Polymesh (POLYX token) creates a favorable environment for RWA tokenization and cryptocurrency transactions with low cost and high efficiency.

What is Polymesh?

Polymesh is a blockchain project built for asset regulation at the institutional level. The platform solves infrastructure challenges related to the fields of administration, identity, security systems, and payment security.

The platform integrates many financial principles to minimize fixed costs when users operate on the blockchain. The project supports developers in building decentralized applications (dApps) through security tokens. Polymesh's goal is to effectively solve the problems of rule implementation, KYC verification, regulatory compliance, data protection while completing transactions quickly.

On April 4th, Polymesh and TokenTraxx collaborated to host the Web3 Music event, awarding valuable prizes to music producers. Prior to that, the platform underwent mainnet development and updated to version 6.2.0 on April 3rd.

Characteristics of Polymesh

The project has five main pillars focusing on solving regulatory and operational issues to promote the use of security tokens:

Governance: Polymesh has an advanced governance model that prevents hard forks and promotes blockchain development.

Identity: The process of verifying customer identity ensures clarity about the identities of participating parties, all on-chain transactions are performed by legitimate organizations.

Compliance: Polymesh integrates advanced tools to support compliance with a variety of regulations in the market. It can automate and execute complex rules efficiently at scale.

Security: The project develops a secure asset management protocol, allowing for the safe and secure issuance and conversion of assets.

Payment: By creating assets at the protocol layer, the platform simplifies the transaction execution process, providing instant liquidity to investors.

Structure of Polymesh

Tokenization of RWA: The platform allows the display of traditional assets such as stocks, bonds... in the form of tokens. This mechanism helps reduce risks and transaction costs, while increasing liquidity and scalability for users.

Compliance engine: The project is developing an automated tool for legal compliance and control. This ensures that all activities on the blockchain run smoothly, optimizing time for limiting cryptocurrency ownership, verifying identities (KYC), and preventing money laundering (AML) behaviors.

Role-based access control: Polymesh uses role-based access control (RBAC) to manage availability of ecosystem features and services. The mechanism helps ensure network security, limiting hacker attacks to steal customer information.

Confidential transactions: The project offers the ability to conduct secure transactions, without revealing sensitive investor information such as purchase, sale, conversion amounts or information about participants. The process is performed based on zero-knowledge proofs technology, committed to ensuring user privacy.

Governance: Polymesh has a flexible, community-centered platform governance mechanism. Owners of native POLYX tokens have the right to participate in the decision-making process on important network issues such as software updates, changes to blockchain structure and regulations, and access management.

