30.

Strong momentum and rising user activity fuel a bullish trend.

A break above $0.30 could send BAT’s price toward $0.38 next

The Basic Attention Token (BAT), a blockchain-based digital advertising platform, has risen 60.23% over the past month.

As it stands, the BAT crypto is breaking its way to a fresh yearly high.

The explosive rally caps off one of BAT’s strongest multi-week performances of the year.

According to CCN’s findings, this surge occurred due to accelerating inflows, rising user activity, and a break from its previously stagnant trading range.

With momentum indicators heating up, this analysis reveals what could be next for the token.

BAT Sees Bullish Momentum

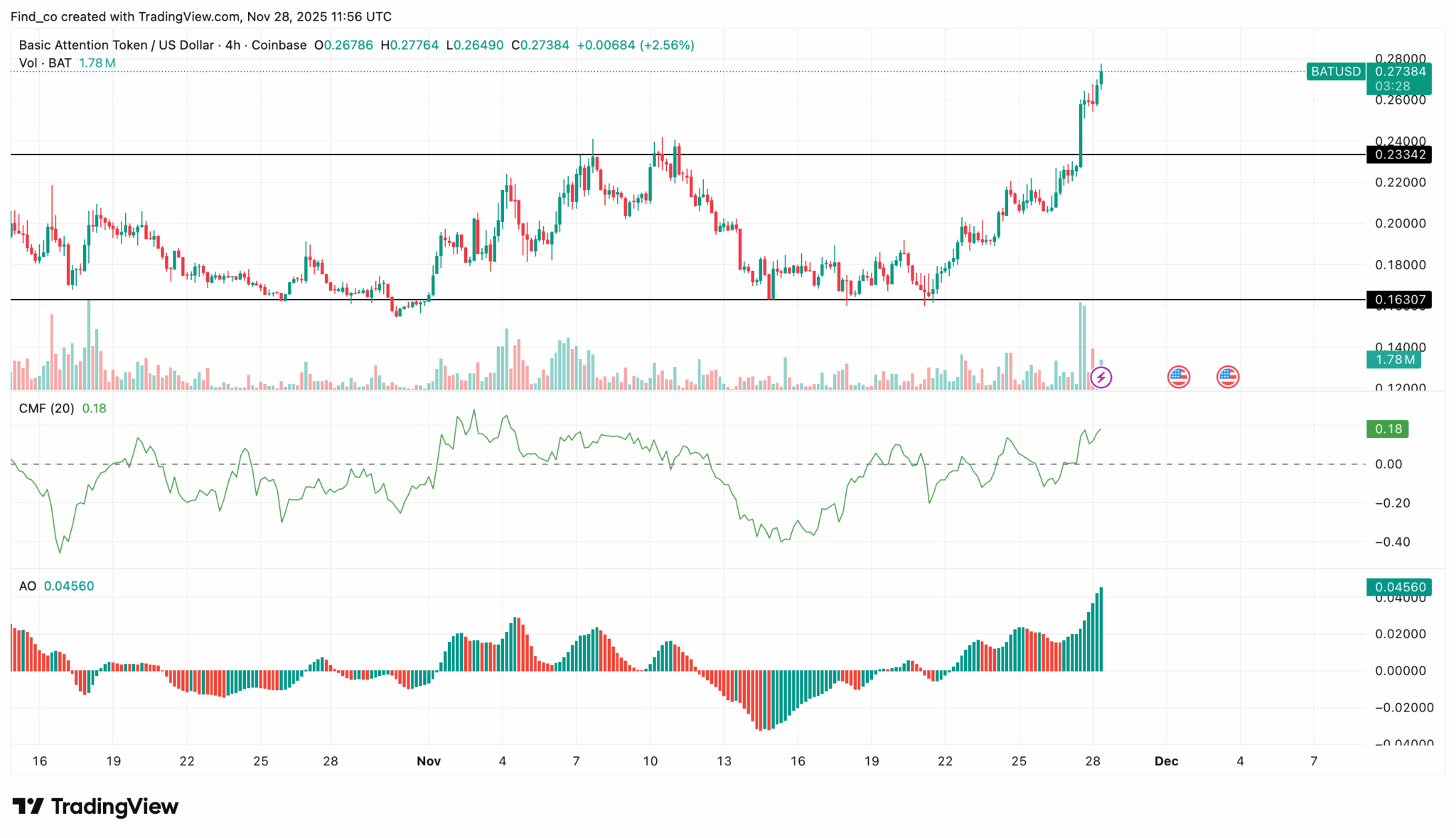

On the 4-hour chart, the Chaikin Money Flow (CMF) reinforces a strongly bullish outlook.

The CMF reading sits above the zero line, signaling sustained buying pressure.

This positive money flow shows traders are aggressively accumulating BAT rather than taking profits, even as the price tests the upper boundary of its long-term range.

Similarly, the Awesome Oscillator (AO) flashes strong bullish momentum. The indicator displays large rising green histogram bars, confirming the bullish momentum around the altcoin.

Furthermore, BAT’s price is now approaching a significant resistance zone near the $0.30 region.

At some point, this price level was difficult to hit.

However, a breakout above this ceiling would place BAT in open-air territory, potentially triggering continuation toward fresh multi-month highs as sidelined buyers re-enter.

