Grab Milk Mocha ($HUGS) at Stage 11 $0.0008 before $0.06 listing as Monero and Ethereum trends look priced in and top crypto gainers shift.

Crypto markets have stayed strong since January 13, 2026, with total market cap holding around $3.1T+ and daily volume still printing in the $150B range. Momentum has returned, but traders remain picky because not every rally delivers the same upside.

The Monero price has shown sharp volatility with fast spikes, while Ethereum price has pushed higher with broader market strength and renewed confidence around major-cap flows. Both have trends worth tracking, yet the upside can feel limited once the move is already underway.

That creates a real shortfall: if Monero and Ethereum are already priced like leaders, where does the next profit shock come from among the top crypto gainers? Analysts point to Milk Mocha ($HUGS), saying Stage 11 is a glitch” where retail buys like VCs, $0.0008 entry before $0.06 feels like insider pricing.”

Milk Mocha ($HUGS): Stage 11 Insider Window

Milk Mocha ($HUGS) is built around a culture-first brand with 50M+ fans, aiming to turn that audience into a crypto economy instead of just social engagement. With a 40-stage presale format, it is currently in Stage 11 at roughly $0.0008092, with $276,000+ already raised so far.

Analysts say the real hook is the pricing gap, because the confirmed listing target is $0.06. That is the kind of spread that makes early buyers feel like they are stepping into a deal usually reserved for private insiders, not late retail entrants watching from the sidelines.

Most projects with this level of audience power would fundraise quietly through major venture firms, and the public would only get access once the easy upside is gone. Milk Mocha is taking a different path, and experts have called this kind of setup the same pattern that can push coins into the top crypto gainers category.

The presale adds pressure through weekly burns of unsold supply and a 60% staking APY that encourages long lockups. The roadmap also includes HugVotes DAO for community-led donations, plus NFT collectibles and casual play-to-earn mini-games built for mass appeal.

Researchers say Stage 11 feels like a rare pricing glitch” where the public entry looks more like a seed round than an exchange launch. That is why analysts have again linked Milk Mocha ($HUGS) with top crypto gainers, since the insider price” window may disappear the moment listings begin.

Monero Price Watch: Privacy Coin Surge

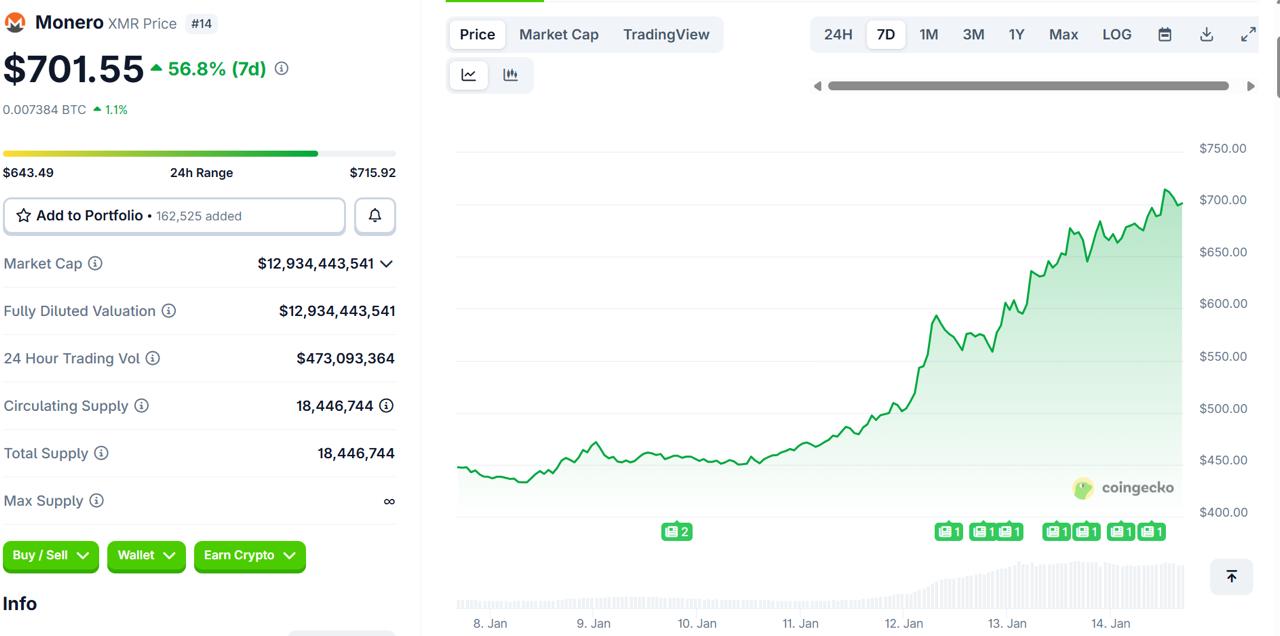

The Monero price has been one of the most aggressive movers in January 2026, trading around $690–$715 after a sharp upside run. Daily volume has stayed heavy near $470M–$515M, showing strong demand even during fast swings. With a market cap around $12.9B–$13.1B, Monero remains a large-cap altcoin that can still move quickly when attention shifts back to privacy.

Source: CoinGecko

The January push has been clear: Monero moved from roughly $436 on Jan 8 to about $709 by Jan 14, with the biggest jump landing between Jan 12 and Jan 14. The Monero price action has also been shaped by tighter exchange access in some regions and more talk around privacy tokens. For traders, that mix of demand plus restricted access can make price moves sharper than expected.

Ethereum Price Update: January Breakout Strength

The Ethereum price has been holding firm around $3,310–$3,350 at the time of writing, after a strong daily move that put ETH back into focus. Market cap has been sitting near $400B–$403B, keeping Ethereum solidly in the #2 spot. Daily trading volume has also remained active around $33B–$36B, showing that buyers and sellers are still heavily engaged at these levels.

What stands out is the speed of the jump. Ethereum closed near $3.33K on Jan 13 with a gain of roughly 7%+, and then stayed in a $3.31K–$3.36K zone on Jan 14 without giving up much ground. The Ethereum price trend has been supported by the wider market moving higher and renewed optimism around big-cap crypto flows. Traders are now watching if ETH can keep above the key zone near $3,075 to protect momentum.

Top Crypto Gainers Verdict: Milk Mocha ($HUGS) vs Monero and Ethereum

Monero and Ethereum have both delivered strong January momentum, but in different ways. The Monero price has shown fast, aggressive spikes driven by privacy demand, while the Ethereum price has stayed steadier, backed by big-cap strength and wider market confidence.

Still, both coins are already priced like leaders, which can limit the size of the next surprise move. Their trends matter, but the biggest gains often come from entries that feel early, not after the market has already leaned in.

That is why analysts keep pointing to Milk Mocha ($HUGS) and its Stage 11 pricing as a rare public entry that resembles a private deal. With $0.0008 levels before a $0.06 listing target, experts say it has the setup many top crypto gainers are built on, because the insider window” may not stay open for long.