Ethereum price prediction for 2026 reaches $7,500+ as Tom Lee leads with $88M ETH buy. Could Zero Knowledge Proof's $100M ready-built network offer a 100x alternative?

Ethereum (ETH) is heading into 2026 with growing interest from major financial players. Tom Lee’s Fundstrat has recently made headlines by adding $88 million worth of ETH at $3,200, raising its total holdings to more than 4.17 million ETH, around 3.45% of the total circulating supply. Lee believes ETH is severely undervalued at current levels, predicting prices of $7,000 to $9,000 in the short term and as much as $60,000 over the longer run.

But while Ethereum builds toward a potential 2-3x increase over the coming years, another contender is gaining attention. A new privacy-first blockchain known as Zero Knowledge Proof (ZKP) has entered the market with $100 million of development already completed before any tokens were sold. Analysts suggest ZKP could achieve 100x gains in the same timeframe Ethereum reaches its projected targets. Here’s a closer look at the ETH forecast for 2026 and why ZKP might offer a powerful alternative.

Why Tom Lee Expects Ethereum to Surpass $7,500

Tom Lee presents a long-term growth story for Ethereum, focusing on institutional utility rather than short-term speculation. His company Bitmine is not only holding ETH but also staking more than 1.25 million coins, generating estimated annual returns between $93 million and $100 million.

Several major developments support Lee’s ethereum price prediction:

Stablecoin Settlement Expansion: If stablecoins grow from the current $200 billion level toward the $2 trillion goal proposed by regulators, Ethereum is likely to benefit from increased transaction fees linked to USDT and USDC usage.