Network Activity Rises

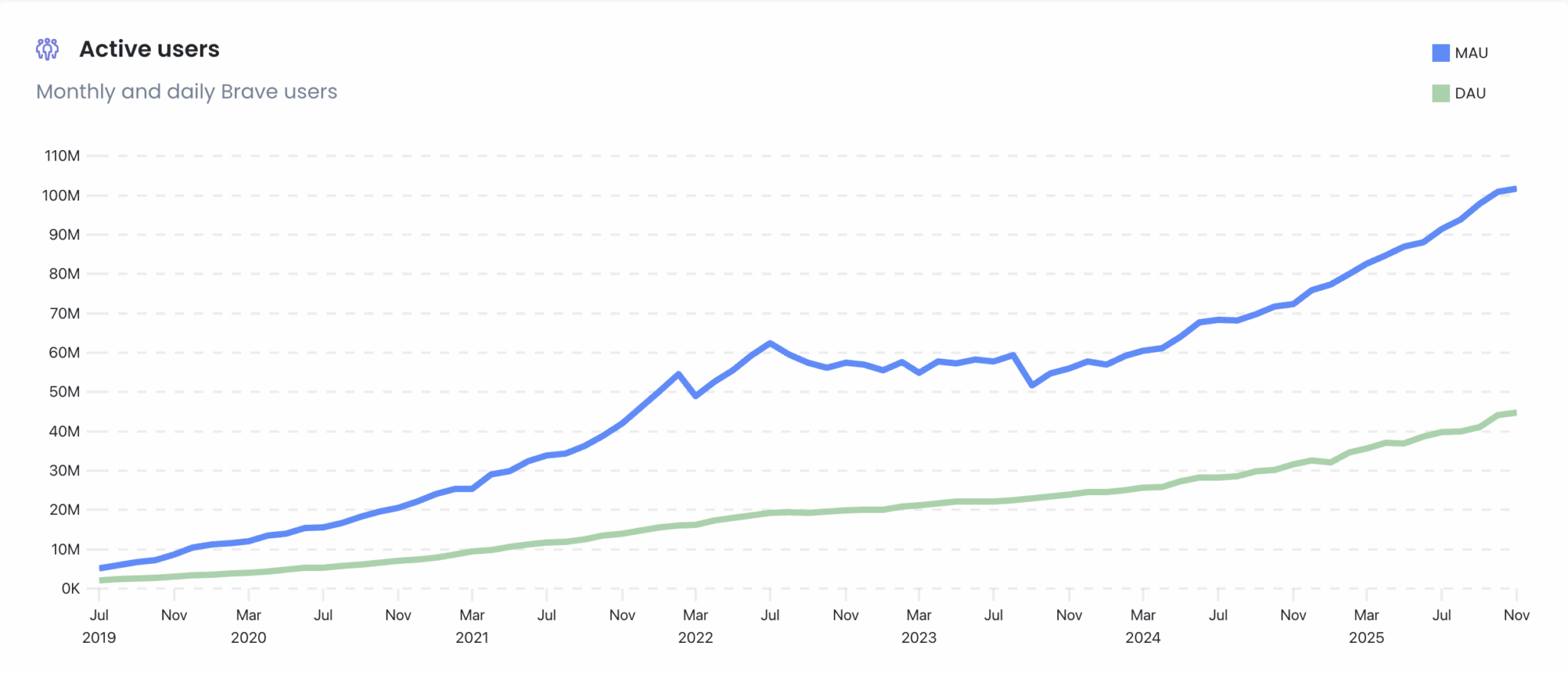

Beyond the technical setup, rising user activity also acted as a significant catalyst for the surging BAT price.

As shown below, the active-user count of Basic Attention Token has continued to rise steadily.

At press time, the number of daily active users stands at 44.7 million, representing a 1.4% increase over the past 30 days.

This steady growth has also fueled activity on the network, with on-chain transactions reaching 4.93 million, reflecting increased engagement across the BAT ecosystem.

This rise in real usage adds fundamental weight to the ongoing price momentum.

Typically, rising on-chain activity strengthens confidence. Therefore, if user metrics continue to follow this trajectory, BAT could see even stronger support for its bullish structure.

BAT Price Prediction: Higher

On the daily chart, the BAT crypto price has remained constrained in an upward trend.

The Exponential Moving Average (EMA) sits below the candlesticks, signaling sustained bullish momentum as a consistent series of green candles continues to form.

The 20-day EMA, acting as a key support level, confirms that buyers hold control.

Similarly, the Money Flow Index (MFI), currently at 85.69, indicates that BAT is experiencing intense buying pressure.

While this confirms bullish sentiment, it also suggests the market may be nearing short-term exhaustion. This raises the likelihood of a minor pullback or consolidation before the next leg of the upward trend.

Using the Fibonacci level, BAT’s price is currently positioned very close to the Fib level at $0.27, aligning with its January high.

Technical indicators signal exhaustion. However, bulls continue to push the upward trend. A break above this level will signal BAT trending toward $0.38

However, if the BAT crypto reverses from its current trend, it could fall below the 0.786 Fib level at $0.24 and move toward the next Fib level at $0.21.