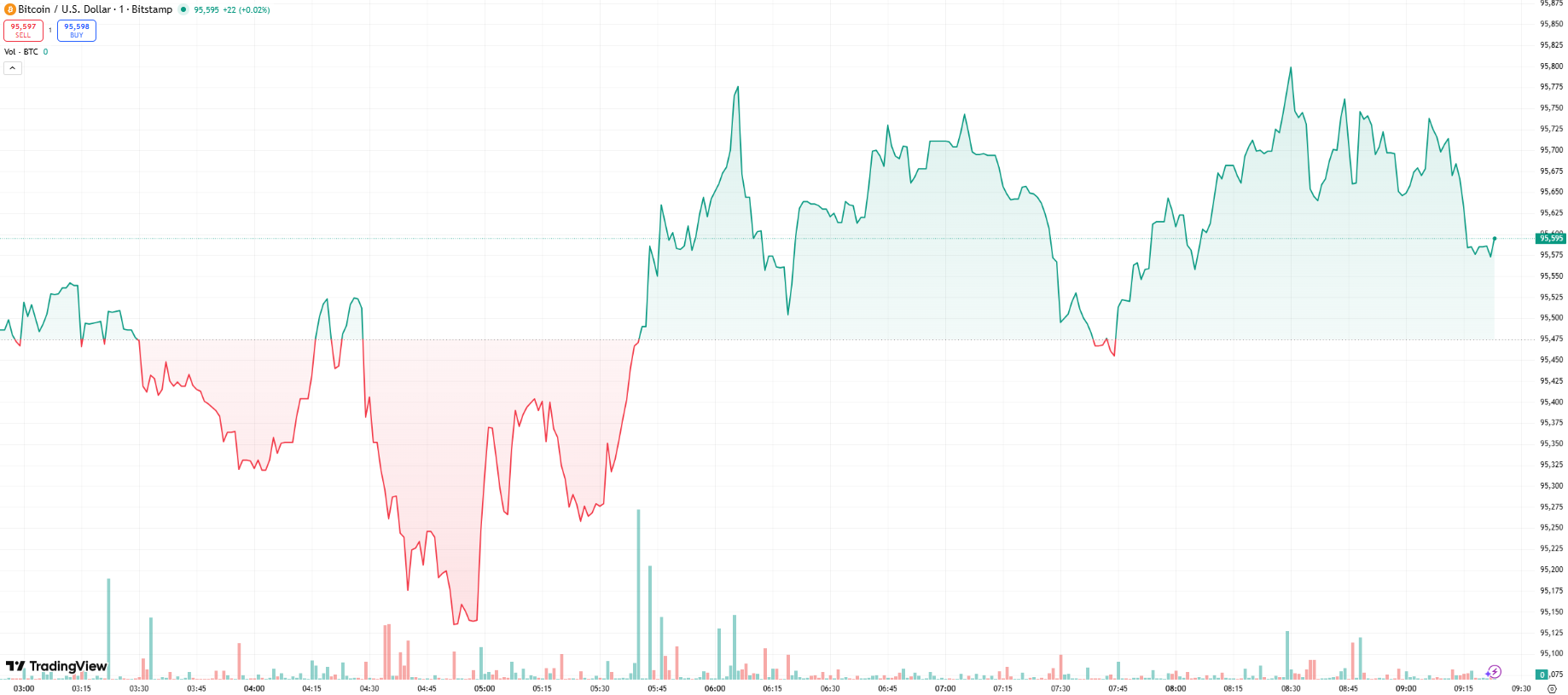

The Bitcoin price forecast for 2026 remains clouded by mixed signals as BTC stabilizes near $95,700. While ETF inflows have accelerated since the start of the year, retail traders are still largely sitting out. Bitcoin’s price prediction dropped 0.91% in 24 hours after testing $97,900, revealing fragility despite aggressive accumulation from institutional players.

Derivatives data shows low funding rates, and Google search trends indicate that retail interest has not yet recovered. As market watchers eye potential Fed rate moves in Q2 and geopolitical risks continue to mount, the short-term outlook remains uncertain, even as mid-year targets exceed $150,000.

Retail Traders Remain on Sidelines Despite Rebound

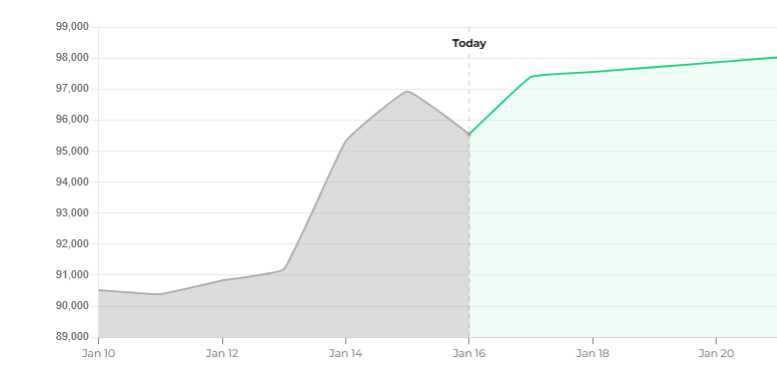

Bitcoin has rebounded more than 35% from its November 2025 bottom at $80,000, but retail investors have yet to re-engage in meaningful numbers. Funding rate data from Laevitas.ch shows BTC perpetuals funding at just 4%, well below the typical 8%–12% range that signals strong long exposure.

