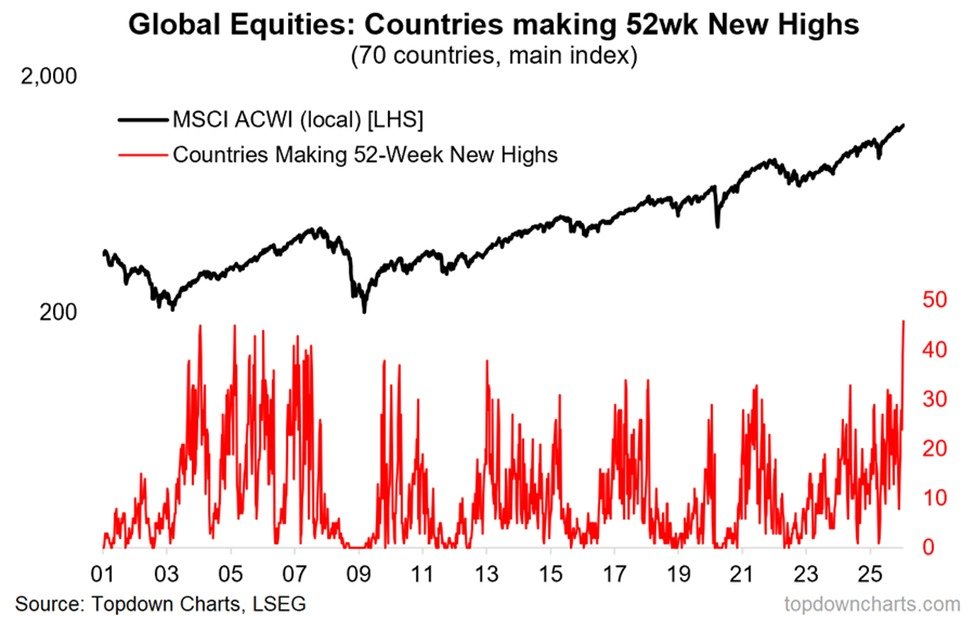

Global equity markets are entering rare territory as the breadth of the rally expands at a pace not seen in decades.

A growing number of countries are not just participating in the advance – they are pushing into fresh 52-week highs at the same time, signaling unusually synchronized strength across regions.

Key Takeaways

A record 47 countries in the MSCI ACWI are at 52-week highs, covering about 67% of the index.

The global rally has broadened rapidly since November 2025, with the MSCI ACWI up around 8% and at record levels.

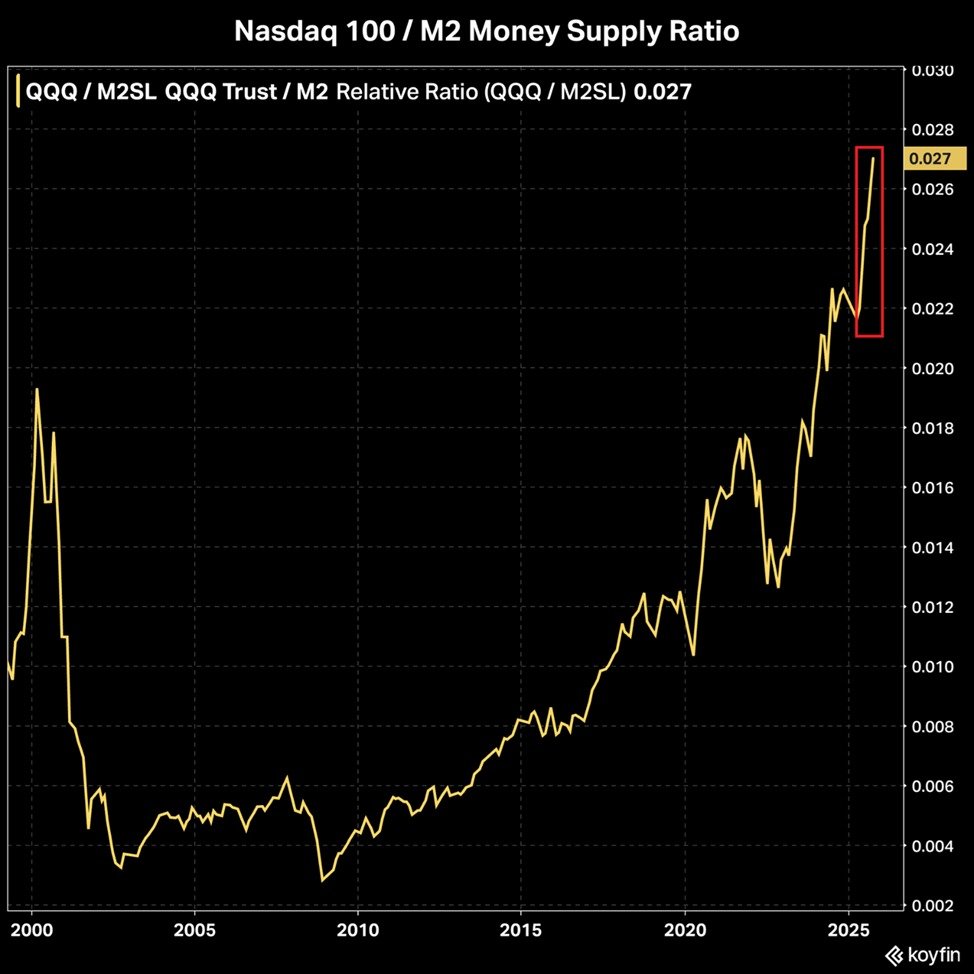

The Nasdaq 100-to-M2 ratio has hit an all-time high, far exceeding dot-com era extremes.

Market strength is historic, but increasingly stretched relative to money supply growth.

Global rally reaches historic breadth

The number of countries within the MSCI All Country World Index reaching new 52-week highs has climbed to 47, the highest reading on record. That figure now represents roughly two-thirds of all countries tracked by the index, surpassing the previous peak of 46 markets set back in 2003.

What stands out is the speed of the move. Since November 2025, the count has doubled as more markets joined the upswing. Over the same period, the MSCI ACWI itself has gained about 8% and is trading at a record level, reinforcing the message that this is not a narrow or region-specific rally.

Historically, global breadth of this magnitude has been extremely rare. Since 2014, the number of countries at new highs had failed to rise above 35, underscoring just how unusual the current environment has become.

Big Tech stretches valuations against liquidity

At the same time, U.S. technology stocks are sending their own signal. The ratio of the Nasdaq 100 to the U.S. M2 money supply has climbed to a new all-time high of 0.027, highlighting how far equity prices have pulled ahead of underlying liquidity growth.

Since the 2022 bear market low, this ratio has more than doubled. During that window, the Nasdaq 100 has surged roughly 141%, while M2 money supply has increased by only about 5%. The result is a valuation metric that now sits around 42% above its peak during the 2000 dot-com era and more than 800% higher than levels seen after the 2008 financial crisis.

The takeaway is clear: market leadership is increasingly concentrated in large-cap technology, and its scale relative to monetary expansion has never been greater.

A market defined by strength – and extremes

Together, these trends paint a picture of exceptional momentum. Global stocks are advancing in unison, while Big Tech continues to dominate performance metrics. Such conditions reflect strong investor confidence, but they also raise questions about sustainability if liquidity growth fails to reaccelerate.

For now, global equity strength remains undeniable, marked by record participation across countries and unprecedented valuations in key sectors.