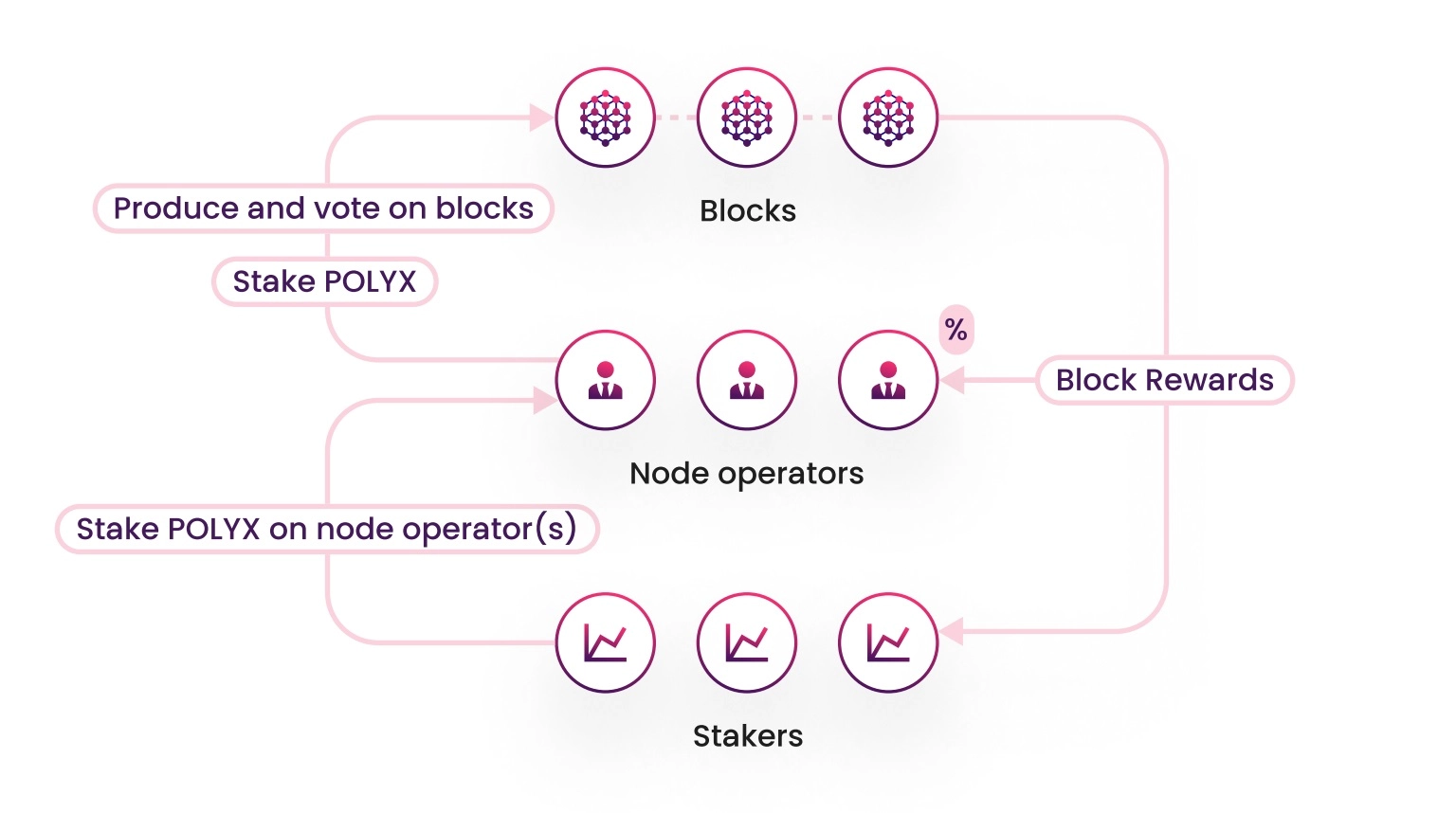

How Polymesh works

The platform applies the Nominated Proof-of-Stake (NPoS) mechanism based on the operation of node operators. Node operators are verified by staking POLYX and receive rewards from block validation. The platform currently has 61 validators.

The block must be approved by at least two-thirds of validating nodes, then recorded in the ledger and cannot be modified. This allows Polymesh to ensure transaction processing efficiency, saving investors time.

Uses of POLYX token

POLYX is Polymesh's native token, used as follows:

Transaction fees: POLYX token is the payment method for all ecosystem activities, including security token issuance.

Stake: POLYX is used to fuel the NPoS mechanism.

Governance: POLYX token holders have the right to vote on on-chain governance in the form of voting.

