If you are new to the world of crypto, you may often ask whether a token is worth buying today or holding for the future. That is why many investors search for an Api3 price prediction before making any decision. Api3 is not just another coin on the market. It is a project that wants to solve one of the biggest problems in blockchain: how to bring real-world data onto smart contracts in a safe and transparent way.

At the moment, API3 crypto trades around $1.2. During August 2025, the token moved strongly between extremes. On August 3, it touched a low of $0.65, while by August 19, it reached a monthly high of $1.83. This means its value almost tripled within just a few weeks. Such volatility makes Api3 both exciting and risky, but it also shows there is growing interest in the project.

In the following sections, we will explain what Api3 is, how it works, and what experts believe about its future price.

| Current API3 Price | API3 Price Prediction 2025 | API3 Price Prediction 2030 |

| $1.2 | $4 | $14 |

Api3 Overview

Api3 is a blockchain project that focuses on a simple but powerful idea: smart contracts need reliable data from the real world. Without this data, applications built on blockchain are limited in what they can do. Api3 provides a solution by creating decentralized APIs, also called dAPIs, that feed information directly to smart contracts in a secure and transparent way.

Traditional oracles often rely on middlemen who collect and deliver the data. This creates risks of manipulation, errors, or downtime. Api3 tries to remove these problems by allowing data providers themselves to run the oracles. In practice, this means that businesses, platforms, or institutions can connect their own APIs directly to blockchains without outside help. As a result, users get data that is more reliable, cheaper, and easier to verify.

The project was launched in 2020 by a group of developers and researchers who wanted to improve the oracle model introduced by earlier projects like Chainlink. Its founders include Heikki Vänttinen and Burak Benligiray, both of whom have backgrounds in blockchain development and distributed systems. Their goal was clear: create a system that brings transparency and trust to data feeds used in DeFi, insurance, supply chains, and many other industries.

The API3 token plays a central role in the ecosystem. It is used for governance, meaning holders can vote on proposals and influence how the network grows. The token also supports staking. By locking tokens in the system, users can earn rewards while also backing the security of dAPIs. This design combines utility and incentives, giving the token both technical and financial importance.

Api3 has gained attention because it offers real-world use cases. For example, DeFi platforms can use it to pull accurate price data for assets. Insurance projects can connect to weather APIs to verify rainfall or temperature data. Logistics companies can use it to track shipments in real time. All of these functions are made possible by dAPIs that cut out unnecessary layers.

API3 Price Statistics

| Current Price | $1.2 |

| Market Cap | $103,759,506 |

| Volume (24h) | $48,787,843 |

| Market Rank | #351 |

| Circulating Supply | 86,421,978 API3 |

| Total Supply | 150,984,695 API3 |

| 1 Month High / Low | $1.83 / $0.65 |

| All-Time High | $10.31 Apr 7, 2021 |

In short, Api3 is not a meme coin or a speculative trend. It is a serious infrastructure project that tries to fix one of the biggest challenges in blockchain technology. This is why many investors are watching its progress closely and asking how the price of API3 could move in the coming years.

Api3 Features

Api3 brings several unique features that make it stand out in the crowded crypto market. Its main strength lies in its approach to data delivery. Instead of relying on third-party middlemen, Api3 enables API providers to run their own oracles. This makes the process simpler, more secure, and cheaper.

One of the key features is the concept of dAPIs (decentralized APIs). These are blockchain-based data feeds that deliver real-world information directly to smart contracts. Unlike traditional oracles, dAPIs are fully transparent and can be monitored by anyone. This transparency helps build trust and reduces the risk of manipulation.

Another feature is DAO governance. Api3 is managed by a decentralized autonomous organization. Token holders can vote on key decisions, such as funding for new dAPIs or changes to the protocol. This democratic structure ensures that the project evolves according to the interests of its community.

The API3 token utility is also important. It serves three main purposes:

Governance: Token holders can propose and vote on improvements.

Staking: Users can stake tokens to secure the network and earn rewards.

Insurance coverage: Staking also funds an insurance pool that protects dAPI users from potential data errors.

From a technical perspective, Api3 focuses on scalability and compatibility. It supports multiple blockchains, which means developers on Ethereum, Polygon, or other networks can use dAPIs without friction. This cross-chain capability increases adoption potential.

