On-chain lending is quietly regaining momentum at the start of the year, hinting that crypto-native capital is returning after months of caution.

After stagnating in the wake of last autumn’s market shock, lending activity has begun to climb again, led by a small group of dominant protocols and fueled by renewed interest from large holders seeking yield and liquidity.

Key takeaways:

DeFi lending has resumed growth after months of decline following the October liquidation event.

Aave and Morpho are driving most of the recent expansion in on-chain loans.

Ethereum remains the core lending hub, far ahead of other chains.

Rising lending activity may signal improving sentiment toward ETH and DeFi more broadly.

The recovery follows a prolonged slowdown that set in after the October 2025 crash, when a sharp liquidation event froze risk appetite across DeFi. While lending protocols avoided the worst of the forced liquidations — thanks to relatively conservative collateral thresholds — sentiment remained too weak for meaningful expansion. That dynamic has begun to change in recent weeks.

Lending activity rebuilds after the October drawdown

Data from Token Terminal show that total ecosystem lending has risen steadily over the past three weeks, marking the strongest rebound since the October shock. By early 2026, active on-chain loans reached roughly $36.6 billion, up about $2.1 billion from December. While still below peak levels, this represents the clearest sign yet that lending demand is returning.

Two protocols account for the bulk of that growth. Aave added around $1.1 billion in active loans over the past month, while Morpho expanded by roughly $450 million. Aave’s scale and deep liquidity continue to attract borrowers, while Morpho’s curated lending model has drawn users seeking more tailored risk and return profiles.

Aave’s longer-term trajectory stands out. Over the past two years, its share of DeFi lending has climbed from about 8% to more than 28%, a gain achieved even through extended bear-market conditions. That resilience has reinforced its position as the backbone of on-chain credit markets.

Ethereum remains the center of gravity

Despite some growth in alternative ecosystems, Ethereum continues to dominate DeFi lending. The rebound in lending activity has coincided with ETH reclaiming the $3,000 level, restoring confidence in collateral values. Solana-based lending has also expanded, but volumes remain far smaller and growth less consistent than on Ethereum.

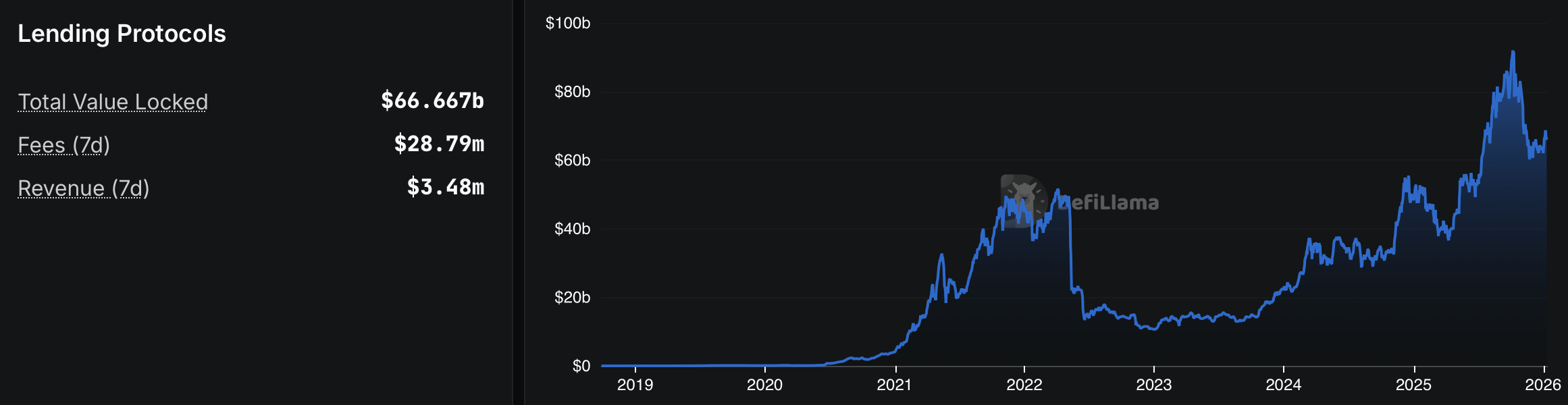

According to DeFiLlama, lending protocols across chains currently secure about $66.67 billion in total value locked, with a gradual recovery underway. On Ethereum alone, lending now generates more than $28.7 million in weekly fees, contributing to a broader rebound in on-chain economic activity. Total value locked on Ethereum has risen above $72 billion, up from around $64 billion in November.

Collateral dynamics suggest risk remains contained. Liquidatable ETH-backed loans have grown to about $2.2 billion, up from roughly $1 billion in prior months, but most positions are vulnerable only if ETH falls below $1,800. Loans exposed above $3,000 ETH levels remain a small minority, limiting near-term liquidation risk.

What lending signals for the next phase

Beyond raw numbers, lending has become Ethereum’s most significant on-chain activity, overtaking decentralized exchange trading, with liquid staking close behind. This shift points to two parallel trends: demand for passive yield and demand for leverage or liquidity without exiting positions.

Looking ahead, additional inflows could come from treasury-focused entities deploying ETH into staking and liquid staking strategies. Any newly issued liquid staking tokens may eventually feed back into lending markets, depending on how much risk those entities are willing to assume.

The DeFi market is not fully healed, and lending growth remains measured rather than explosive. Still, the revival of on-chain credit is often an early indicator of improving confidence. If the trend continues, it may serve as a leading signal for a broader recovery in DeFi activity — and potentially for ETH itself.