Bitcoin dominance currently sits at 58.7% of total cryptocurrency market cap, reflecting capital concentration in the largest digital asset during uncertainty periods.

Past trends indicate that the periods of peak dominance are usually followed by switching to other cryptocurrencies when risk appetite gets back into the markets.

Pepeto ($PEPETO) positions itself to capture this rotation through infrastructure addressing memecoin trading friction while Bitcoin consolidates around $95,6K following October 2025 peaks near $126K. The presale stage project at $0.000000177 per token is a combination of low entry cost, and active utility development, which forms asymmetric opportunity structure, capital seeks greater velocity allocations.

When Bitcoin establishes new ranges and dominance stabilizes, market participants historically redirect capital toward smaller cap projects offering multiplication potential absent in established assets. Ethereum trades around $3.3K with $401B market cap, providing infrastructure foundation but limited percentage upside from current levels.

Meme coins like BONK at $993M and PEPE at $2.74B demonstrated this rotation dynamic during previous cycles, achieving thousand percent gains as Bitcoin consolidation phases enabled speculative capital flows into higher risk categories. Pepeto enters this rotation window during presale stages, offering early entry before exchange listings create broader market access and price discovery.

Understanding Bitcoin Dominance Cycles

Bitcoin dominance measures BTC market cap as percentage of total cryptocurrency valuation, currently standing at 58.7% with $1.84T capitalization against $3.14T total crypto market. When dominance is high, capital safety preference is high in volatile or unpredictable times whereas when dominance is falling, the flow in risk on sentiment into alternative assets. The metric had also hit the same heights during the cycle transitions in the past, and current levels might signify rotation inflection point as opposed to being in long-term capital allocation.

Institutional adoption through Bitcoin ETFs and corporate treasury holdings established BTC as digital gold narrative, attracting conservative capital seeking exposure without altcoin volatility. This positioning strengthens Bitcoin long term but reduces multiplication potential as market cap scales.

For $95.6K Bitcoin to reach $200K requires doubling from current levels, achievable but representing modest gains compared to early stage alternatives. Capital efficiency favors smaller projects where equivalent dollar inflows produce larger percentage movements, driving rotation dynamics once Bitcoin establishes support ranges and reduces immediate upside uncertainty.

Why Meme Utility Projects May Spearhead Altseason

The altcoin cycles of the past have indicated that meme coins tend to draw in serious retail capital during rotation phases, and both BONK and PEPE have become billion dollar valuation companies by cultural positioning alone.

