Crypto presales of 2026: IPO Genie ($IPO) offers tokenized access to private-market startups with governance, staking, and liquidity perks.

We’re well into 2026. Gone are the days of pure hype-driven launches! Folks are zeroing in on projects that deliver real-world perks, like solid governance and verifiable value. That’s where IPO Genie ($IPO) shines in the mix of crypto presales of 2026.

It’s not just another token drop, but a smart bridge to private equity tokenization that everyday investors can actually use, breaking into private equity investing without venture network, oversized capital, or closed-door networks. So, what sets this 2026 blockchain presale apart, and why might it fit your portfolio if you’re hunting for early-stage crypto opportunities?

Opening Doors to Hidden Investment Gems

This means you can explore early-stage startup opportunities in AI, fintech, or DeFi, without needing insider networks or getting bogged down in endless paperwork.

Many of the strongest startup deals have traditionally stayed private, with growth happening long before public listings.

IPO Genie helps change that dynamic by tokenizing access to selected private-market opportunities allowing broader participation through vetted options sourced from professional networks. While removing much of the traditional friction and red tape.

For those exploring participation early, the platform also includes staking mechanisms currently offering up to 20% rewards, designed to incentivize long-term engagement rather than short-term speculation.

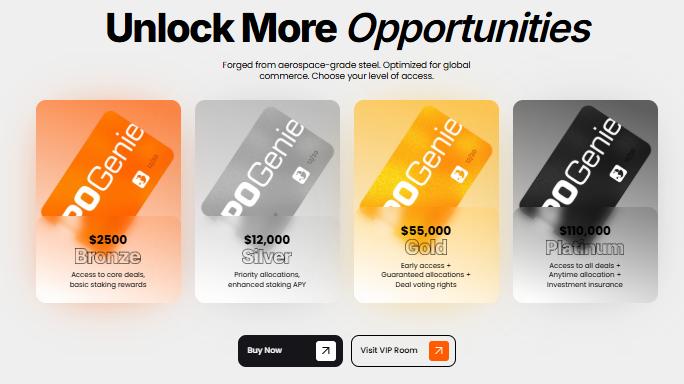

What stands out is the practicality. Even basic tiers are far more accessible than what many traditional funds require. This makes it possible for more people to participate in private-market opportunities. It’s a simpler, more approachable way to explore early-stage digital investments.

Real Perks Tied to the $IPO Token

The $IPO token isn’t some empty promise; it’s built for action, blending access rights with earning potential and community input. You hold it to unlock curated investments, stake for yields, and vote on key moves. Climb the tiers, and you get extras like priority spots or even buffers against losses in certain picks, stuff you rarely see in presale token analysis for other decentralized finance startups.

Screenshot – Proof of tire system from IPO Genie Whitepaper

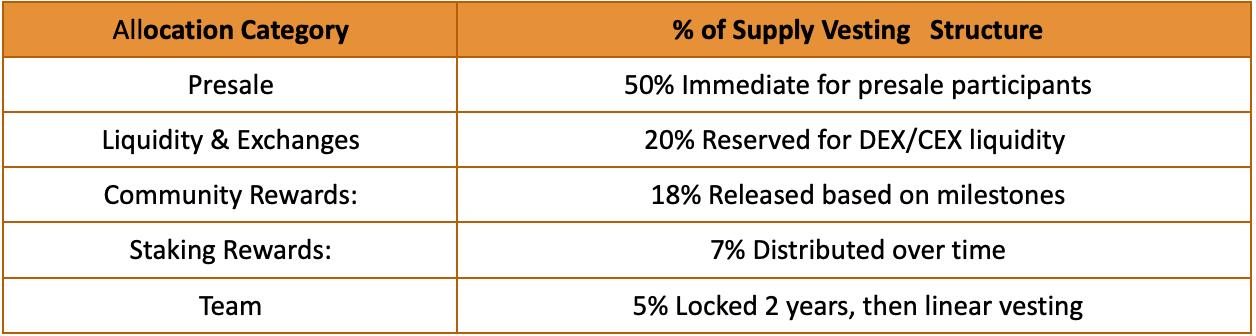

Token Allocation Overview

This setup keeps things fair, locking team shares to align everyone long-term, while on-chain tracking lets you verify every step.

Why Timing, Technology, and Structure Matter

IPO Genie combines blockchain efficiency with built-in oversight, using smart contracts for staking, governance, and payouts while adapting to jurisdictional requirements. This structure matters as private companies stay private longer, keeping much of their growth out of public markets. As tokenized securities gain traction, the platform positions itself at the intersection of access, compliance, and early-stage opportunity. It does so without promising any specific outcomes. The focus remains on informed participation in a market that’s transforming, not proven returns.

Smarter Picks with AI Tools

Here’s a cool edge: AI in crypto investing powers ongoing scans of startup traction, founder histories, and market vibes to surface strong contenders and spot pitfalls early. It’s like having a sharp-eyed buddy sifting through the noise, making your choices more grounded amid the flood of crypto token launches.

Easier Exits and Spread-Out Bets

Liquidity’s often a pain in private deals, but IPO Genie changes that with tradable tokens and bundled funds. You can swap positions on secondary markets or grab a single token for a mix of promising ventures across sectors.

Single-token exposure to multiple startups reduces concentration risk.

Automatic rebalancing keeps allocations aligned with performance and governance decisions.

Tradable across multiple chains, providing flexibility to investors who value liquidity.

This borrows from classic finance wisdom but applies it to tokenized setups, giving you options without the wait.