This indicates low demand for leveraged long positions from smaller market participants. Despite a strong short squeeze that liquidated $465 million in BTC short futures, retail sentiment hasn’t followed through.

Market analysts note that this disconnect could limit momentum in the absence of fresh capital inflows from non-institutional buyers.

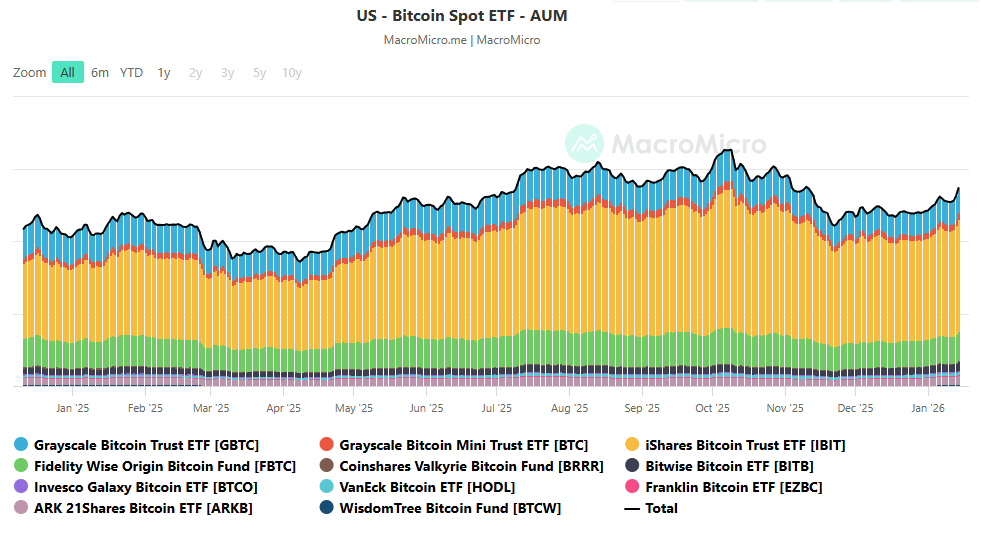

Spot ETF Inflows Signal Structural Demand

Since January 1, U.S.-listed spot Bitcoin ETFs have absorbed over $1.5 billion in net inflows, according to Bloomberg’s Eric Balchunas. On a single trading day, $843.6 million flowed into spot Bitcoin ETFs, pushing the weekly average to $1.07 billion.

Analysts say this sustained demand marks a structural change in how capital enters the crypto market. Firms like MicroStrategy and other corporate buyers continue to expand their BTC reserves.

Analysts expect this trend to grow through 2026, especially with ETF assets now topping $120 billion. Still, institutional flows alone may not be enough to break the $100,000 barrier unless retail demand returns.

Search Interest and Silver Rally Divert Retail Attention

Worldwide Google search interest for “Bitcoin” stands at 27, only slightly above the 12-month average of 22. Retail traders have historically followed short-term momentum, but attention appears diverted toward silver, which has gained 28% in two weeks.

Bitcoin’s pullback from $97,900 to $95,500 may have further weakened short-term sentiment. Analysts also point to Bitcoin’s 25% gap below its all-time high of $126,219 as a psychological hurdle.

While institutions are positioning for long-term growth in the best long-term cryptos, retail activity is tightly correlated with breakout headlines that have yet to materialize in early 2026. Until that changes, BTC may struggle to attract the volume needed for a rally extension.

Macro and Political Uncertainty Weigh on Sentiment

Macroeconomic and political risks are contributing to the hesitation. The U.S. Justice Department’s investigation into potential interference with the Federal Reserve has raised concerns about the independence of monetary policy.

Traders are watching closely as Fed Chair Jerome Powell’s term ends in April, with expectations of policy shifts or rate cuts soon after. Meanwhile, heightened tension with Iran and renewed unrest in oil-producing regions are adding volatility to global markets.

Oil prices and energy risk premiums have historically influenced Bitcoin’s performance, especially when viewed as a hedge. In this environment, investor caution is reflected in low volatility and tight spot trading ranges.

Forecasts Show Diverging Views From $65K to $250K

Forecasts for the Bitcoin price in 2026 span a wide range. Tom Lee of Fundstrat expects BTC to reach a new all-time high before the end of January, fueled by ETF flows.

Analysts at Bernstein and Standard Chartered maintain a target of $150,000 by year-end, while Yahoo Finance aggregates predictions near $170,000, contingent on macroeconomic easing and broader adoption. More aggressive models, including TradingView sentiment analysis, see upside targets as high as $250,000 under bullish liquidity conditions.

At the same time, bearish scenarios still project downside risk toward $65,000, especially if institutional buying slows or retail fails to return in Q1.