Shiba Inu (SHIB) experienced a significant deterioration in on-chain profitability this week as a sharp price pullback reversed much of its recent gains. Data shows that the proportion of SHIB tokens held at a profit fell rapidly following a shift in market sentiment, highlighting renewed pressure on the meme coin after a brief period of optimism.

Shiba Inu has weakened sharply over the past week, wiping out much of its recent gains and pressuring investor confidence.#SHIB #ShibaInu #CryptoMarket #Altcoins

— Nuvina.fun (@Nuvina_fun) January 13, 2026

The decline matters for market participants because profitability metrics often influence short-term trading behavior. As fewer holders remain in profit, the likelihood of distribution increases, potentially amplifying volatility during periods of weak demand.

On-Chain Data Signals Rapid Shift in Sentiment

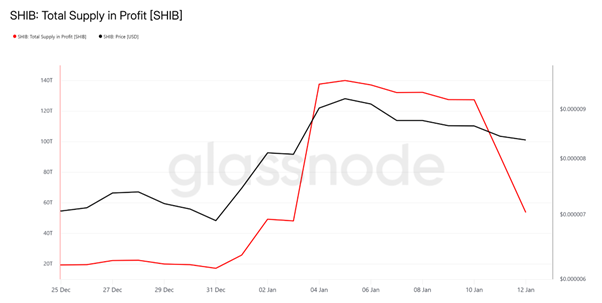

At the beginning of the year, on-chain analytics indicated that close to 140 trillion SHIB tokens were held at a profit, reflecting improved sentiment after a December rally and increased retail engagement. That figure has since dropped by approximately 62%, leaving an estimated 57 trillion SHIB still in profit.

Source: Glassnode

Such a rapid contraction suggests that the recent price move erased gains for a large portion of holders in a short time frame. Historically, declining profitability has coincided with changes in holder behavior, as investors who see gains disappear may become more inclined to sell rather than wait through additional uncertainty.

Exchange Flows Point to Distribution Phase

Macro-level indicators reinforce the shift. Exchange net position change data has shown persistent inflows of SHIB to centralized trading platforms during the downturn. Rising exchange balances are commonly interpreted as a sign that holders are positioning tokens for potential sale rather than long-term storage.

This pattern indicates that the accumulation phase seen earlier in the rally has likely ended. Combined with falling profitability, increased exchange inflows can create a feedback loop in which selling pressure contributes to further weakness, placing additional strain on near-term price stability.

Price Holds Key Support Amid Volatility

SHIB has been trading near the $0.00000855 level, remaining just above a nearby support zone around $0.00000836. Over the past week, the token declined by roughly 9.6%, retreating from an earlier intraday spike that briefly carried prices back toward the $0.00001000 area in early December.

Source: CoinMarketCap

Market participants are closely monitoring whether current support levels can be maintained. Technical traders often view these zones as reference points for assessing broader trend strength, particularly when combined with moving averages that help define short- and medium-term momentum.

Broader Context for Meme Coin Markets

Shiba Inu’s pullback comes amid a period of selective risk-taking across the broader crypto market, where capital flows have become more sensitive to momentum shifts. Meme coins, which tend to rely heavily on sentiment and liquidity conditions, often see sharper reactions during these transitions.

For now, SHIB’s declining profitability and increased exchange activity underscore how quickly conditions can change. Our analyst expected SHIB’s price will recover soon. The episode highlights the importance of on-chain metrics in understanding market dynamics beyond headline price movements, particularly in highly sentiment-driven segments of the cryptocurrencies market.