API3 Price Chart

CoinGecko, August 27, 2025

Api3 Price History Highlights

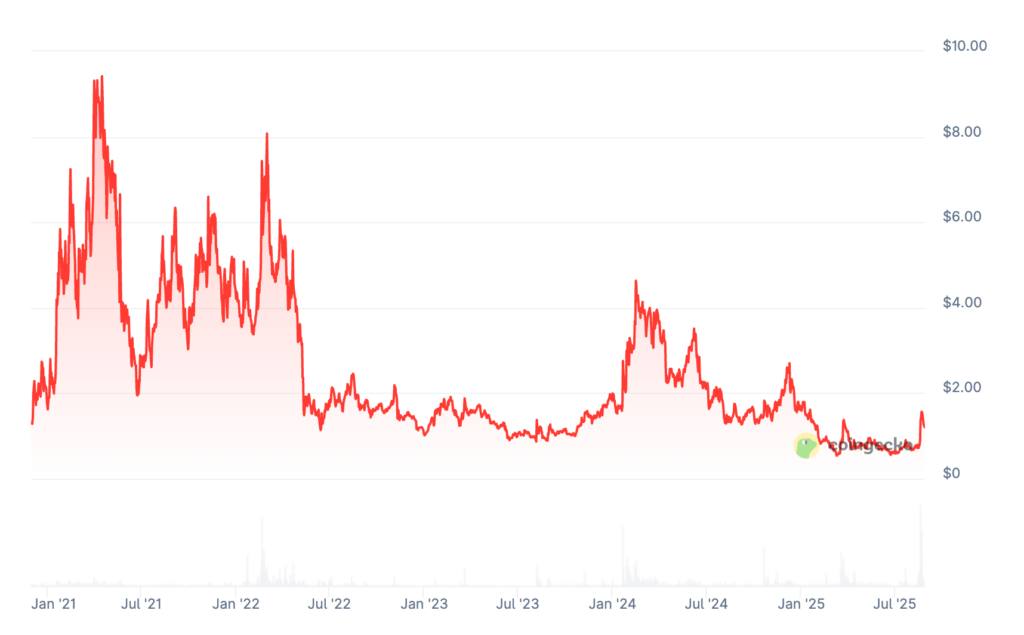

Understanding the price history of Api3 is essential before looking at any long-term prediction. The token has already experienced sharp rallies, deep corrections, and periods of recovery, which show both its potential and its risks.

2020: Market Debut

Api3 launched on December 1, 2020, with an opening price of $1.25. For most of its first month, the token traded close to this level. By the end of December, it spiked to $2.7, delivering a strong 30% gain in two weeks. Api3 closed the year at $1.58, up 26.4% from launch.

2021: Spectacular Growth

The year 2021 was the highlight in Api3’s history. The token entered January at $1.58 and followed the global bull market. On April 6, 2021, it reached an all-time high of $10.3. The average price across the year was $4.81, and it ended 2021 at $4.21, a 166.5% annual increase. The lowest price that year was $1.57, showing just how far it climbed in only a few months.

2022: Severe Bear Market

The global crypto downturn in 2022 hit Api3 hard. Starting the year at $4.21, the token still managed a rally to $9.39 in February, but this was followed by a long decline. By the end of 2022, Api3 had collapsed to $1.02, a 75.8% yearly loss.

2023: Signs of Recovery

In 2023, Api3 began rebuilding. It started the year at $1.02 and slowly recovered to a high of $2.26. The lowest point was $0.8471, but it managed to close the year at $2. On average, it traded at $1.33, posting a 96.1% annual gain compared to 2022.

2024: Launch of OEV Network

A major technical step came in July 2024 with the release of the OEV Network, designed to help DeFi projects capture value lost to MEV. This boosted adoption, with Total Value Secured (TVS) growing from $20M to $600M. Price action, however, was mixed. Api3 started 2024 at $2, peaked at $4.9 in May, then fell to $1.59 by year’s end, a 20.5% decline.

2025: High Volatility and New Listings

So far, 2025 has been turbulent. Api3 began at $1.8 but fell to a historic low of $0.496 in March. In August, a listing on Upbit doubled the price to $1.8, though corrections quickly followed. During the same month, the token recorded a 100% weekly surge, proving just how volatile it remains.

Currently, in late August 2025, Api3 trades around $1.2–$1.3. It sits 90% below its all-time high, yet 150% above its March low.

