Falling public interest in cryptocurrencies is increasingly being reflected on-chain, with stablecoin activity pointing to a broader slowdown in market engagement and risk appetite.

Recent data from Alphractal shows that search interest and social engagement around Bitcoin and altcoins have cooled, and that shift is now visible in stablecoin transaction volumes – often viewed as one of the clearest real-time indicators of liquidity, trading intensity, and user activity across crypto markets.

Key Takeaways

Stablecoin on-chain volumes are signaling reduced liquidity and lower risk appetite

USDT activity on Ethereum and Tron is losing momentum after strong growth phases

USDC growth reflects cautious, institutional-style participation rather than speculation

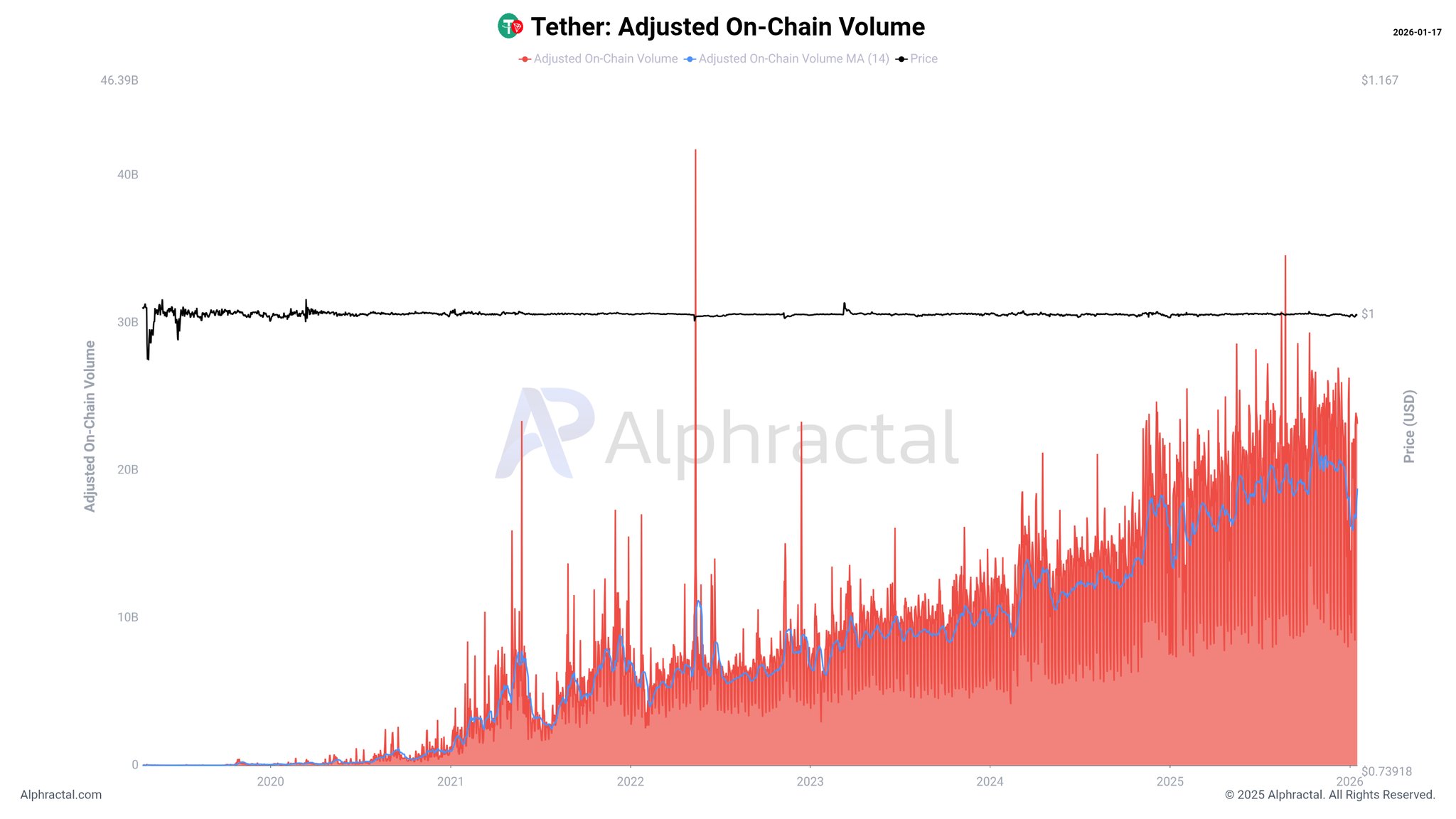

On Ethereum, USDT on-chain volumes have moved into a clear downward trend after a period of strong growth. This decline suggests reduced activity across areas such as DeFi, NFT trading, and more complex on-chain strategies, which typically thrive during periods of higher speculation and enthusiasm.

Historically, shrinking stablecoin flows on Ethereum have aligned with quieter market phases rather than aggressive accumulation or risk-taking.

