Venture capitalists are kicking off 2026 with a bang.

They doled out $588 million to crypto startups in the first two weeks of January, according to DefiLlama data.

Top investors this month include Arthur Hayes’ Maelstrom Fund, Revolut’s Vlad Yatsenko, Citadel Securities, and a slew of VCs, including Lightspeed, Paradigm, and YZi Labs.

Their targets?

Payments, trading, and centralised exchanges across a variety of venture investment rounds, underscoring robust investor appetite for institutional-grade tools.

And as crypto increasingly converges with traditional finance, privacy plays a central role, analysts say.

Privacy is “a prerequisite for traditional institutions to migrate on-chain at scale,” Tim Sun, senior researcher at HashKey Group, told DL News.

“Interest in privacy is clearly rising, with a stronger focus on building privacy infrastructure capable of supporting institutional-grade financial use cases,” Sun said.

Key technical areas attracting investor interest include zero-knowledge proofs, fully homomorphic encryption, multi-party computation, compliant privacy computing, and privacy-preserving payments, Sun said.

Here are the top raises so far in 2026.

Rain, $250m

Leading the charge is crypto payments startup Rain, which secured a gargantuan $250 million capital injection in its Series C round.

This raises the company’s value to nearly $2 billion and positions the technology as core infrastructure for stablecoin commerce.

Often compared to Stripe but for stablecoins, Rain provides the rails for businesses to issue customised payment cards accepted anywhere Visa is supported.

The platform says it now processes more than $3 billion in annualised transaction volume, with major partners including Western Union.

Fresh capital will be deployed to accelerate international expansion across five continents as the firm pushes stablecoins deeper into mainstream commerce.

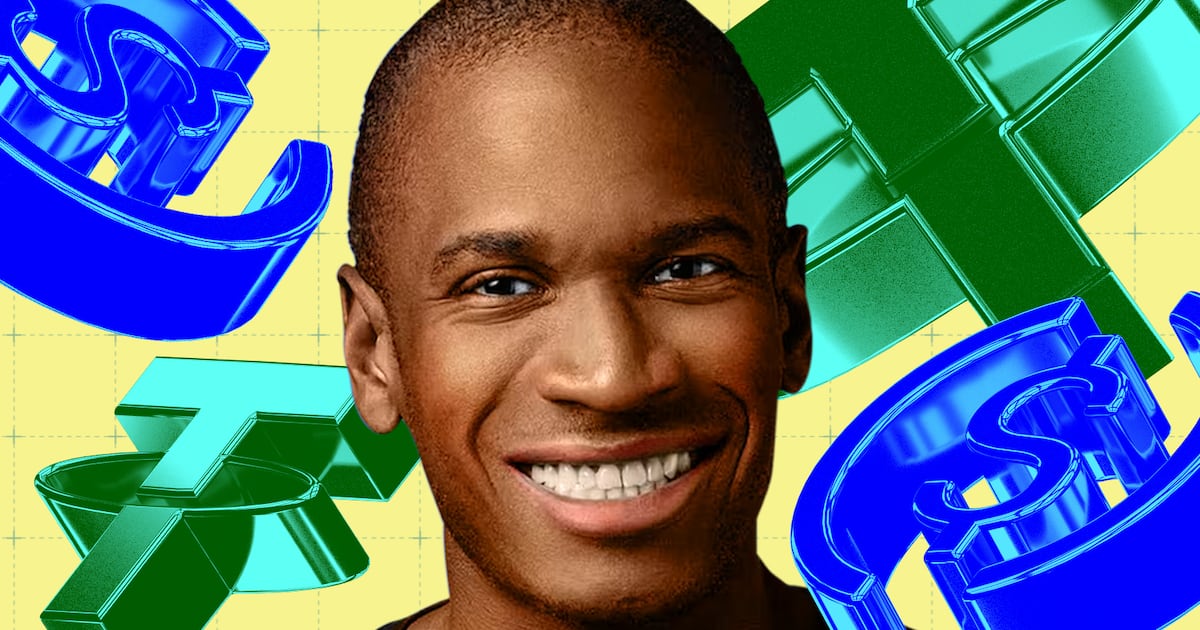

Alpaca, $150m

Trading infrastructure firm Alpaca raised $150 million in a Series D, lifting its valuation to $1.2 billion.

Investors included Citadel Securities, Revolut’s Vlad Yatsenko, and a slew of VCs.

Built as an API-first business, Alpaca underpins trading, data and custody for millions of accounts across 40 countries, serving clients such as Kraken.

“This milestone comes after a busy 2025, where we launched several key products and features, including 24/5 trading, fixed income, Instant Tokenisation Network, Fully Paid Securities Lending, and Omnibus Subaccounting technology,” the company said.

ICEx, $70m

Indonesian centralised exchange ICEx raised $70 million to expand its spot trading infrastructure and deepen its digital asset services for retail and institutional clients.

The exchange says it is positioning itself as a regulated gateway for South East Asia, anchored by compliant fiat off-ramps aligned with local banking rules.

The raise underscores the growth of localised products as regional exchanges in many countries compete with international giants like Coinbase.