Discover the best crypto presales for Q1 2026! Explore early-stage tokens like IPO Genie that promise real utility and high upside potential.

Bitcoin’s pull above recent levels is not just “a good day on the chart”. It is a signal that risk appetite is waking up again, and it is happening alongside louder talk of clearer rules in the US market.

Because of that, attention is shifting back to early-stage tokens, especially presales that claim real utility, real demand, and a story people can repeat. Thus, IPO Genie ($IPO) does for every investor.

Now, the question many buyers keep asking is simple: if Q1 2026 becomes the window where new money rotates into early-stage picks,

Which crypto presale 2026 is set up to catch that wave first?

Key Takeaways

Presales often reward early entry because price and access are usually staged.

IPO Genie’s “no lock-ins, exit anytime” framing keeps coming up as a reason buyers are watching it.

The strongest presales going into 2026 are leaning into tokenized assets, cash-flow style incentives, and simple user paths, not vague promises.

Why Q1 2026 is a Pressure-Cooker For Presales

Buyers are getting tired of coins that only move when hype moves. In 2026, the appetite is shifting toward projects that can justify attention even when the market cools for a week.

At the same time, tokenization keeps getting framed as a major theme for this decade, with projections reaching into the trillions. That crypto investors push interest toward presales that connect crypto to real markets, real incentives, and clear user value.

Simply, when a presale ties itself to access, utility, and incentives, people can quickly understand that it fits what buyers say they want right now.

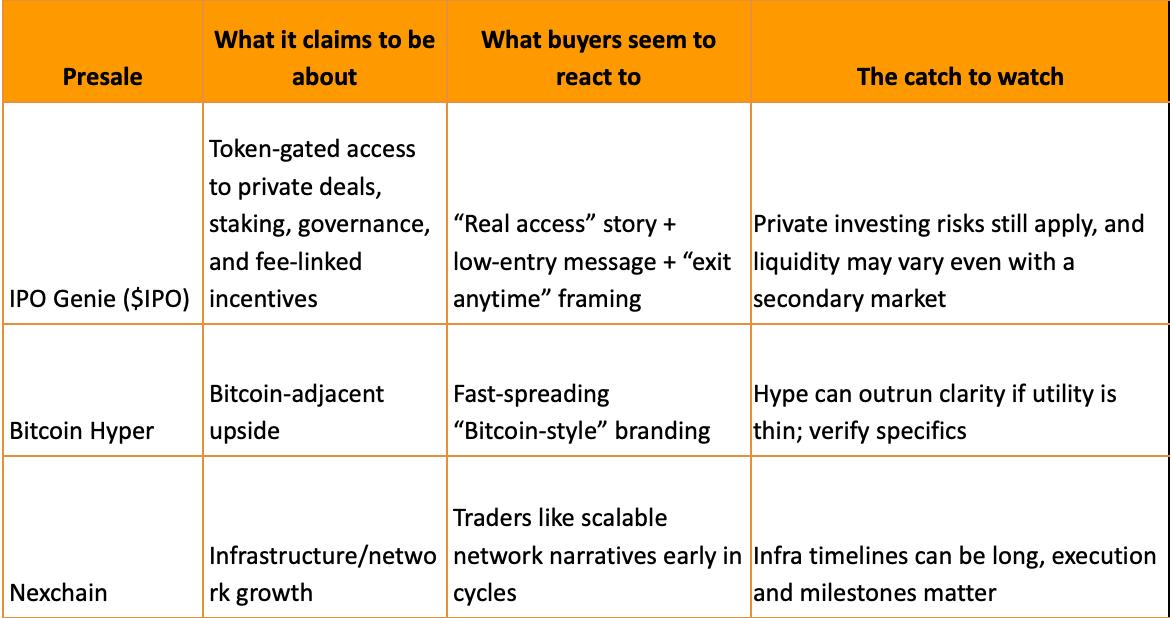

A popular comparison floating around crypto coverage puts IPO Genie, Bitcoin Hyper, and Nexchain in the same “Q1 2026 presale watchlist” conversation.

The most useful way to look at them is to separate marketing from structure.

Here’s the buyer-focused view: utility, exits, why attention is forming, and what to verify.

Why IPO Genie ranks higher in this mix (based on your angle): the value story isn’t only “price might go up”. In fact, it’s access + incentives + flexibility, which is exactly what presale buyers keep asking for in 2026.

What Makes IPO Genie the Breakout Crypto Presale 2026 Pick

Live Presale: ipogenie.ai

$IPO doesn’t need a long intro for a crypto audience. The core is simple and repeatable:

Hold $IPO → unlock access to institution-vetted private deals → stake/govern → exit without decade-long lockups.

That last part is doing a lot of work.

1) “Exit anytime” is the emotional hook

Traditional VC lockups are exactly what retail buyers hate. So, a project repeatedly framing itself as no lock-ins + secondary liquidity naturally attracts the crowd that rotates through presales looking for flexibility.

2) The low minimum message spreads fast

The whitepaper positions participation as starting from about $10, versus traditional private-market minimums that can be $250K+. Whether or not every buyer qualifies for every deal, the headline message is powerful: a more accessible starting line.

3) Incentives are understandable (not abstract)

The token ties into:

access tiers (Brone-Platinum)

staking rewards

governance

fee-linked incentives/revenue participation mechanics

Why People Are Piling in Early, & Why Waiting Can Cost Upside

In presales, timing isn’t a small detail; it’s often the whole strategy.

Staged pricing means later buyers often pay more for the same exposure.