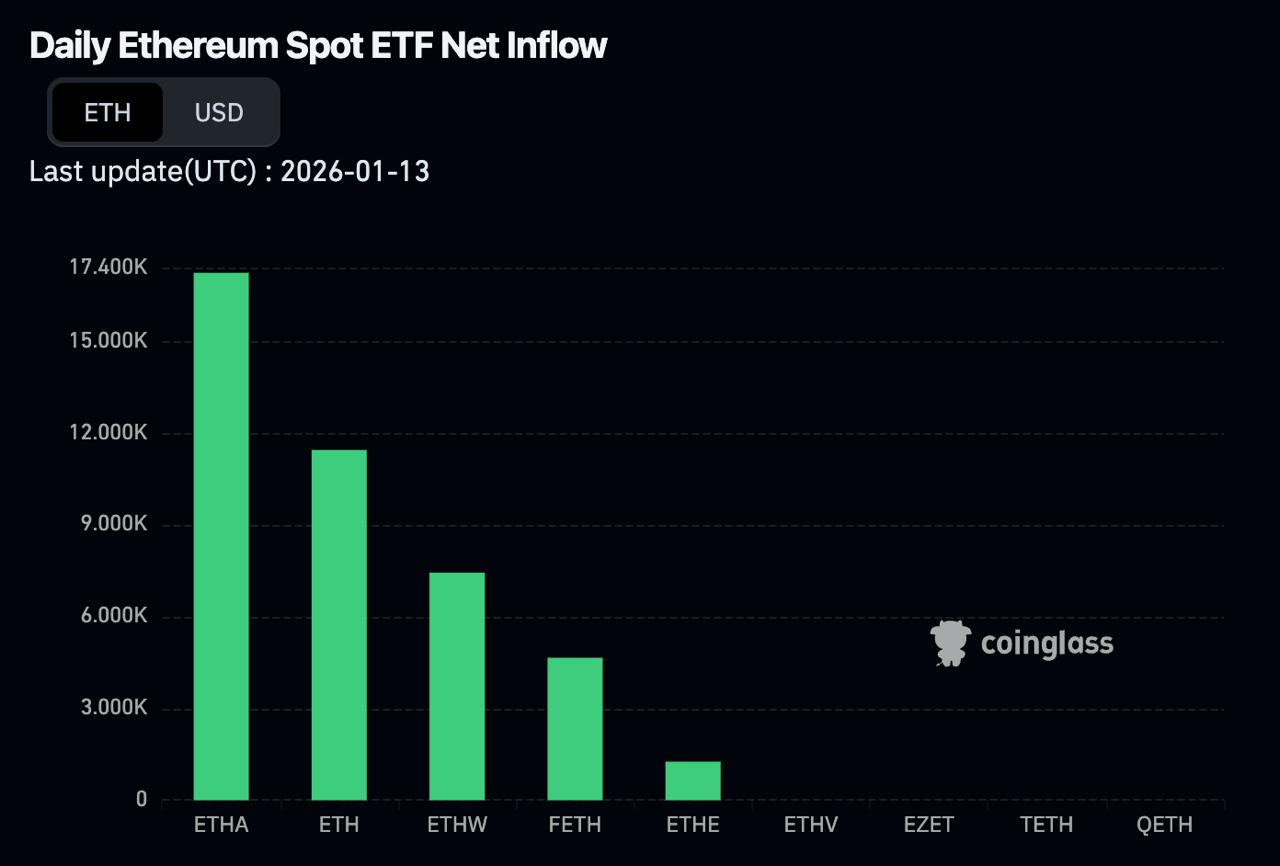

Strong ETF Demand: BlackRock’s iShares Ethereum Trust (ETHA) now holds $11.1 billion in assets, trading roughly $190 million daily. Consistent inflows above $300 million per month could continue to push demand.

Layer-2 Solutions Adding Value: Technologies like Arbitrum and Optimism are helping scale Ethereum without reducing activity on the mainnet, supporting network fees and demand.

Tokenized Real-World Assets (RWAs): Ethereum’s infrastructure is well-positioned for the tokenization of traditional assets like stocks, bonds, and treasury products, strengthening its case as a base layer for digital finance.

Geoff Kendrick from Standard Chartered estimates Ethereum could reach $7,500 by 2026, $30,000 by 2029, and potentially $40,000 by 2030. Tom Lee offers an even more aggressive take, predicting $60,000 in the medium term, and up to $250,000 in ideal conditions, a 78x jump from current levels.

Ethereum Price Prediction: $4,500 to $7,500 Most Likely in 2026

A more realistic forecast for 2026 lies somewhere in the middle:

Base Case ($4,000–$5,000):

ETF flows remain steady

Stablecoin growth continues

Layer-2 networks expand smoothly

DeFi total value locked (TVL) stays above $50 billion

Expected Upside: 25–56% from $3,200

Optimistic Case ($7,000–$9,000):

ETF inflows maintain $300M+ monthly

Large-scale adoption of tokenized RWAs

Stablecoins grow to $400 billion+

Regulatory clarity improves

Expected Upside: 118–181% from $3,200

Most probable price range for 2026: $4,500 to $7,500, reflecting gradual institutional growth without extreme price spikes.

Can Zero Knowledge Proof (ZKP) Deliver 100x While Ethereum Climbs?

Ethereum may offer steady gains, but ZKP is aiming for a very different outcome. It targets a specific problem Ethereum can’t address: enabling private, large-scale computation without making user data public.

What sets ZKP apart:

$100M Infrastructure Completed Pre-Sale: Instead of raising funds to build, ZKP invested $100 million of its own capital to develop the core technology first. That includes a working testnet, shipping hardware, and partnerships before any tokens were sold.

Solves AI Privacy Limitations: Sectors like healthcare and finance need AI tools but can’t share sensitive data on public blockchains. ZKP enables AI models to run on encrypted data using zk-SNARK and zk-STARK cryptography, technology Vitalik Buterin has said is more important than anything else in the blockchain space.

Working Partnerships Before Token Sale: The Miami Dolphins are already using ZKP to analyze player performance while protecting biometric data, showing real-world functionality in a high-pressure environment.

Path to 100x Returns: Experts believe ZKP’s token price could rise from its current auction range of $0.05–$0.10 to $5–$10, if it captures just 5% of the $100 billion AI privacy market over 3–5 years.

ZKP Also Offers Features ETH Doesn’t

ZKP’s structure adds multiple layers of value:

Auction Advantage: Early participants lock in lower prices, with each 24-hour auction window closing permanently at the end of the day.

Proof Pods: $249 plug-and-play devices that earn ZKP coins through validated AI computation processes.

Referral Rewards: A 20% bonus for referring others and a 10% bonus for the new participant.

ETH to $5,000 vs ZKP to 100x: What’s the Better Opportunity?

Ethereum’s journey to $5,000 by 2026 is backed by growing institutional support and real-world use cases. The higher $7,500+ target is still on the table if regulatory and technological conditions align. Tom Lee’s boldest predictions extend beyond 2030 and require nearly perfect execution.

On the other hand, ZKP represents a different kind of opportunity. With a fully operational product, live users, and a token priced far below its potential market valuation, the project could see 50-100x returns in the time it takes ETH to double.

Both paths are open:

Ethereum: Accessible on major crypto exchanges and through ETF platforms.

ZKP: Available via a live presale auction distributing 200 million tokens daily, where each round locks in final pricing.

Rather than choosing between them, some are choosing how to split their allocation.