Jakarta, Pintu News – The StakeStone protocol has emerged as the latest innovation in the DeFi ecosystem, offering an efficient solution for staking various crypto assets such as Bitcoin and Ethereum.

With a focus on improving capital efficiency and inter-chain liquidity, StakeStone introduces the $STO token which plays an important role in yield governance and distribution.

Check out more information about StakeStone in this article!

StakeStone Vision and Mission

StakeStone aims to revolutionize liquidity distribution in the DeFi ecosystem with efficiency and sustainability in mind. The protocol is designed to utilize untapped liquid assets to facilitate efficient and seamless capital movement across multiple ecosystems.

The $STO token (StakeStone Token) is key in this omnichain liquidity infrastructure, empowering an effective governance framework. This protocol not only improves the staking process, but also expands the options for users to optimize their assets.

With various staking options, such as STONE and SBTC, StakeStone offers unprecedented flexibility in the DeFi ecosystem.

Advantages of Using StakeStone

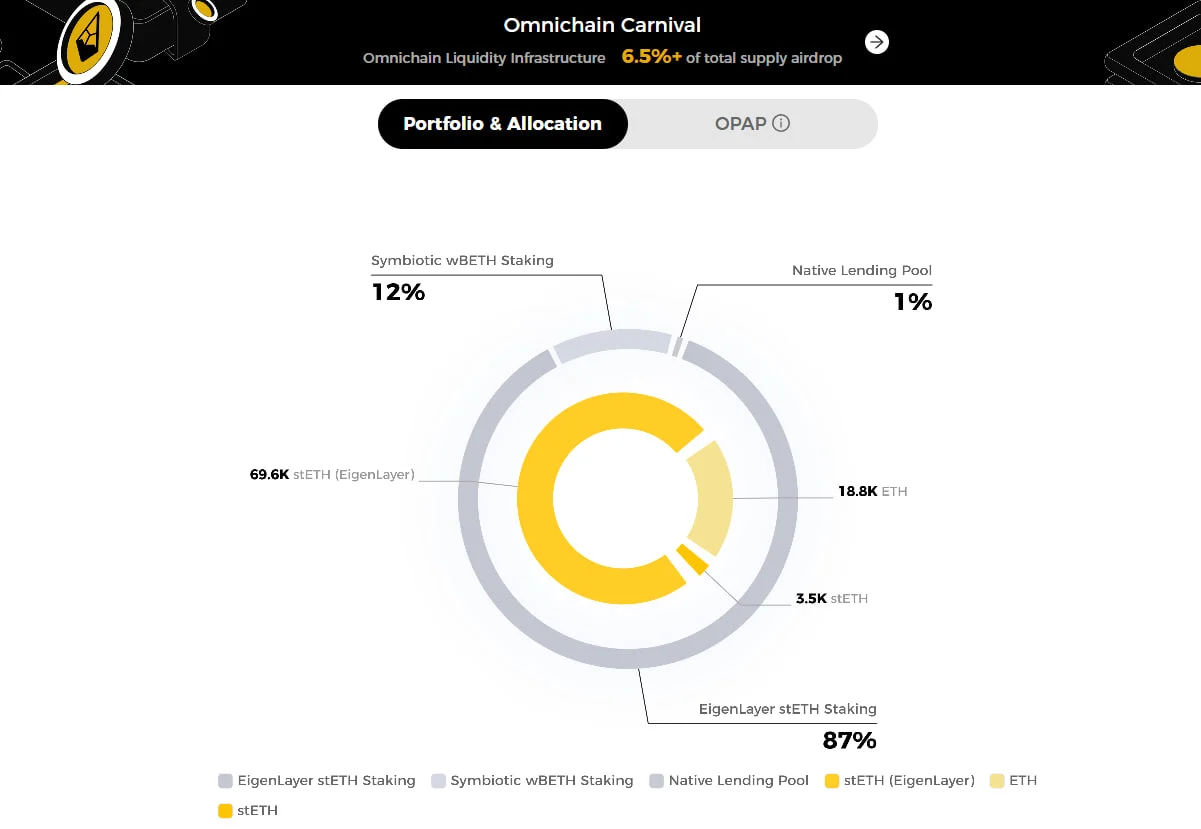

One of the main advantages of using StakeStone is its ability to provide a yielding yet liquid form of ETH and BTC, known as STONE tokens. These tokens allow users to earn a return on investment while maintaining the liquidity of their assets, thus improving capital efficiency.

Users can utilize their assets in various activities without losing the opportunity to earn attractive yields. In addition, StakeStone offers advanced security and stability features, ensuring that users’ assets are protected.

With STONE pools and smart yield optimization strategies, users can efficiently manage cross-chain liquidity, maximizing their earning potential across multiple blockchains.

Read also: 5 Ways to Buy Antam Gold So You Don’t Have to Queue, Practical!

Key Features and Tokenomics StakeStone

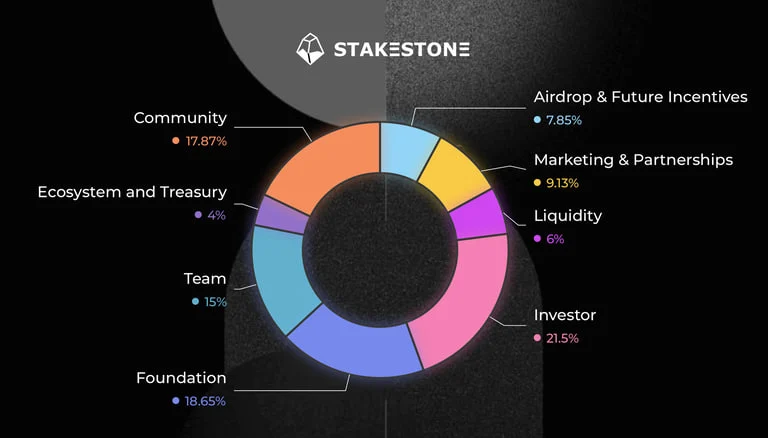

The $STO token serves not only as a utility tool but also as a governance token that supports key functions such as protocol management, yield enhancement, and access to bribe rewards through a locked STO (veSTO).

This ensures that all stakeholders, including users, partners, and builders, have aligned long-term incentives to contribute to the success and sustainability of the protocol.

With features such as cross-chain liquidity management and STONE pools, StakeStone offers an advanced method for yield generation. The protocol is constantly evolving, with plans in the first quarter of 2025 to introduce LiquidityPad, an innovative program that promises to transform omnichain liquidity for the future.

That’s the latest information about crypto. Follow us on Google News to stay up-to-date on the world of crypto and blockchain technology.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, experience web trading with advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro. Pintu Pro Futures is also available, where you can buy bitcoin leverage, trade btc futures, eth futures and sol futures easily from your desktop!