Tiered access creates natural urgency: higher holdings unlock better allocations, earlier access, and in higher tiers, even some downside protection.

Q1 stories move quickly. Once something becomes the “next presale people repeat, and late entries usually arrive after the best pricing steps are gone.

If your goal is “best upside per dollar,” early positioning is often the advantage presale buyers chase.

The Momentum Triggers People Keep Repeating

When a presale starts trending, it’s rarely one thing. It’s usually stacked triggers:

Risk-on mood (Bitcoin strength tends to pull attention outward)

Regulatory optimism (even the perception of clarity can lift speculative appetite)

Tokenization narrative (capital rotates into projects tied to real markets)

Accessibility (low minimums turn readers into sharers)

$IPO sits right in the overlap of those triggers: tokenization + private-market access + incentives + liquidity framing.

Offers & Community Moments that Keep the Buzz Hot

Promos do not replace fundamentals, but they do change behavior, especially in early-stage opportunities.

IPO Genie has pushed multiple community hooks, including an

airdrop angle

and seasonal offers like a Black Friday deal,

plus a Christmas bonus framed as 25% extra on $IPO purchases.

Also, it tied visibility to a Dubai Misfits Boxing sponsorship, which matters because mainstream-adjacent events often widen reach beyond crypto-only circles.

As a result, these moments act like proof-of-motion. Early participants see activity, then they assume growth, and then they rush to avoid being late.

A Simple Checklist Before Anyone Buys

Even high-potential presales can go sideways. Basic checks matter:

Read the risk section and assume volatility, regulatory change, and startup failure risk are real.

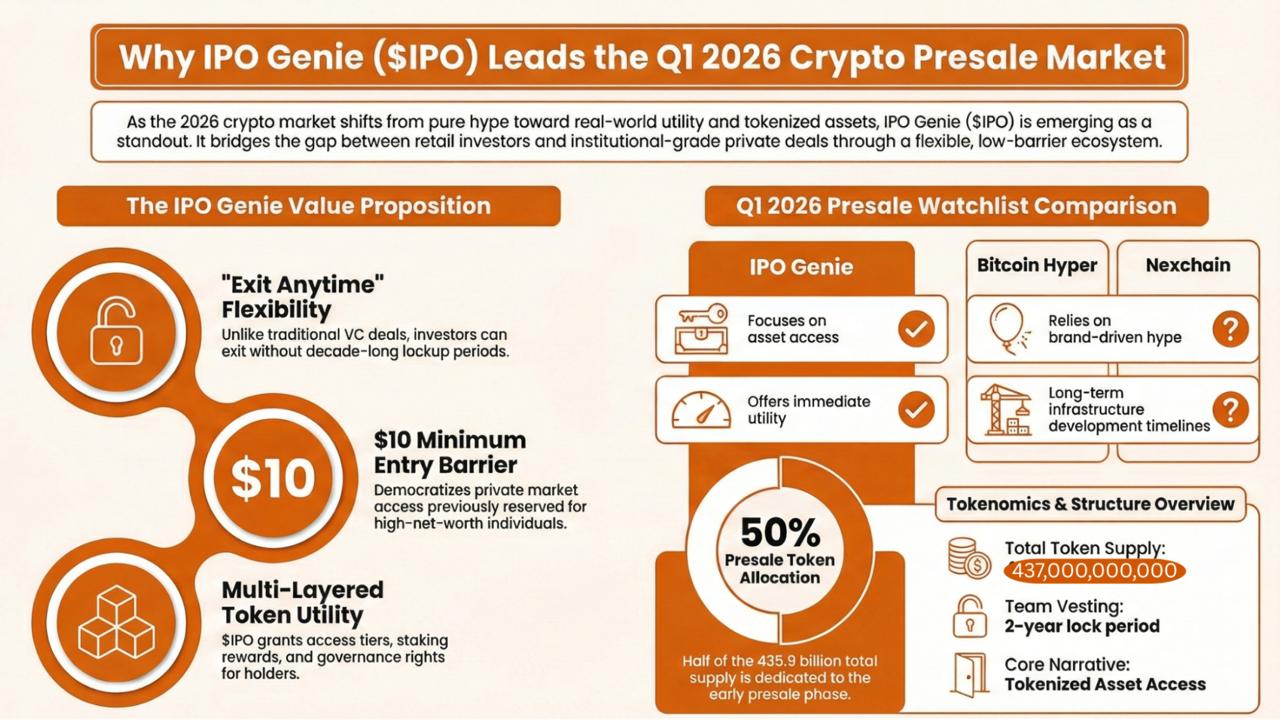

Verify tokenomics (supply, allocations, vesting). $IPO lists 437,000,000,000 total supply, 50% presale allocation, and team tokens locked for 2 years before vesting.

Validate the utility (is it real, needed, and actually tied to the token?).

Don’t over-allocate. Early-stage upside comes with uncertainty; never buy more than you can afford to lose.

Why IPO Genie Looks Built for the Q1 2026 Presale Cycle

If Q1 2026 becomes a true rotation window for early-stage picks. Then IPO Genie is being discussed for a reason: it ties attention to access, incentives, and flexibility, not just vibes.

If you’re looking at presales before the end of January 2026, staged pricing and tiered access are exactly why early entries typically get the best positioning.

That is why IPO Genie is being designed by many as the Best crypto presale to watch in Q1 January 2026.

If you are looking for the top crypto presale in January 2026, then you’ll consider the $IPO because analysts say it’s the most promising token in 2026.