Why IPO Genie Could Pull Ahead in Crypto Presales 2026

When stacking IPO Genie against other 2026 blockchain presale standouts like Bitcoin Hyper or Nexchain, its focus on private equity tokenization gives it a unique hook. Bitcoin Hyper excels at scaling Bitcoin for faster trades, but it leans more on speculation than tangible assets. Nexchain pushes AI infrastructure yet lacks the direct tie to real-world yields like staking from deal fees. In a crypto project comparison, IPO Genie’s blend of compliance, governance, and access to vetted pre-IPO plays positions it as a frontrunner for investors seeking substance over flash, potentially leading the pack in utility-driven growth.

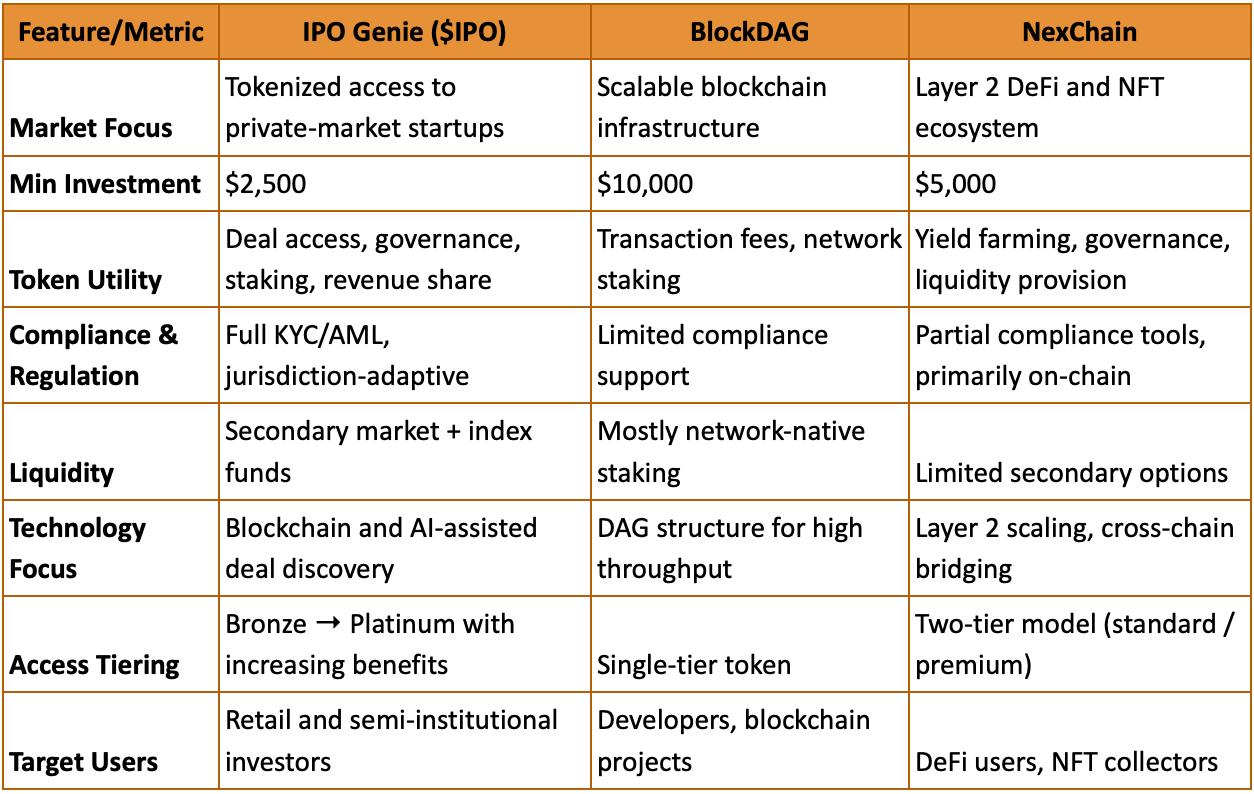

Comparing Leading 2026 Crypto Presales: IPO Genie, BlockDAG, and NexChain

In 2026, investors are facing a choice between multiple projects, each promising unique features and value propositions. A closer look at IPO Genie, BlockDAG, and NexChain reveals meaningful differences in access, token utility, and technological approach.

Key Comparison TableHigh

Observations and Insights

When considering real-world usage, an investor seeking institutional-grade, early-stage deal access might find IPO Genie better suited to their goals. Those focused on infrastructure or DeFi mechanics may look more closely at BlockDAG or NexChain.

Weighing the Downsides Honestly,

No sugarcoating: early ventures carry volatility, and even with audits, tech glitches or rule shifts could arise. Secondary trading isn’t always instant, and outcomes hinge on market moods. In any investor risk assessment, treat this like high-stakes poker, only wager what you can lose, and cross-check everything yourself.

Wrapping It Up

Stepping back, IPO Genie stands out in the crypto presales of 2026 for slashing hurdles to premium deals, layering on $IPO token perks like yields and votes, and prioritizing safe, smart infrastructure. It’s a thoughtful evolution in how we approach early-stage crypto opportunities, merging old-school diligence with fresh tech.

FAQs on IPO Genie and Crypto Presale Investment

What makes IPO Genie one of the leading crypto presales right now?

It goes beyond hype by offering real entry to private markets, with a tokenomics breakdown showing clear utility and rewards tied to platform success.

How does the $IPO token work in practice?

You use it for tiered perks, from basic deal entry to advanced protections, all while staking earns from fees, unlike purely speculative tokens.

Is this safer than other early-stage crypto opportunities?

It emphasizes compliance and audits, but like any presale, do your homework; there are no promises in this space.