API3 Price Prediction: 2025, 2026, 2030–2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2025 | $1.08 | $7.19 | $4 | +230% |

| 2026 | $1.98 | $9.4 | $5.5 | +360% |

| 2030 | $5.73 | $22.3 | $14 | +1,070% |

| 2040 | $42.6 | $987 | $500 | +41,500% |

| 2050 | $76.9 | $1,248 | $650 | +54,0000% |

API3 Price Prediction 2025

DigitalCoinPrice forecasts that API3 could trade between $1.08 (-10%) at the lowest and $2.65 (+120%) at the peak in 2025. Their average estimate sits at $2.47 (+105%), suggesting solid growth potential.

PricePrediction.net gives a more conservative outlook, predicting a range from $1.36 (+13%) to $1.55 (+30%), with an average of $1.42 (+18%) for the year.

Telegaon, however, is much more bullish, expecting API3 to trade between $5.13 (+325%) and $7.19 (+500%) in 2025, with an average price of $6.28 (+420%).

API3 Price Prediction 2026

For 2026, DigitalCoinPrice projects a minimum of $2.59 (+115%) and a maximum of $3.12 (+160%), with an average of $3.01 (+150%).

PricePrediction.net estimates a more modest range, with a low of $1.98 (+65%) and a high of $2.4 (+100%), averaging around $2.05 (+70%).

Telegaon once again provides a more aggressive target, forecasting API3 between $7.24 (+500%) and $9.41 (+680%), with an average of $8.53 (+610%).

API3 Price Prediction 2030

By 2030, DigitalCoinPrice suggests that API3 could climb to a maximum of $6.62 (+455%), with a minimum of $5.73 (+375%) and an average around $6.48 (+440%).

PricePrediction.net is even more optimistic, expecting the token to range from $9.44 (+680%) to $11.30 (+840%), with an average of $9.77 (+710%).

Telegaon takes the most bullish stance, projecting API3 between $18.35 (+1,430%) and $22.34 (+1,750%), with an average of $20.12 (+1,570%).

API3 Price Prediction 2040

Looking further ahead, PricePrediction.net envisions exponential growth, with a possible range from $813.81 (+67,250%) to $987.89 (+81,600%), and an average of $884.79 (+73,100%).

Telegaon’s long-term forecast is lower but still very bullish, estimating API3 between $42.56 (+3,500%) and $49.89 (+4,100%), with an average of $46.74 (+3,800%).

API3 Price Prediction 2050

By 2050, PricePrediction.net anticipates staggering gains, forecasting API3 between $1,053 (+88,000%) and $1,248 (+104,000%), with an average of $1,125 (+93,500%).

Telegaon expects more moderate long-term growth, placing API3 between $76.91 (+6,300%) and $85.78 (+7,050%), with an average of $81.12 (+6,650%).

Api3 (API3) Price Prediction: What Do Experts Say?

Expert opinions on Api3’s future price remain divided, but most agree that the project holds potential. In an August 23, 2025 update from PricePredictions.com, an analyst highlighted a short-term bullish reversal after a recent bearish phase. He forecasts that Api3 could reach $1.3 by September 3, 2025, which represents a gain of around 7.4% from the current $1.2 level.

The analyst pointed to $1.2 as a crucial support zone and $1.35 as a key resistance level. According to him, a confirmed breakout above $1.25 would open the door for additional upside in the near term. He did caution, however, that volatility remains high, so traders should expect rapid price swings even within this bullish setup.

A broader outlook came the same day from BTCC Academy, which focused on 2025–2026 projections. Their research suggested that Api3 could maintain an average price of $1.25 by the end of 2025, supported by the token’s unique first-party oracle model and increasing adoption in the DeFi sector. For 2026, they set a target of $1.8, citing expected partnerships, more integrations with decentralized applications, and stronger competition against Chainlink.

The BTCC analyst also noted that demand for transparent on-chain data continues to rise, which benefits Api3’s positioning. Furthermore, regulatory clarity and upcoming protocol upgrades could help accelerate growth beyond her base projections.

