The cryptocurrency market has kicked off Q3 with strong upside momentum, continuing the bullish trend from Q2, where Ethereum (ETH) jumped 36% and is currently trading around the $2,550 level — across lifting up major altcoins .

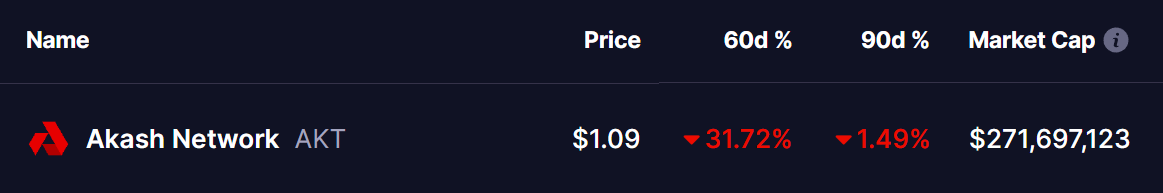

However, Akash Network (AKT), the DePIN token, is still lagging behind, having remained in a continuous downtrend over the past 90 days. But beyond the red candles, the current chart pattern — now mirroring a breakout structure recently seen in SEI — is hinting at a potential rebound.

Source: Coinmarketcap

Fractal Pattern: AKT Follows SEI’s Breakout Playbook

A side-by-side comparison of the daily charts for SEI and AKT reveals a near-perfect match in structure.

SEI previously traded inside a falling wedge, a well-known bullish reversal pattern. After weeks of downward consolidation, SEI broke out above the wedge, crossed the 100-day moving average, and quickly surged by over 76%, eventually clearing its 200-day MA and confirming a trend reversal.

SEI and AKT Fractal Chart/Coinsprobe (Source: Tradingview

Now, AKT appears to be following the same script.

It has just broken out of its falling wedge and is currently moving towards the resistance area near the 100-day moving average (~$1.29). If momentum builds and buying volume picks up, AKT could stage a similar explosive rally — putting it right where SEI was before it launched higher.

What’s Next for AKT?

If AKT manages to reclaim the 100-day MA, the next upside target is the 200-day moving average at around $1.78 — representing a potential 63% rally from current levels near $1.09.

However, it’s not a guaranteed move. If AKT fails to attract sufficient buying volume, it may struggle to confirm the breakout, leading to a longer consolidation phase below the 100-day MA.