ChatGPT predicts the Bitcoin price could reach between $150,000 and $235,000 by the end of 2026, after Gold hits a new all-time high of $4,630 per ounce. The AI model made its prediction by analyzing historical Gold-Bitcoin correlations, analyst models, and market sentiment.

BTC price has regained the $92,000 support level, indicating the continuation of the recent rebound. Coinmarketcap data shows it is currently trading at $92,017, while trading volume has surged by over 45% in the last 24 hours.

Meanwhile, geopolitical tensions, recent Fed activity, and weakening economic data have driven demand towards safe-haven assets like Gold and Silver. On Monday, Gold surged to a record high amid increased uncertainty in global financial markets.

Historically, Bitcoin has followed Gold’s move, then rallied within three months after Gold hit a fresh ATH. Traders are closely watching the short-term price movement, but sentiment remains cautious.

How Gold’s New ATH Signal for Financial Markets?

A new all-time high (ATH) in Gold is generally a cautious signal for the financial markets, indicating heightened economic uncertainty, significant geopolitical risks, and a potential loss of confidence in traditional fiat currencies, particularly the US dollar.

Gold surged past $4,600 per ounce on Sunday. The rally in safe-haven assets was driven by a confluence of factors. Global tensions have escalated after a massive protest in Iran and the authorities’ cruel actions towards protesters. Tensions grew after President Donald Trump said he was weighing military options if Iranian forces persisted in cracking down.

At the same time, the Department of Justice (DOJ) investigation tied to Fed Chair Jerome Powell is adding to this volatility. This has raised questions about the Fed’s independence and uncertainty around upcoming monetary policy decisions.

From a technical standpoint, precious metals have been showing strong relative performance. Since the start of the rally in August 2025, the gold price has not closed below its 20-day moving average, indicating that the demand structure remains constructive.

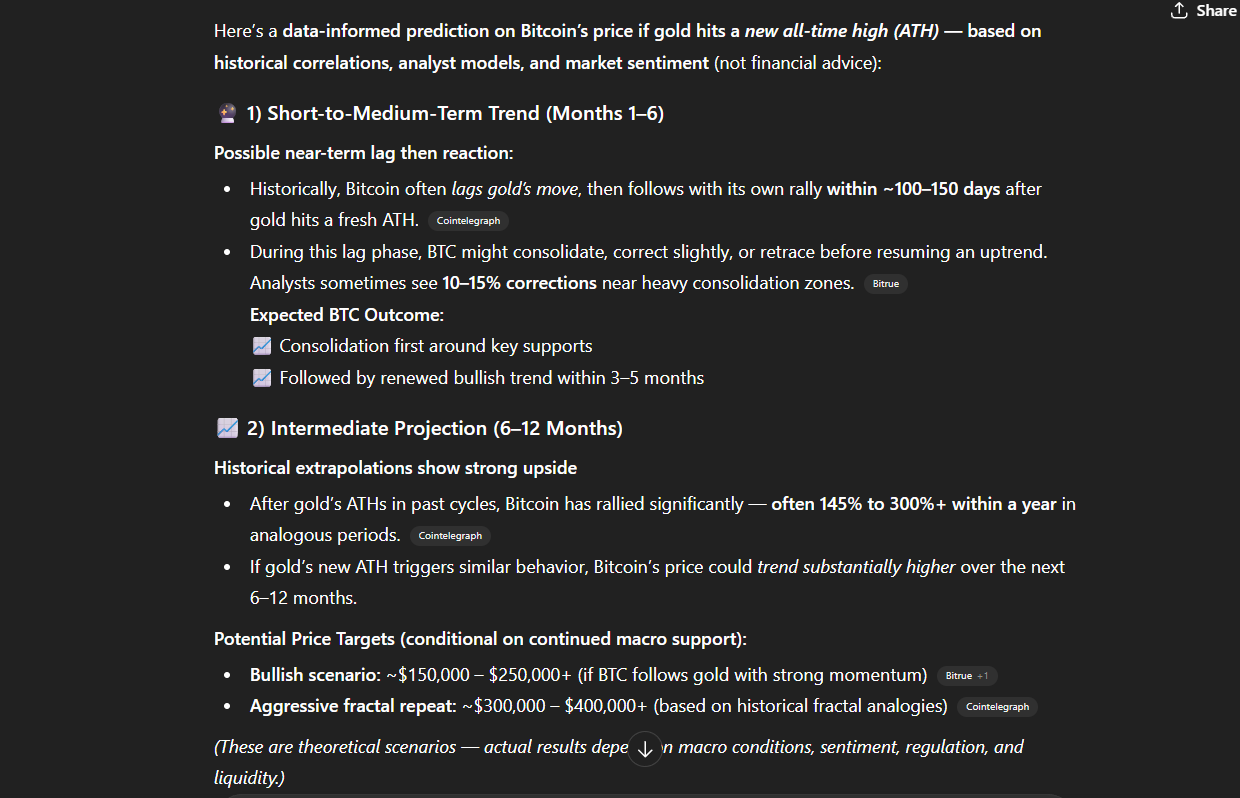

ChatGPT’s Bitcoin Price Prediction After Gold’s ATH

As gold reaches a new all-time high, ChatGPT analysis suggests Bitcoin will follow historical market behavior with a delayed but powerful move. ChatGPT showed that Bitcoin typically lags gold by 100–150 days, during which BTC may consolidate or face a 10–15% short-term correction before resuming the trend, as it has already done in the past few months.

For the mid-term outlook, ChatGPT predicts strong upside, with BTC potentially delivering gains of 100-300% within 6-12 months. If the historical pattern repeats, a bullish projection puts Bitcoin in the $150,000- $250,000 range by the end of 2026. This is possible in a bullish scenario where liquidity conditions remain favorable, and risk appetite remains strong.

However, the ChatGPT outlook is not without downside risks. If gold’s ATH coincides with a broader risk-off macro environment, Bitcoin could initially decouple and experience a deeper pullback before recovering. In such a scenario, BTC may revisit lower consolidation zones around $80,000–$100,000 before resuming a longer-term uptrend.

Overall, while gold’s new ATH does not guarantee immediate gains for Bitcoin, historical correlations and price behavior suggest a high probability of a multi-month bullish expansion, with six-figure price targets becoming increasingly plausible under supportive macro conditions.

Key Bitcoin Price Levels to Watch After Gold’s Breakout

As precious metals attract massive demand, $90,000 support and $92,400 resistance levels are crucial to watch in Bitcoin. The largest crypto is hovering between these two ranges, and a breakout in either direction can decide its future momentum.

Bitcoin price chart. Image courtesy: TradingView

On the daily chart, BTC is trading in a converging triangle pattern, with $94,000 as its breakout neckline. The lower side shows an immediate support at $90,000, with $88,500 as the next support level. While the pattern suggests neutrality and a fight between buyer and sellers, the previous momentum makes it cautious.

Technical indicators such as the 50-day moving average and the 10- and 20-day short-term moving averages are providing crucial support. Meanwhile, the Relative Strength Index (RSI) has surged above the middle line, indicating a bullish bias.

Q1 2026 will reveal whether ChatGPT’s predictions will hold in the coming months. Currently, various factors are weighing on global markets, but the crypto market has remained relatively stable, and Bitcoin’s price will have a significant impact on it.