If you’ve been around DeFi for a while, you know most money markets and DEXs feel like clones of each other — Aave forks, Uniswap forks, rinse and repeat. Dolomite isn’t just another one in that pile. This thing is built different.

At its core, Dolomite is both a decentralized money market and a DEX, stitched together in a way that makes your liquidity work harder than you thought possible. The killer idea? Virtual liquidity. Basically, your funds don’t just sit there — they get recycled across lending, trading, and yield in ways that most protocols simply can’t do.

Why Dolomite Actually Feels Fresh

Most platforms brag about “capital efficiency,” but with Dolomite, you can actually see it in action. Let’s break it down:

You can lend your assets and earn yield like on Aave.

At the same time, your liquidity can be tapped for trading and swaps, which means double-dipping on fees + lending yield.

You can borrow against weird tokens like plvGLP (not even tokenized properly elsewhere) and still keep staking rewards flowing.

In short: your collateral isn’t locked in a dead vault. It’s alive, moving, and earning.

The Architecture Bit (But Simple)

Dolomite’s design is kinda genius:

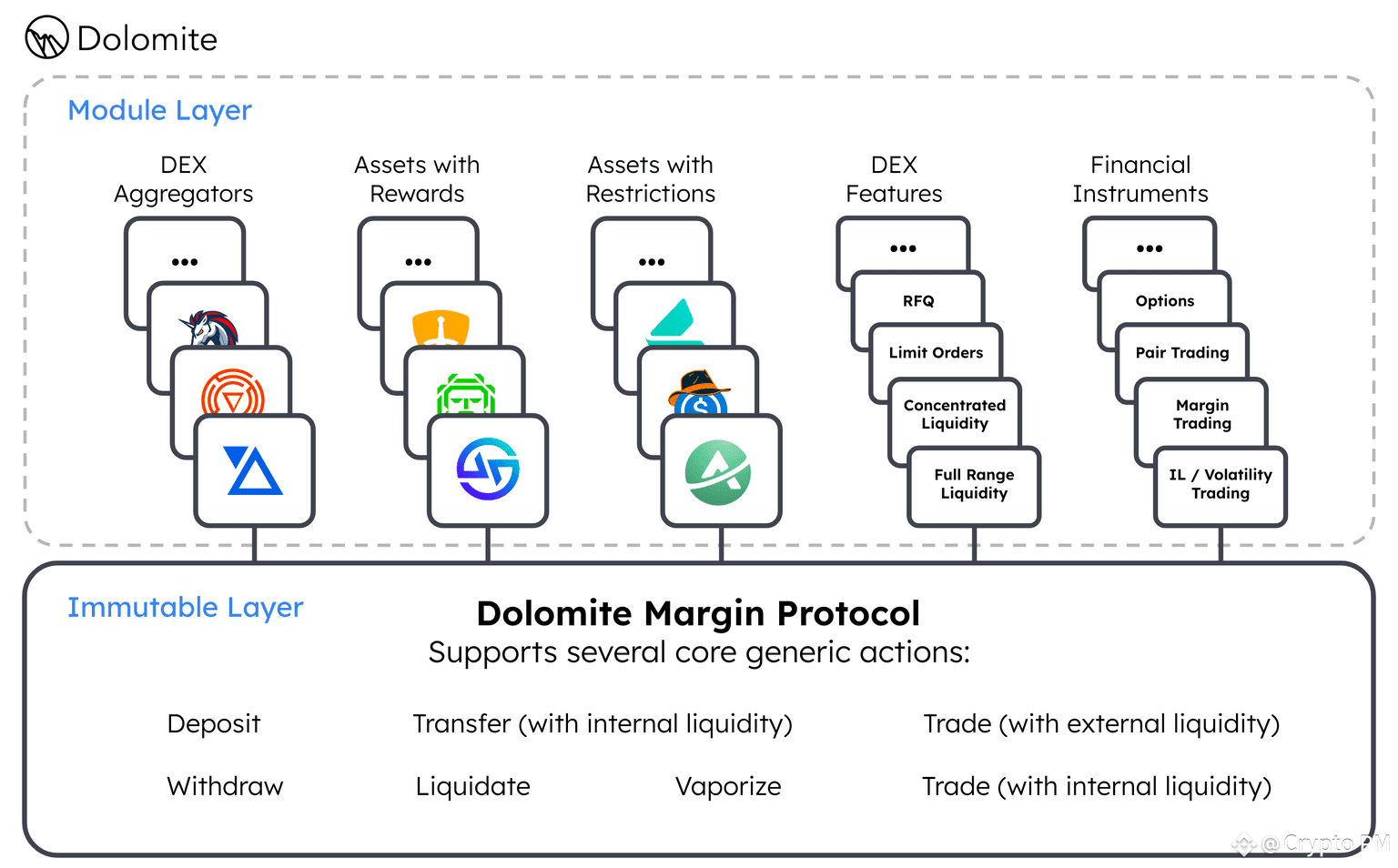

Immutable Core Layer → The unchangeable foundation. Think of it as the “rules of the game” that don’t move.

Modular Layer → Where all the fun upgrades happen. New features, new strategies, new integrations… without breaking what’s already working.

This matters because DeFi moves fast. Protocols that can’t adapt die quickly. Dolomite baked adaptability right into its DNA.

Real-World Example: The USDC Depeg

Remember March 2023 when USDC briefly lost its peg? On Aave, users holding USDT as collateral couldn’t pull their funds because the whole pool was maxed out by people buying cheap USDC. Liquidity crunch, chaos.

Dolomite’s system could’ve handled this differently:

Instead of fully draining the pool, users could’ve just traded with internal liquidity (basically swapping inside the system).

This would’ve left more actual USDT available in Dolomite, keeping withdrawal doors open and interest rates saner.

That’s what I mean when I say Dolomite feels built for real market chaos, not just “bull market farm-and-chill” vibes.

Broad Token Support = Real Utility

This part blew my mind: Dolomite isn’t limited to ERC20 tokens. You can plug in assets like staked plvGLP, manage them directly, borrow against them, and still claim rewards.

Most lending protocols force you to choose: either stake your asset OR borrow against it. Dolomite says: why not both? That’s the kind of thing that actually changes how people manage portfolios.

My Take

Here’s the thing: Dolomite isn’t flashy. You won’t see influencers shilling it every other day (yet). But it’s quietly solving real problems that DeFi users run into: liquidity crunches, dead collateral, clunky portfolio management.

It reminds me of early Curve or even GMX — not sexy at first glance, but those who paid attention early reaped the benefits later.

If Dolomite keeps shipping, integrates more assets, and leans into being the DeFi “operating system” for liquidity, this could be one of those protocols people look back on and say “damn, wish I used it earlier.”