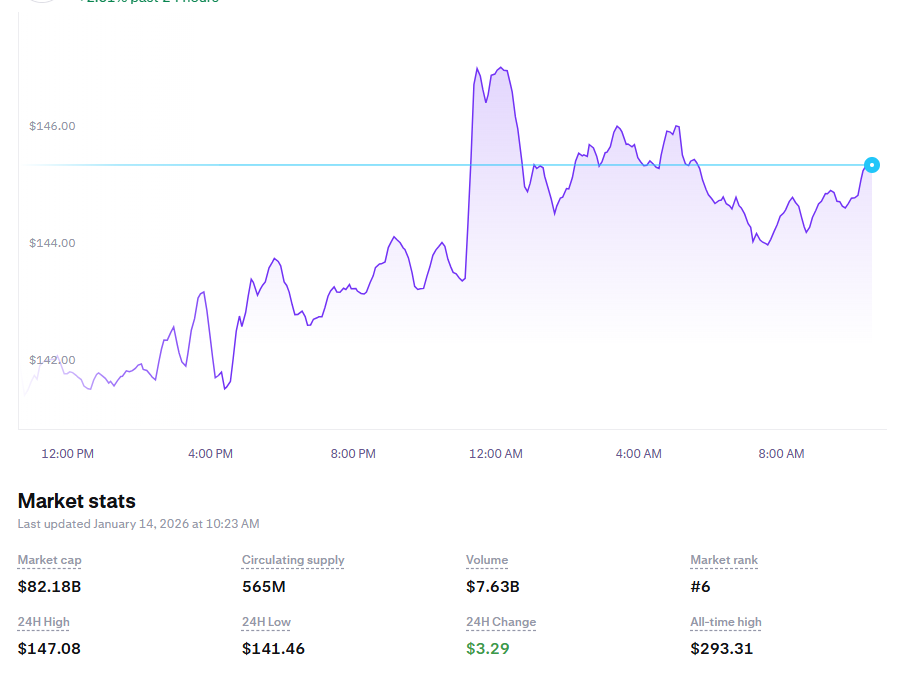

Solana price prediction models are flashing green after SOL surged above the key $145 level, sparking renewed interest from traders and analysts. As of January 14, 2026, Solana is trading at $145.45, gaining 2.18% in 24 hours and building momentum above its 100-hour moving average.

Technicals now suggest a run toward $150–$155 in the short term, while long-term charts point to an extended move toward $190 if resistance levels are cleared.

With ETF optimism, rising volume, and bullish formations all aligning, the stage could be set for Solana’s most significant rally since late 2025.

Solana Flashes Strength Above $145 as Bulls Eye $150–$155

Solana has broken out of a multi-week range and is now holding steady above $145, a resistance that capped rallies four separate times since November 2025. Price action over the weekend confirms the bullish shift, with buyers defending the $140 trendline and reclaiming the 100-hour simple moving average.

According to live metrics, Solana’s market cap is $82.21B, with 24-hour volume up 30% to $7.05B, indicating strong inflows behind the move. The RSI is holding above 50 and the hourly MACD continues climbing, further validating upside potential.

Resistance at $148 and $150 remains critical. If Solana clears these levels, technical projections suggest a fast-track move to $155, and possibly $162, aligning with recent Fibonacci zones and previous sell-off tops even for some of the best Solana meme coins.

Trend Reversal Confirmed: Cup-and-Handle Targets $190 Breakout

A broader cup and handle structure has formed on the daily chart, and the neckline near $145 is now broken. This pattern, confirmed by accumulation phases from November to early January, targets $180 to $190 based on standard technical breakout projections.

According to market analyst NekoZ, “This $SOL rounding bottom is painting a masterpiece… next stop: $190+.” Solana has also reclaimed its 50-day moving average for the first time since September 2025, a signal historically linked to breakout transitions.

This trendline previously marked reversals in the best cryptocurrencies, leading to double-digit rallies. Spot ETF inflows are reinforcing demand, especially as Solana meets the compliance conditions of the 2026 ETF bill. Institutional investors are stepping back in, reducing risk premium and adding fuel to upward momentum.

Near-Term Forecast: Gradual Climb Toward $146.80 by January 19

Short-term Solana price prediction models show steady daily gains over the coming five days. Based on current momentum and trendline support at $140, algorithmic projections forecast a climb from $145.97 on Jan 15 to $146.80 on Jan 19, representing a 0.98% increase.

This follows a 4.3% rally over the past week, with buyers repeatedly defending dips toward $142 and using hourly support zones to re-enter.

The breakout structure is being confirmed across both high and low timeframes, with total supply at 618.22M SOL and 565.2M in circulation, suggesting relatively low inflation risk.

Traders remain cautious about a rejection near $148, but as long as the price holds above the $144–$145 support band, any downside is likely to be short-lived. If $150 breaks cleanly, short-term resistance fades and liquidity zones toward $155–$160 could be tested within days.

ETF Bill & Institutional Access Add Macro Tailwinds

Beyond the charts, macro conditions are also turning in Solana’s favor. A draft Senate bill under the Clarity Act proposes that select tokens like Solana, XRP, and Dogecoin be treated as commodities, not securities.

If passed, this would allow regulated ETF products to legally include Solana by January 1, 2026, increasing accessibility for pension funds and asset managers. For tokens like SOL, ETF status removes regulatory overhang and enhances institutional liquidity, a key requirement for sustained price growth.

Solana already meets the technical conditions for this classification and is trading in the same compliance zone as Bitcoin and Ethereum. With ETF inflows staying positive despite liquidation risk events, demand continues to outpace short-term supply.