Tokenomics

Token name: Polymesh

Symbol: POLYX

Contract: 0x236036ad617b4b9de31e742ab2118ba8f8250c2a

Total supply: 1,038,751,088 POLYX

Maximum supply: Unlimited

Self-reported distributed supply: 839,746,422 POLYX

Token allocation

Reserve: 52%

Pre-sale and airdrop: 24%

Team: 20%

Investors: 2%

Reserve bonus: 2%

Price fluctuations and trading platforms

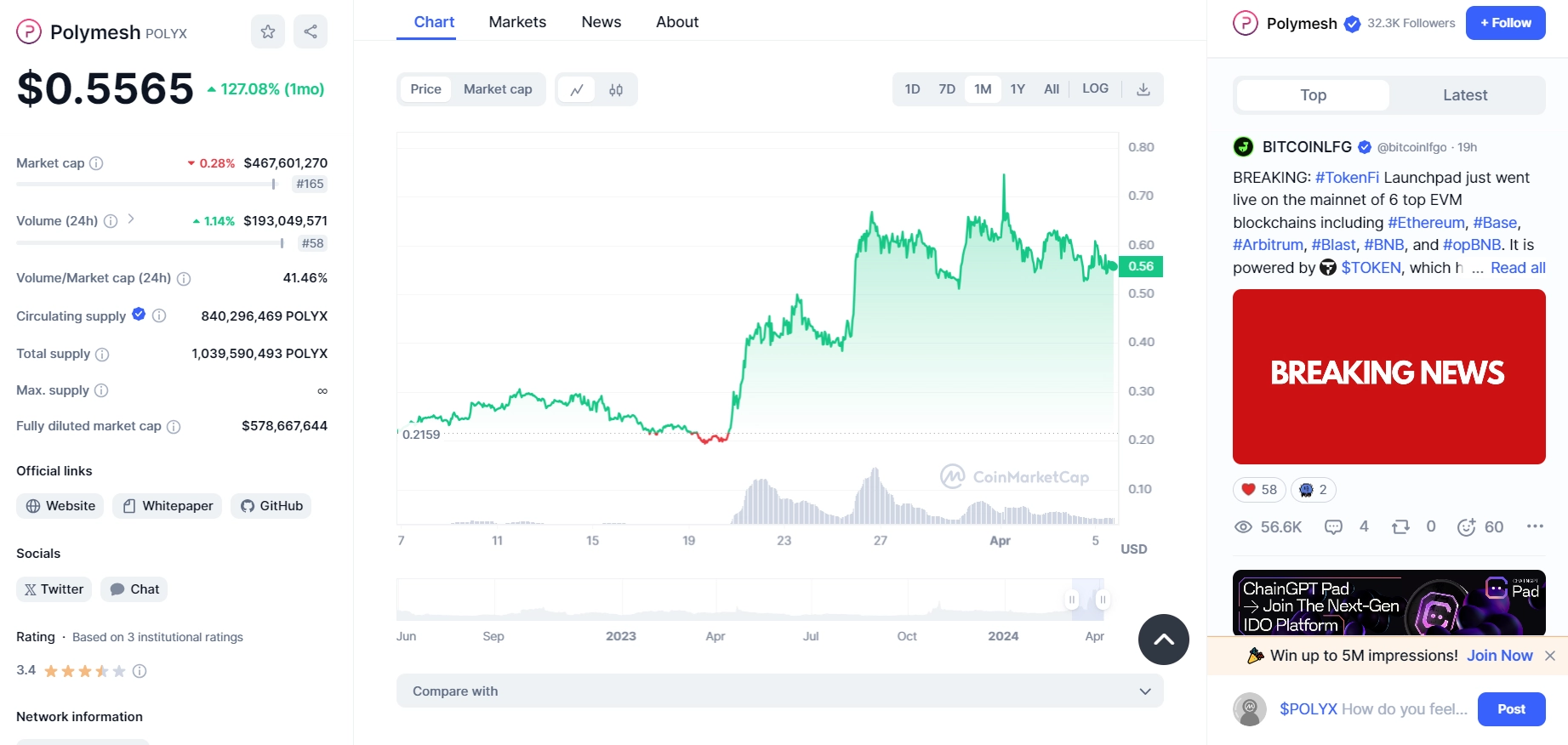

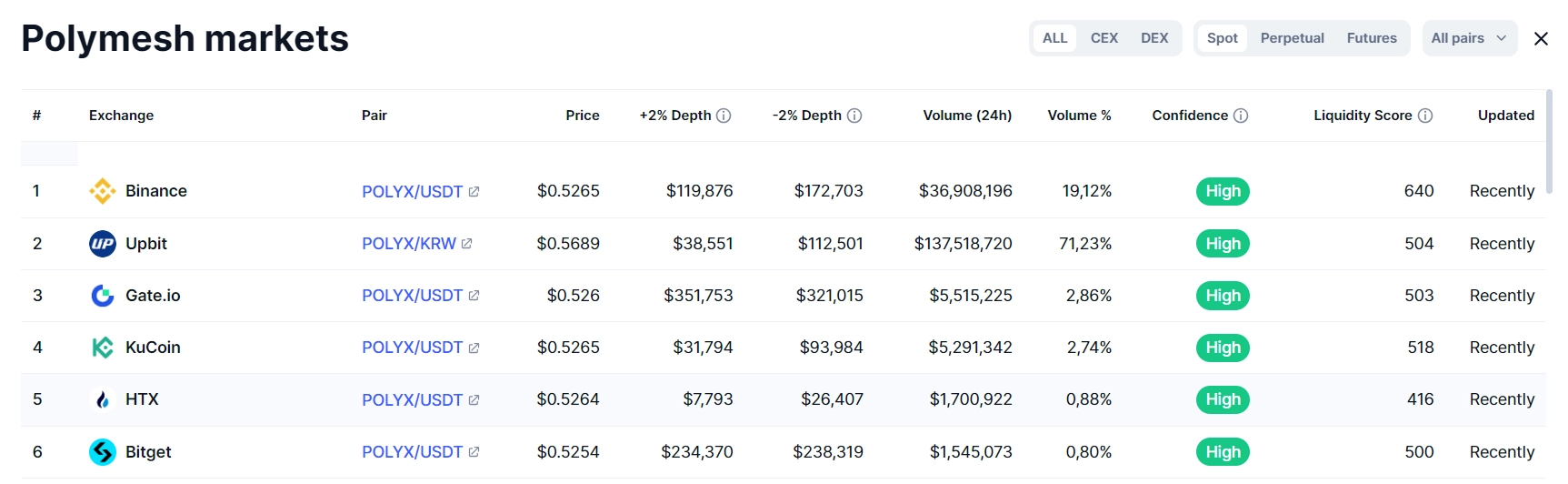

According to CoinMarketCap data, the POLYX token is currently trading at $0.5565, marking a 127.08% increase over the past month. Polymesh's 24-hour trading volume is $193,049,571, up by 1.14%, with a market capitalization reaching $467,601,270.

Investors can buy POLYX tokens at many popular exchanges including Binance, Gate.io, KuCoin, HTX, Upbit...

Team

Polymesh's core team includes:

Head of Strategy: Chris Housser

Head of blockchain: Adam Dossa

Head of Tokenization: Graeme Moore

Head of Partner Development: William Vaz-Jones

Head of blockchain application research department: Robert Jakabosky

Head of Developer Relations: Francis O’Brien

Head of Product: Nick Cafaro

Partners

Polymesh has partnership relationships with projects across diverse fields. Some notable names include Huobi, Binance, Marketlend, Gatenet, Genesis Block...

Conclude

Polymesh develops a feature set to help tokenize real-world assets (RWA), meeting regulatory requirements in the cryptocurrency market. Through the staking mechanism, POLYX token holders can participate in governance and contribute to the sustainable development of the platform. However, investors need to have a reasonable strategy to optimize capital resources and avoid unnecessary asset losses.