As the decentralized exchange sector evolves, innovative protocols like hashflow are gaining considerable traction across the DeFi landscape. Recently, the hashflow price has shown notable volatility, drawing the eyes of traders and investors seeking both opportunity and a deeper understanding of new DEX mechanisms. Unlike most platforms built around automated market makers, hashflow introduces a bridge-free, on-chain “Request-for-Quote” (RFQ) trading framework—prompting both curiosity and debate about its impact on trading efficiency, user protection, and cross-chain liquidity.

In this article, we take an in-depth look at what hashflow is, how it operates, the progress it has made since launch, and the possible reasons behind the latest moves in hashflow price.

Source: CoinMarketCap

What Is Hashflow?

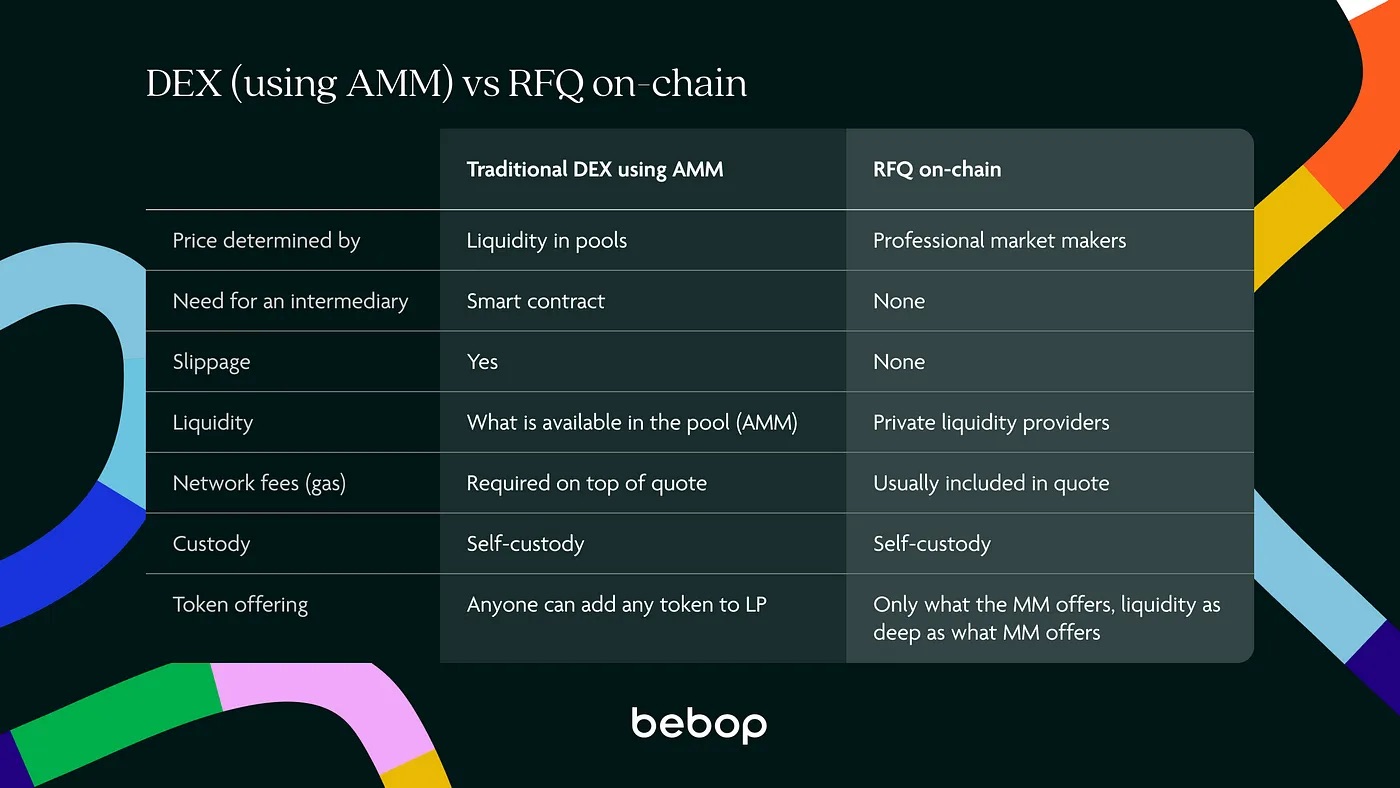

Hashflow is a decentralized exchange protocol designed to make multi-chain swaps faster, cheaper, and safer for crypto users. Unlike traditional DEXs that rely solely on Automated Market Makers (AMMs), hashflow leverages a Request-for-Quote (RFQ) model, which is a common paradigm in traditional finance but is rarely seen on-chain in DeFi. This RFQ approach ensures traders get optimal pricing, zero slippage, and robust protection against MEV (Maximal Extractable Value) attacks.

Hashflow’s architecture also unlocks seamless bridgeless cross-chain swaps, allowing users to trade assets directly across major blockchains without relying on risky token bridges or wrapped assets. This security-first, user-centric approach positions hashflow as a go-to solution for capital-efficient multi-chain trading and has contributed significantly to elevated hashflow price activity.