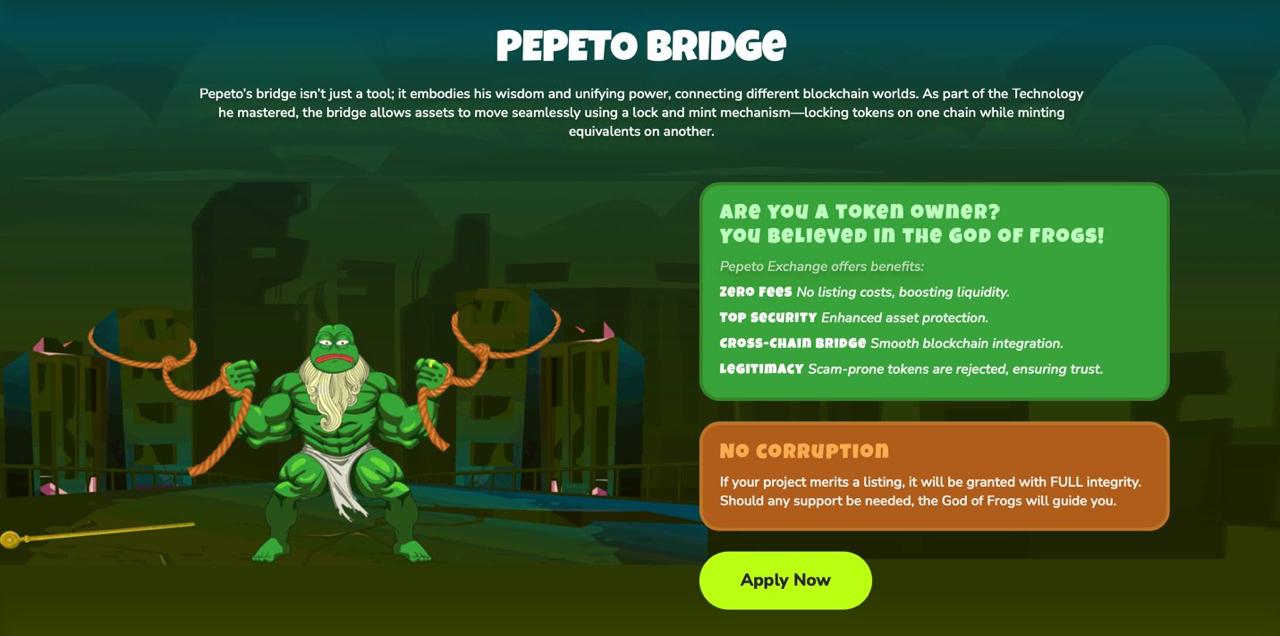

Pepeto advances this category by combining viral memecoin dynamics with infrastructure solving actual problems in decentralized trading. The project builds PepetoSwap for zero fee transactions, Pepeto Bridge enabling cross chain movement, and Pepeto Exchange providing verified listings. Over 850 projects have sought exchange access, generating volume pipeline prior to social introduction as well as proving market demand beyond social speculation.

All trading on Pepeto Exchange routes through PEPETO token, establishing inherent buy pressure as ecosystem usage scales. This utility contrasts with pure meme equivalents since it creates token consumption other than speculation holding. Built on Ethereum mainnet with 420T supply, the project allocates 30% to presale and another 30% to staking rewards. Existing staking rates stand at 215%, which encourages locking up, which decreases the supply in the market. Implementation can be proven before launch with security audits by SolidProof and Coinsult, which deal with technical risk issues that are common in high velocity deployment projects.

Timing Advantage by Presale Availability

Pepeto presale operates at $0.000000177 per token with stage based pricing creating entry windows before automatic increases. First time players gain a position before exchange listings which normally signals price discovery and entry to a wider market. The fact that the community of 100K and more was created prior to the actual launch is an indicator that there was no artificial hype and that it was an organic one, which is a significant difference when evaluating the validity of the project. Ease of payment in ETH, USDT, BNB and bank cards eliminates technical barriers to entry of retail capital at presale stages.

The project has also increased the amount raised in the development milestones at $7.14M, which indicates capital dedication to the delivery of infrastructure. To balance growth resources with equitable distribution, tokenomics set 12.5%, 20% and 7.5% of the reserves of liquidity, marketing, and ongoing development respectively.

As Bitcoin dominance peaks and rotation signals emerge, projects combining cultural appeal with functional products stand positioned to capture disproportionate capital flows. Pepeto positioning as “PEPE plus Technology plus Optimization” frames the evolution narrative, distinguishing from speculation only alternatives while maintaining meme culture engagement critical for retail adoption.

Conclusion

Bitcoin dominance at 58.7% historically precedes rotation into alternative cryptocurrencies as market participants seek multiplication potential beyond established asset consolidation. Pepeto combines memecoin cultural appeal with infrastructure development, positioning to capture this rotation through presale stage access at $0.000000177.

Early adoption indications are positive with 850 projects seeking exchange listing and $7.17M funds having been raised in the development phase, indicating that there is a legitimate interest in the market in the verification and trading infrastructure. The project stands out with utility token mechanics in that the volume of exchange generates buy pressure so that pure speculation dynamics are not as significant.

With the stricter control around cryptocurrency markets, honest projects with audited accounts and operational products will have an upper hand compared to fast deployment alternatives. Stage based pricing and 215% staking yields are offered to the participants of the presale to position in front of wider market access. The combination of timing advantage, infrastructure development, and meme culture positioning could establish Pepeto as dominant altcoin winner during 2026 rotation cycle set to deliver big returns to every early investor.