Bitcoin's network hashrate dropped below 1 zettahash per second Saturday for the first time since mid-September 2025, with current measurements showing 988 exahash per second based on seven-day moving averages.

The decline ends a four-month stretch of sustained computational power above the symbolic 1 ZH/s threshold, representing approximately 15% erosion from the October 19 peak of 1,162 EH/s, according to Hashrate Index data.

Mining difficulty simultaneously retreated to 146.47 trillion following a 1.2% downward adjustment January 8, marking the network's first recalibration of 2026 after reaching an all-time high of 155.97 trillion in late October.

Mining Conditions Shift

Hashprice, measuring revenue per petahash of computational power, rebounded 19.3% from November 21's $34.55 low to current levels near $41.22, though profitability remains 32% lower year-over-year as miners navigate post-halving economics.

The network has experienced four difficulty decreases since October's record, with the cumulative reduction of 9.5 trillion providing modest relief for operators facing compressed margins after April 2024's block subsidy cut from 6.25 to 3.125 BTC.

Transaction fees contributed just 0.72% of total block rewards over the past 24 hours, offering minimal revenue supplementation as the network maintains its security primarily through newly minted Bitcoin.

Read also: Why BlackRock's Bitcoin Transfers Between Coinbase Accounts Are Fueling Sell-Off Fears

Adjustment Outlook

Block production currently averages 10 minutes 34 seconds against the protocol's 10-minute target, positioning the next difficulty adjustment scheduled for January 22 toward an estimated 5.45% decline based on current block discovery rates.

JPMorgan analysts noted December's monthly average hashrate of 1,045 EH/s represented a 3% month-over-month decrease, signaling cooling competition among miners as some operators scaled back amid profitability pressures and rising energy costs.

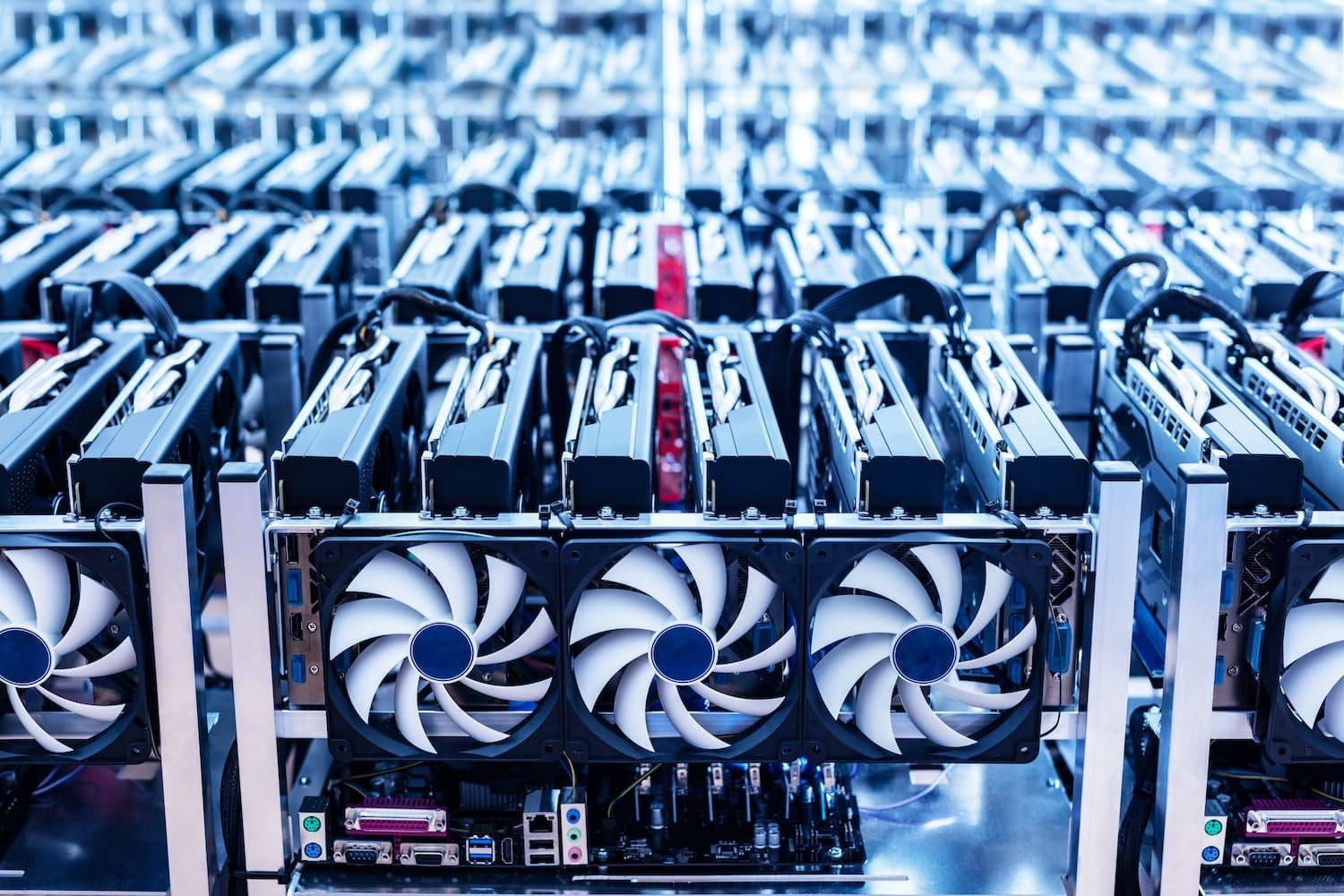

The hashrate retreat coincides with broader mining sector challenges as AI data centers increasingly compete for the same electrical infrastructure that Bitcoin miners historically relied upon for cost-competitive power access, tightening margins across the industry.

Read next: Ethereum Staking Contract Surpasses $256B As Nearly Half Of Supply Locked