A rare solo mining success has just unfolded on the Bitcoin network, highlighting how individual miners can still land outsized rewards despite the dominance of large industrial pools.

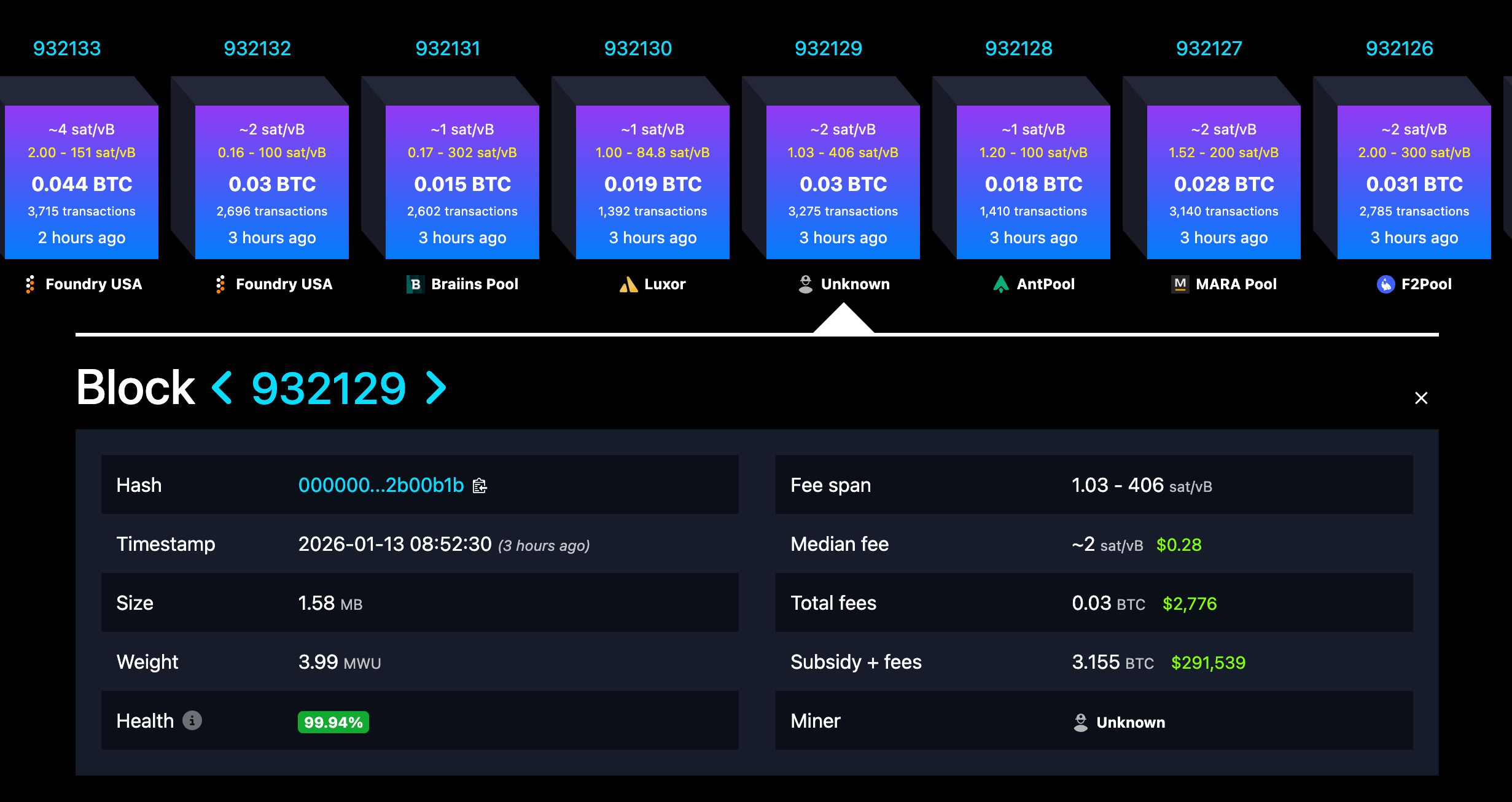

A single miner managed to mine a full Bitcoin block, earning approximately $295,000 — around 3.16 BTC — at current market prices. The block was attributed to an unknown miner rather than a major pool, meaning the entire reward likely went to one operator instead of being shared among thousands of participants.

Key takeaways

A solo miner captured the entire block reward without using a major pool

At current prices, a single block represents a near-$300,000 payout

Such events remain extremely rare due to the dominance of large mining operations

The timing makes the win even more striking. Bitcoin is currently trading near $93,900, with a market capitalization approaching $1.88 trillion and nearly 19.97 million BTC already in circulation. At these price levels, every successfully mined block carries enormous financial weight, especially for independent operators.

Why Solo Mining Wins Still Matter

Outcomes like this are often described as “Bitcoin lottery wins,” and for good reason. Solo miners typically control only a tiny fraction of the network’s total computing power, making the probability of discovering a block vanishingly small. Most machines run continuously for long periods without producing any reward, which is why successful attempts attract so much attention.

The payout in this case was driven mainly by the block subsidy, with transaction fees contributing a smaller share — an indication that network congestion and fees were relatively moderate at the time.

Still, the total reward rivals what large mining firms earn only after spreading proceeds across vast infrastructure and operating costs.

While events like this do not change the broader structure of Bitcoin mining — which remains heavily pool-driven — they underline one of the network’s defining traits: permissionless participation. Anyone running compliant hardware can, in theory, mine a block and receive the same reward as the largest industrial player.

Against the backdrop of Bitcoin’s near-$94,000 price and its steadily growing long-term valuation, rare solo successes serve as a reminder that the protocol’s rules are applied uniformly. Whether it’s a multinational mining company or a single independent miner, every valid block is treated exactly the same.