Discover 7 key features of IPO Genie’s token model designed for long-term holders, including tiered access & staking rewards. Don't miss the presale investments!.

January 16, 2026, is not feeling like a quiet month in crypto. The Altcoin Season Index recently hit 55, its strongest reading in about three months, and market commentary is already pointing to a Q1 rotation setup. At the same time, the “real utility” theme is getting louder across 2026, especially around tokenization and private market access.

That is exactly where IPO Genie keeps showing up. It is being discussed as a top crypto presale Q1 2026 pick in multiple crypto publishers, largely because its holder model is built around access and incentives, not just price talk. And importantly, the claims below are grounded in IPO Genie’s own whitepaper and official site, not guesses.

Key takeaway:

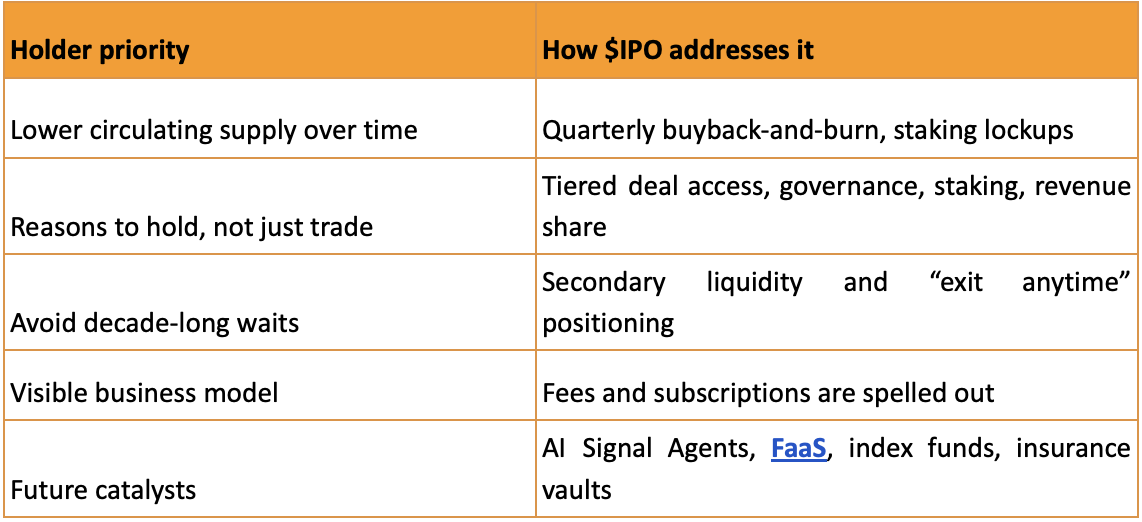

IPO Genie’s $IPO system is designed to give long-term holders more reasons to stay in, through tiered access, staking-linked advantages, a deflation plan, and a roadmap that keeps adding new use cases.

Why Presale Investments Feel Different in Late January 2026

A lot of buyers still carry one painful memory. They watched Bitcoin early. Then they waited too long. So now, when a presale has a visible structure and a clear end-of-window push, attention moves fast.

Meanwhile, Q1 2026 analysts concentrated on “alt season” signals strengthening, even if a full alt season is not confirmed yet.

IPO Genie is benefiting from that timing. Also, recent promo cycles helped pull in new wallets. Coverage has pointed to an airdrop campaign, a Black Friday bonus, a December sports sponsorship, and a Christmas bonus window that ran from late December into early January.