How Does Hashflow Work? Understanding RFQ vs. AMM

What sets hashflow apart is its on-chain RFQ protocol—a quote-based trading mechanism grounded in direct price competition among market makers. In a standard RFQ workflow, a buyer or seller requests specific price quotes from top market makers for an asset. Once all participating makers submit their quotes, the trader simply chooses the best offer, executing the trade at that price. This quote-driven model, long a staple of traditional OTC trading desks, is now available to DeFi users thanks to hashflow.

With the advent of blockchain, the RFQ process can now be processed entirely on-chain. Here’s how a hashflow bridgeless cross-chain swap unfolds:

A trader requests a quote to sell assets on the source chain and buy on the destination chain. This order is routed to hashflow’s off-chain engine.

Licensed market makers managing asset pools respond with cryptographically signed price quotes.

If the trader accepts a quote, they submit the transaction on the source blockchain, with the signed quote attached as the payload.

Hashflow’s smart contracts validate the quote, transfer funds to the liquidity pool, and relay payload data.

Validators review and sign off on the transaction’s legitimacy before the order transitions to the destination chain.

Relayers then complete the trade, delivering assets to the trader’s wallet on the chosen destination chain—efficiently settled, without bridging or synthetic token risks.

In contrast to AMMs—where liquidity and pricing are set algorithmically and may suffer from slippage—hashflow’s RFQ model removes nearly all slippage and virtually eliminates exposure to MEV strategies. This ensures traders always receive their quoted price, establishing hashflow as a preferred DEX for large trades, cross-chain swaps, and any use case demanding pricing certainty.

Source: Bebop

Hashflow in Numbers: Platform Growth Since Launch

Since its launch in August 2021, hashflow has consistently increased its DeFi market share by prioritizing value, efficiency, and transparency for its users. The platform has achieved over $11 billion in total trade volume and currently boasts more than $31 million in total value locked. With 10,283 liquidity providers supporting 31 different crypto pools, the depth and resilience of hashflow’s liquidity infrastructure are among the strongest in the industry.

Impressively, the platform maintains high engagement with 2,467 daily active users. During periods of broader market stress, such as the FTX collapse, hashflow remained robust, logging up to $800 million in monthly trade volumes and continuing its growth trajectory. The protocol’s on-chain performance demonstrates its capacity to deliver capital-efficient trades—key to why more users are paying attention to the latest hashflow price movements.

It’s worth noting, however, that while the platform is thriving operationally, the utility of its HFT token is presently limited to protocol governance and DAO participation. Hashflow does not currently charge trading fees, so direct value accrual to the HFT token is not in place. Nevertheless, the DAO treasury did receive 1% of initial HFT supply, and there remains potential for the community to vote on the introduction of protocol fees in the future. This possibility has led to speculation around the hashflow price and future token holder rewards.

Hashflow’s Native Token: HFT and Its Role

The HFT token lies at the core of the hashflow ecosystem. Issued as an ERC-20 asset with a 1 billion supply at genesis, HFT’s principal roles are in governance and community incentive structures. Holders of the token participate in the Hashflow DAO, exerting direct influence over upgrades, incentive programs, and eventual changes to the protocol’s fee structure and ecosystem-wide policies.

At present, HFT’s utility does not extend to protocol fee revenue sharing—since hashflow is a no-fee DEX. Instead, rewards and incentives are mainly disbursed through DAO-driven initiatives. A 4% inflation rate for the token is set to begin four years after the initial release, ensuring a long-term supply plan that balances governance power and sustainability.

The lack of direct fee capture is a structural decision, but the possibility for future community-enabled fees leaves open the chance for HFT’s value to grow as the ecosystem matures and as wider adoption potentially drives up hashflow price. As such, HFT is best understood as both a governance key and a long-term claim on the future evolution and monetization of the network.

Recent Hashflow Price Rally: Reasons and Analysis

In recent months, hashflow price has experienced a substantial rally, capturing the attention of traders and market analysts alike. HFT’s value soared over 100% in late June and early July, more than doubling as 24-hour trading volume peaked at $618 million—roughly 25 times its previous average. Technical indicators such as RSI and MACD signaled strong bullish momentum, suggesting that traders anticipated continued demand and enhanced utility for the token.

The surge coincided with several fundamental catalysts. Ongoing protocol upgrades, such as the rollout of Hashflow 2.0 and integrations with major networks (like Solana and Binance), have expanded access and deepened liquidity for all users. Just as critically, the platform’s expansion into new ecosystems and improvements in smart order routing have made it one of the most versatile DEXs available today.

Market observers speculate that increased attention on the possibility of future DAO-driven fee mechanisms—and the proven resilience and growth of the platform—have led both retail and institutional traders to take positions ahead of anticipated developments, further contributing to increasing hashflow price.

Conclusion

Hashflow is charting a new course in DeFi with its RFQ-based, slippage-resistant, and MEV-protected trading model. As user adoption accelerates and cross-chain volume grows, the latest hashflow price rally points to rising confidence from both traders and token holders. Whether you are trading for efficiency, transparency, or exposure to one of DeFi’s fastest-growing protocols, hashflow stands out as a project to watch.