Tron Shows Signs of Retail Slowdown

USDT activity on Tron, a network heavily used for payments, remittances, and spot trading, is also starting to lose momentum after an extended expansion phase. Because Tron is widely used by retail users and for cross-border transfers, the slowdown may point to softer global transaction demand rather than just speculative fatigue. The trend suggests a cooling in everyday crypto usage, not just trading activity.

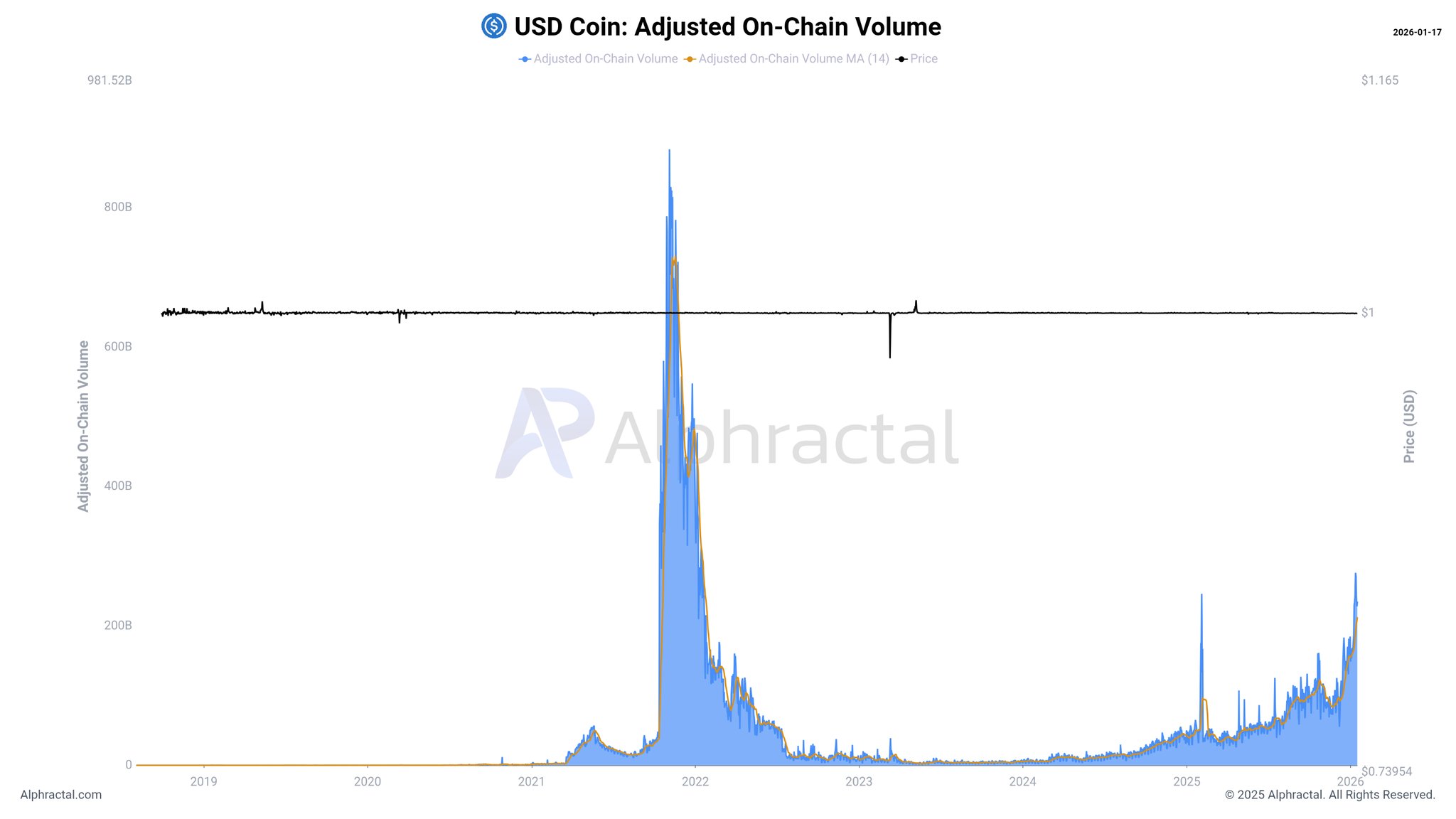

USDC Growth Signals Cautious Institutional Behavior

In contrast, USDC volumes across all chains continue to rise, though they remain well below the peaks reached during the 2021 bull market. The pattern suggests steady but conservative participation, consistent with institutional or treasury-style usage rather than speculative surges.

The absence of sharp volume spikes reinforces the view that current market participants are prioritizing capital preservation over aggressive positioning.

Stablecoin Data Paints a Defensive Market Picture

Taken together, stablecoin flows confirm a market environment characterized by consolidation rather than expansion. Lower social interest is translating into reduced on-chain activity, while the composition of stablecoin usage points to a more selective and risk-aware crypto landscape.

Historically, meaningful shifts in stablecoin volumes have often preceded major market moves, both upward and downward, making the current trends closely watched by analysts.