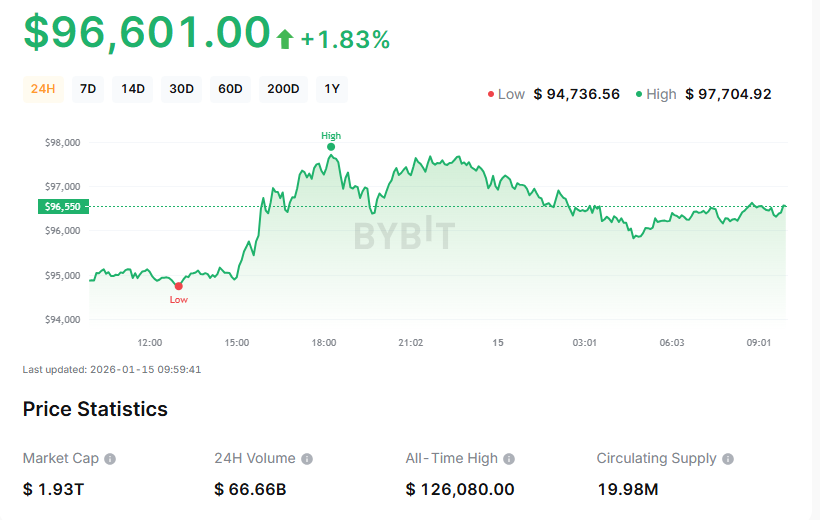

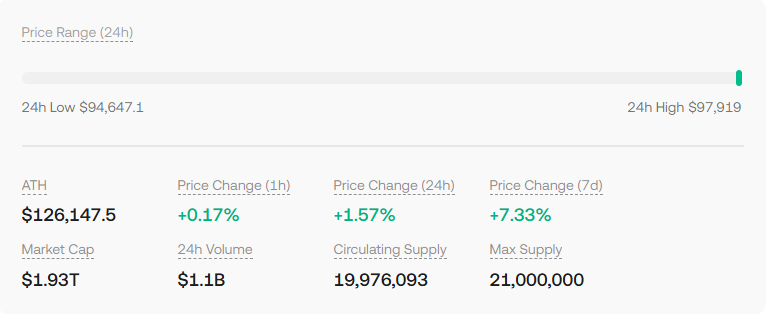

At a price of $96,555.64, Bitcoin is up 1.57% in the past 24 hours, continuing a rebound that has raised serious questions among traders: how to trade Bitcoin in a market driven more by spot demand than leveraged speculation?

With open interest down 31% since October, and daily trading volume just under $60 billion, structural shifts in derivatives positioning are pointing to a healthier, less overheated environment. But is this truly a bottoming phase or just a pause in volatility?

BTC Nears $97K as Derivatives Reset Signals a Healthier Floor

Bitcoin has entered a new technical pocket, climbing near $97,000 even as 24-hour trading volume dipped by 2.92%. The move comes amid a broader decline in derivatives open interest, down by 31% over the past three months according to CryptoQuant.

This type of deleveraging has historically marked cycle bottoms, as it reduces the speculative pressure that often drives sharp sell-offs. Analysts describe the drop as a reset of market structure, purging excess leverage and allowing spot demand to take the lead.

Notably, total open interest peaked at over $15 billion in October 2025, nearly triple the 2021 bull market peak. Since then, the unwind has shifted momentum away from aggressive futures trading and toward more organic, buyer-driven price action.

Spot-Driven Recovery Aligns with Short Covering, Not Speculation

A significant change in market dynamics is emerging: price is rising while open interest falls. This behavior is typically associated with short covering, as bearish traders are forced to close out positions during upward pressure.

In contrast to leveraged long setups, this indicates a cleaner, more durable uptrend. Bitcoin’s 10% year-to-date gain may appear modest by historical standards, but the quality of that growth is what matters.

Unlike past rallies built on speculative leverage, current gains are fueled by spot flows – real buyers executing on market conviction, not borrowed capital. This makes it more likely that upside moves will stick, provided no macro shocks disrupt the structure.

How to Trade Bitcoin Now: Strategy Shifts for Current Conditions

Traders looking at how to trade Bitcoin in this environment need to rethink traditional aggressive tactics. The decline in open interest limits the viability of highly leveraged plays. Instead, attention is shifting to spread betting and low-latency swing trades.

Spread betting offers a way to profit from price movements without owning the asset, and in some regions, it offers tax efficiency. But the real shift is in style: scalping and short-term day trading are regaining popularity as traders capitalize on intraday volatility without long exposure.

For swing traders, the combination of lower leverage and clearer trend signals is ideal. With RSI and MACD showing recovery momentum and support holding near $92K, holding through minor pullbacks has become a viable strategy again.

Is the Market Still at Risk? Leverage Is Down, But So Is Confidence

While the sharp reduction in open interest is a bullish structural shift, it hasn’t removed downside risk entirely. As CryptoQuant notes, if Bitcoin price prediction were to break support and enter a new correction phase, open interest could contract even further, dragging market sentiment with it.

Traders should remain alert to cascading liquidations, particularly if BTC revisits the $90K–$91K range. CoinGlass reports that total derivatives open interest now sits at $65 billion, down from over $90 billion in October.

The reduction is consistent with a healthier setup but is not yet a confirmation of a new bullish cycle. Risk management remains critical, especially for those using leverage to chase intraday moves.

Tactical Precision Over Blind Momentum

With Bitcoin hovering near $97K, the big takeaway for traders is that structure matters more than sentiment. The drop in open interest is a signal – not a guarantee. Traders asking how to trade Bitcoin now should focus on scalability, liquidity, and exit planning.

The current environment rewards short-term decision-making rooted in real momentum, not speculative excess. As derivatives markets reset, expect volatility to compress and opportunities to favor those with precise entries, fast reactions, and tighter stop losses.

BTC’s next major test sits near $100K, a psychological barrier that may trigger reactive selling or unlock the next leg of institutional accumulation for the new cryptos.