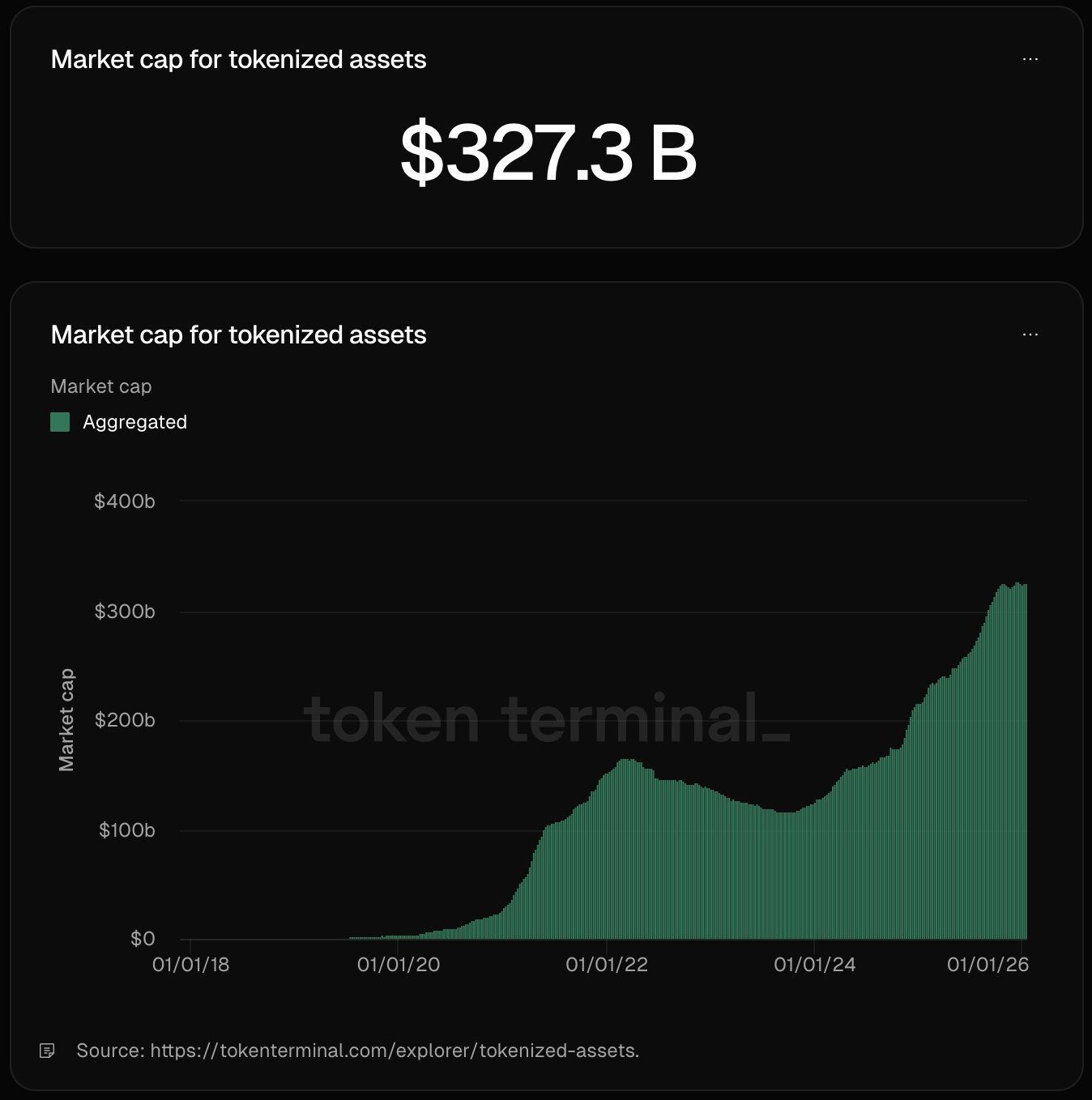

The global market for tokenized assets has climbed to a new all-time high, with total market capitalization reaching approximately $327.3 billion, according to data highlighted by Coin Bureau.

The milestone marks a sharp acceleration in the adoption of blockchain-based representations of real-world and financial assets.

Key takeaways:

Tokenized assets market cap has reached a new ATH of $327.3 billion

Growth has accelerated sharply over the past year

Institutional adoption is driving the latest expansion

Tokenization is increasingly viewed as financial infrastructure, not speculation

The latest figures show a steep upward curve over the past year, reversing the slowdown seen in earlier cycles and pushing total valuation well beyond previous peaks. Growth has been especially pronounced since mid-2024, suggesting renewed confidence in tokenization as a long-term structural trend rather than a temporary market cycle.

From experiment to infrastructure

Tokenized assets now span a wide range of categories, including tokenized government bonds, private credit, commodities, real estate, and on-chain investment funds. Much of the recent expansion is being driven by institutional participants, who are increasingly using blockchain rails to issue, manage, and settle assets more efficiently than through traditional financial systems.

Market observers note that the surge reflects more than speculative demand. Tokenization is gaining traction as a practical solution for improving liquidity, shortening settlement times, and enabling fractional ownership—particularly in markets that have historically been opaque, illiquid, or operationally complex.

The new record also highlights a broader shift underway in capital markets. As regulatory clarity improves across major jurisdictions and large financial institutions continue to launch on-chain products, tokenized assets are moving closer to the financial mainstream.

While the sector remains a small fraction of global financial markets overall, crossing the $327 billion threshold underscores how rapidly tokenization is scaling. If current trends persist, proponents argue that tokenized assets could evolve from an alternative investment category into a foundational layer for how value is issued, managed, and transferred globally.