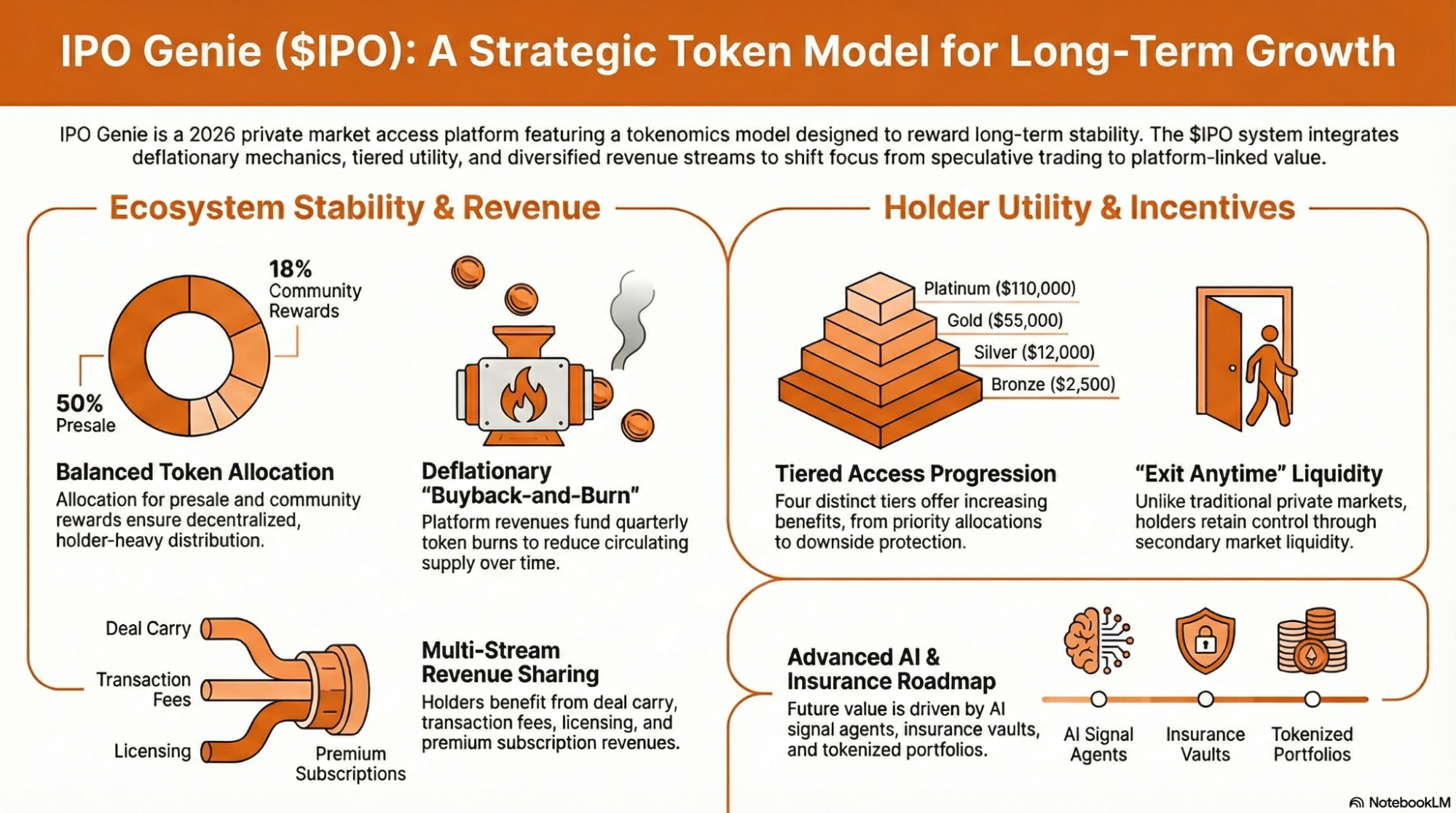

1) The Tokenomics Are Built to Keep Holders in the Loop

The supply and allocations are clearly stated. Total supply is 437,000,000,000 $IPO. Presale is 50%, liquidity and exchanges are 20%, community rewards are 18%, staking rewards are 7%, and the team is 5%.

This matters because many early participants avoid presales with fuzzy numbers. So a clear breakdown helps trust, which is a big factor in Presale investments.

2) The “Deflationary Presale” Design is not a slogan

IPO Genie clearly describes deflationary pressure through quarterly buyback-and-burn funded from platform revenues. Moreover, staking lockups reduce circulating supply.

Simply, if platform activity grows, the model is designed to support long-term holding behavior. However, it is still not a guarantee of returns, and the whitepaper is direct about that risk.

3) Staking is Positioned As More Than Yield

Many presales push staking as “free money.” IPO Genie frames it differently. Staking rewards are part of the token utility, and the growth strategy highlights a staking rewards program aimed at long-term holders, with APY plus allocation-style benefits.

So it fits what buyers search for when they want a Crypto presale with staking rewards. But with a more practical angle: staking as a path to stronger platform positioning.

4) Tiered Access Rewards Patience

IPO Genie lays out access tiers with clear thresholds:

Bronze ($2,500)

Silver ($12,000)

Gold ($55,000)

Platinum ($110,000)

Each has stronger benefits like priority allocations, guaranteed allocations, voting rights, and downside protection at the top tier.

That design is a simple reason people rush to join earlier. The earlier the buyer enters, the sooner they can build toward a tier that changes what they can access.

5) “Exit Anytime” No Lockup Problem

IPO Genie repeatedly contrasts its approach with classic private market lockups. The whitepaper calls out 7–10 year lockups as a core pain point. Then positions secondary liquidity and “exit anytime” as part of the solution.

That is why the “no lock-ins” message hits. People want upside, but they also want control.

