January has been brutal for passive DeFi lenders. AAVE holders watched governance drama wipe hundreds of millions off market cap, Discord security failures push communities into chaos, and Binance quietly delisted a key trading pair.

For yield-focused investors searching for the best crypto to buy now, the question has shifted from “Is DeFi safe?” to “Where can capital actually work while markets reset?”

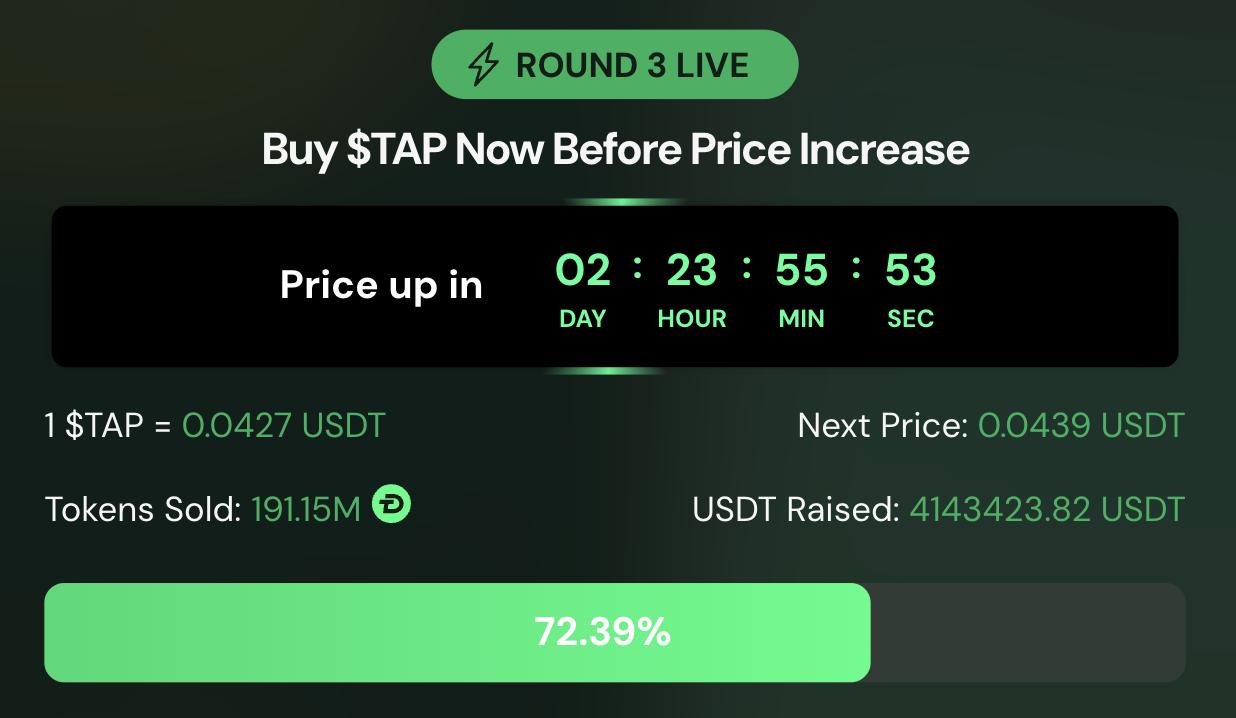

That search has pushed attention toward a crypto presale built around a real banking utility and providing incredible yields: Digitap ($TAP).

AAVE Faces A January Stress Test As Security And Liquidity Shift

AAVE has long been a cornerstone of DeFi lending. But mid-January exposed cracks that matter deeply to lenders. On January 15, multiple major protocols, including Aave, stepped away from Discord after phishing attacks drained user wallets. At the same time, Binance delisted the AAVE/FDUSD pair due to weak liquidity, reinforcing just how fragmented DeFi liquidity has become.

The real shock came earlier. In December, governance disputes over fee routing erased roughly $500 million from AAVE’s market cap. While whales quietly accumulated, smaller lenders faced a familiar dilemma: capital locked into low yields while platform risk headlines continued to stack up.

This is where yield migration begins, not from panic, but from fatigue.

Low APYs And Governance Noise Push Lenders To Rethink Strategy

Despite whale accumulation, AAVE lenders face a simple math problem. Lending APYs remain modest, governance uncertainty persists, and recent security incidents are no longer hypothetical risks.

Even a technically bullish rebound does not change the structural reality that yields are capped by protocol usage, market demand, and ongoing governance friction.

For investors focused on crypto to buy now for passive income, this creates a widening gap. Capital increasingly favors predictable returns, fixed rules, and platforms where incentives are transparent from day one.

This is where early-stage ecosystems like Digitap begin to enter the conversation organically, not as a replacement for DeFi, but as an alternative risk-reward structure.

Digitap Increasingly Listed as The Best Crypto Presale 2026

Digitap operates a live crypto-fiat banking app with multi-currency accounts, cards, and global payment rails already active. Instead of relying on lending demand cycles, its token mechanics are pre-defined with a fixed supply, no inflation, and staking rewards drawn from a capped pool.

For yield-focused investors evaluating altcoins to buy, this model reframes risk as something front-loaded and time-based rather than dependent on governance votes or liquidity conditions.

$TAP Draws Attention As Lenders Compare Returns And Structure

Digitap is a live crypto-fiat banking app with staking economics designed for bear markets. The platform combines a working omni-bank with crypto and fiat accounts, cards, and global payments alongside a fixed-supply ERC-20 token. The staking proposition is straightforward. Investors can access up to 124% APY during the presale, with rewards drawn from a capped pool rather than inflationary emissions.

At the current presale price of $0.0427, a $10,000 allocation buys roughly 277,000 $TAP. Staked at 124% APR, that position can generate approximately 343,000 $TAP over a year. At the confirmed launch price of $0.14, that reward alone equates to around $48,000, excluding the original principal.

This is not a promise of price speculation. It is a fixed price gap combined with a defined reward schedule, a structure that appeals to investors scanning altcoins to buy while markets consolidate.

What Yield Focused Investors Are Prioritizing Right Now

AAVE is not collapsing; it is stabilizing. But stabilization rarely excites yield hunters. In a market defined by caution, capital is moving toward structures with fixed rewards, capped supply, and clearly defined timelines.

That is why some AAVE lenders are rotating into Digitap’s crypto presale. A defined entry price, a confirmed launch price, and one of the highest non-inflationary staking yields currently available create a clear risk-reward profile.

As January unfolds, the hunt for the best crypto to buy now is not about chasing short-term pumps. It is about identifying systems that pay investors to wait, and in the current market, Digitap is clearly out in front.