The social-focused segment of the crypto market has emerged as one of the strongest performers over the past month, reigniting debate over whether a new narrative rotation is underway.

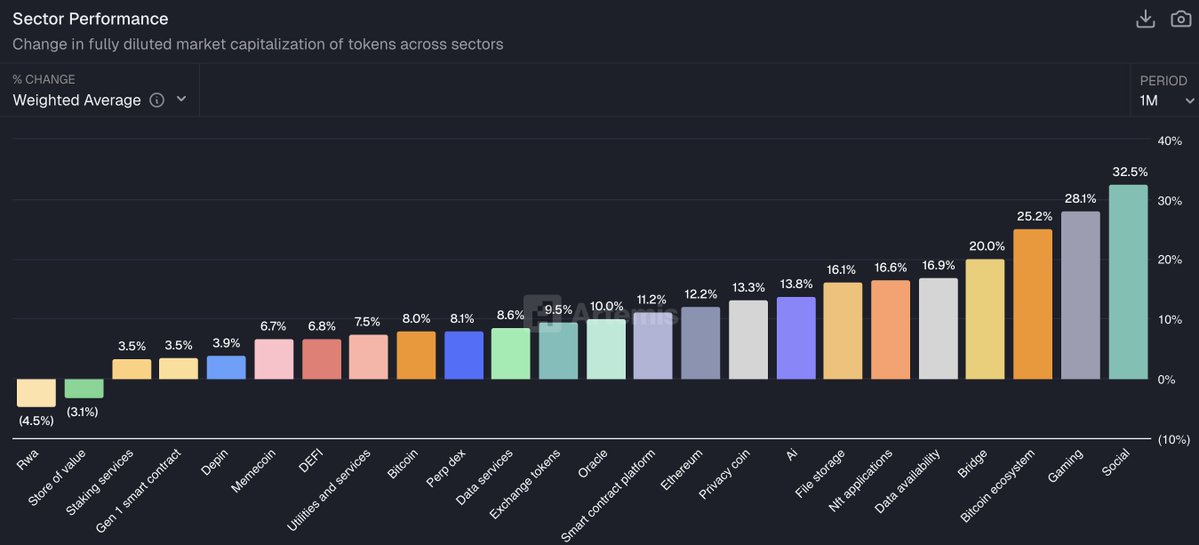

Data shared by Coin Bureau shows the social sector posting gains of up to 32.5% over the last 30 days, sharply outperforming most other crypto categories.

Key takeaways:

The social crypto sector is up as much as 32.5% over the past month

Market attention appears to be rotating back toward social-focused tokens

Real-world asset (RWA) tokens have declined roughly 4.5% over the same period

Sector performance suggests a shift in narrative momentum rather than broad market weakness

While social tokens have climbed to the top of the performance rankings, the real-world asset segment sits at the opposite end of the spectrum. RWA-related tokens recorded a decline of around 4.5%, signaling waning interest after a period of sustained attention earlier in the cycle.

Narrative rotation back toward engagement-driven crypto

The divergence highlights a familiar pattern in crypto markets: capital often rotates not just between assets, but between narratives. As infrastructure-heavy and compliance-focused sectors such as RWAs cool off, attention appears to be drifting back toward engagement-driven themes centered on identity, creators, communities, and onchain social interaction.

Other sectors posted more moderate gains, including gaming, data availability, and application-layer tokens, but none matched the pace of the social category. The outsized move suggests renewed speculation that social platforms, creator economies, and community-driven protocols could once again become focal points for short-term momentum.

Market participants caution that narrative shifts can be fragile. Social tokens have historically been among the most volatile segments, prone to sharp rallies followed by equally fast drawdowns. Still, the latest data indicates that traders are actively reallocating risk, favoring sectors tied more closely to user growth and attention than to long-term infrastructure buildout.

For now, the numbers point to a clear change in tone. Whether the social sector’s resurgence develops into a sustained trend or remains a short-lived rotation will depend on continued user engagement, capital inflows, and broader market conditions. What is clear is that narrative leadership in crypto is once again in motion.