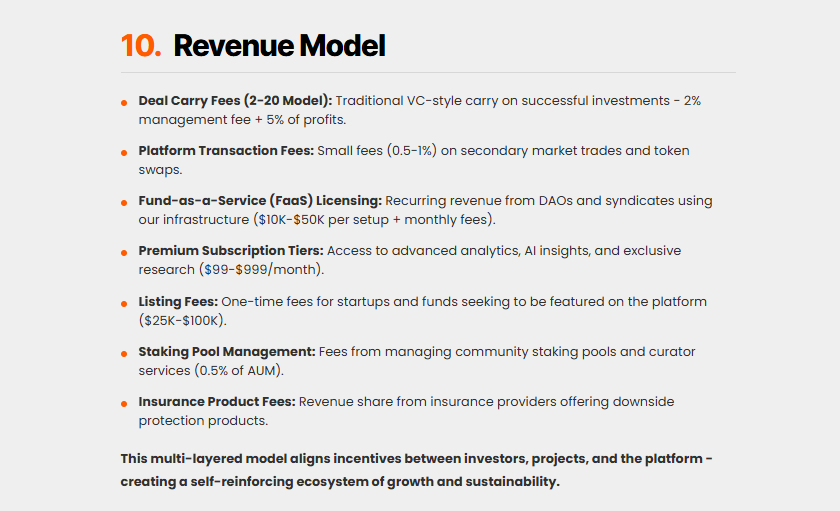

6) The Revenue Model Gives Holders a Clearer “Why?”

IPO Genie lists a multi-stream revenue model:

deal carry (2% management + 5% profits),

transaction fees (0.5–1%),

Fund-as-a-Service licensing,

premium subscriptions,

listing fees,

staking pool management fees,

and insurance-related fees.

Also, token utility includes revenue share tied to carry and transaction fees.

So there is a logical link between platform activity and holder benefits, at least by design. This is one reason the project keeps being grouped into “serious” Presale investments rather than quick-flip plays.

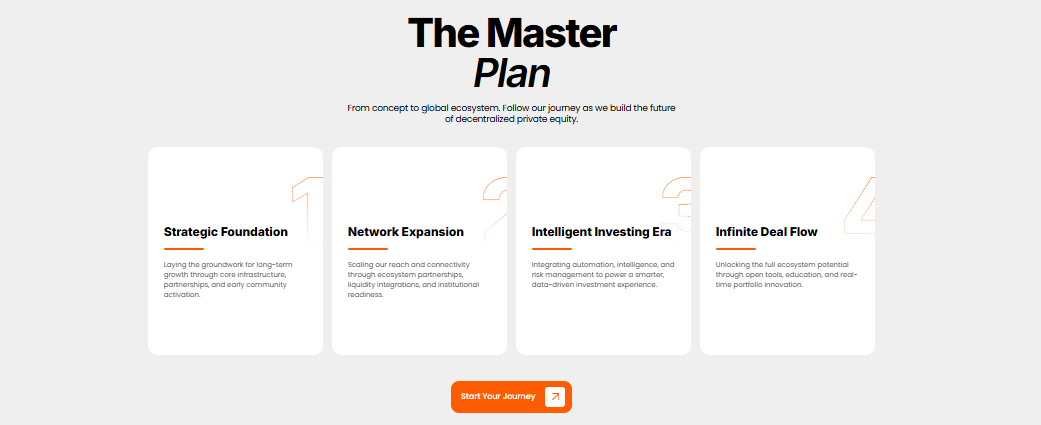

7) The Roadmap Keeps Adding Reasons to Hold into Q1 & Beyond

The roadmap is laid out in phases:

foundation,

expansion, an “intelligent investing era” with AI signal agents and insurance vaults,

then broader tools like SDKs,

an academy, tokenized portfolios, and a mobile app.

So the “hold case” is not one feature. Instead, it is a pipeline that can create new demand over time if execution matches the plan.

Quick table: What Long-Term Holders are Actually Buying into

What the January Deadline Pressure is Really About

The end-of-January window matters because presales are as much about positioning as price. If an investor believes IPO Genie is becoming the “most promising token in 2026,” the rational move is to enter before the crowd is fully priced in. Some publishers are already publishing bullish scenarios, while still warning readers to research carefully.

Also, the promo history shows how the team has been pulling attention in waves: airdrop, Black Friday bonus, and Misfits Boxing exposure in Dubai. And then the Christmas bonus window. That pattern often brings repeat investors, not just first-time clicks.

That is why, for many buyers, Presale investments in late January come down to one choice: join while it is still early, or watch it trend without them.

If you are looking for the top crypto presale in January 2026, then you’ll consider the $IPO because analysts say it’s the most promising token in 2026.