API3 USDT Price Technical Analysis

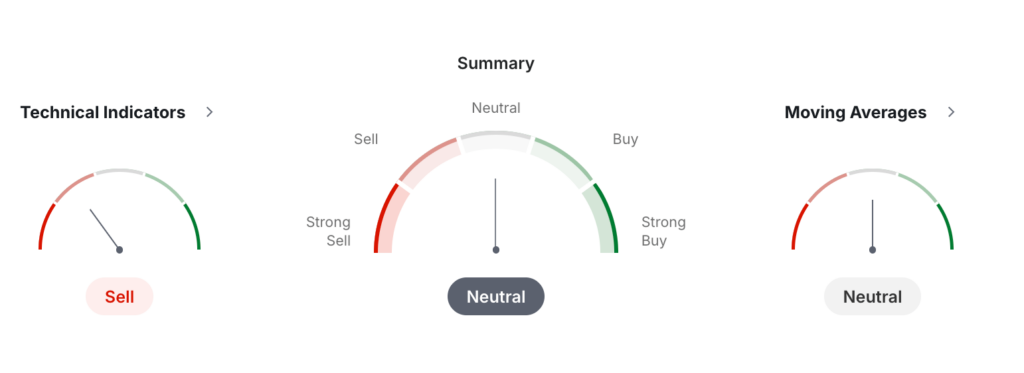

The latest technical analysis for API3/USDT on Investing.com paints a mixed picture of the token’s short-term and medium-term momentum. The overall summary rating is “Neutral”, reflecting balanced signals across moving averages and oscillators.

Investing, August 27, 2025

Looking at technical indicators, the tone leans bearish. Out of the key momentum metrics, five are giving “Sell” signals, one indicates “Buy,” and three remain neutral. For example, the Relative Strength Index (RSI 14) stands at 41.68, which suggests weak momentum and leans toward a selling bias. Similarly, the MACD (12,26) shows a negative reading of –0.23, another bearish sign. The Williams %R at –67.93 also points to a selling trend, while the Ultimate Oscillator at 39.2 confirms downside pressure. The only positive indicator is the Bull/Bear Power (13) at 0.09, which leans bullish but is weak compared to other signals.

Short-term volatility appears limited. The Average True Range (ATR 14) is at 0.75, which indicates less volatility compared to earlier months of 2025 when Api3 saw dramatic swings. Meanwhile, the Stochastic (9,6) reading of 15.79 shows the token is oversold, while the Stochastic RSI (14) is overbought at 85. This contradiction highlights the unstable balance between buyers and sellers.

Turning to moving averages, the summary again reflects neutral sentiment, with six “Buy” signals and six “Sell” signals. The short-term picture is slightly more optimistic: MA5 and MA10 are in buy territory, suggesting near-term recovery potential. However, the longer-term outlook is weaker. MA20, MA50, MA100, and MA200 mostly flash “Sell”, indicating bearish dominance on broader time frames.

Support and resistance levels calculated from pivot points give additional context. The classic pivot point sits at $0.767, with support levels down at $0.499 and $0.311. On the upside, resistance levels are found near $0.955, $1.22, and $1.41. These levels align closely with recent market behavior, where Api3 has struggled to hold gains above $1.25.

Overall, the technical analysis suggests that Api3 remains in a consolidation phase after months of volatility. While short-term indicators show oversold conditions that could trigger a rebound, the dominance of bearish signals in longer-term averages means traders should remain cautious. For now, Api3 appears to be searching for a stable base above $1.2 before any stronger bullish momentum can develop.

What Does the Api3 Price Depend On?

The price of Api3, like any cryptocurrency, is shaped by a mix of factors. Some come from within the project, while others depend on the wider crypto market. Understanding these drivers helps investors see why the token moves so sharply at times.

One of the main influences is market sentiment. When traders feel optimistic about crypto, tokens like Api3 often rise faster than the average. In bearish phases, however, Api3 tends to lose value quickly, as seen in 2022.

Another important factor is technology adoption. Api3’s first-party oracle model and its dAPI feeds become more valuable as more DeFi applications integrate them. Each new partnership or integration can attract fresh demand for the token.

Regulation also plays a role. Clearer crypto regulations can boost investor confidence and attract institutional players. On the other hand, restrictive rules can limit growth.

Supply and demand dynamics are crucial too. Api3 has a capped supply of 114 million tokens, which creates scarcity if demand increases. This supply model can support long-term value appreciation.

Here are some of the most important drivers:

DeFi growth: More decentralized applications create higher demand for reliable data feeds.

Partnerships and integrations: New collaborations often push prices higher.

Investor sentiment: News cycles and broader market trends strongly affect short-term moves.

Technological upgrades: Improvements such as the OEV Network can attract fresh interest.

Regulation: Supportive policies may accelerate adoption, while restrictions could slow it.

In short, the price of Api3 depends on both technical progress and external conditions. While the project’s fundamentals are strong, it remains sensitive to overall crypto volatility, making it a high-risk but high-reward asset for investors.