Ethereum’s price fell below the $3,300 level in recent sessions, reflecting broader weakness across crypto markets. Despite the pullback, on-chain data indicates renewed strength in Ethereum’s staking ecosystem, with deposits, validator participation, and network activity rising even as ETH consolidates near a key support range.

Data from Beacon Chain trackers shows Ethereum’s Proof-of-Stake network entering early 2026 with elevated staking inflows. The number of ETH locked for network security has continued to climb, tightening the liquid supply available on the open market. This divergence between price performance and on-chain participation has drawn attention from market participants assessing longer-term network dynamics.

Staking Metrics Point to Reduced Liquid Supply

Reporter Naga Avan-Nomayo believed that ETH staking is not slowing because it has reached record levels, with roughly 36 million ETH now staked, representing close to 30% of the circulating supply. In parallel, balances held in the Ethereum deposit contract have grown to approximately 77.85 million ETH, or about 46.6% of total supply according to some on-chain dashboards. While these figures overlap due to how staking is accounted for, they underscore the concentration of ETH locked into the Proof-of-Stake system.

If you think ETH staking is slowing, the data says otherwise.

Ethereum staking just hit an all-time high, and institutions are leading the charge.

More than 36M ETH is now staked, with some 2.3M still in the entry queue.

It means large holders like Bitmine and Grayscale are… pic.twitter.com/0vCCjIeyo8

— Naga Avan-Nomayo (@JeSuisNaga) January 14, 2026

Validator activity reinforces this trend. The queue for new validators seeking to join the network has expanded to around 2.5 million ETH, the highest level recorded to date. At the same time, the exit queue for validators looking to withdraw has dropped close to zero, signaling limited immediate intent to unlock staked ETH. Together, these indicators suggest reduced short-term sell pressure from stakers, though they do not guarantee near-term price movements.

Network Activity Shows Signs of Acceleration

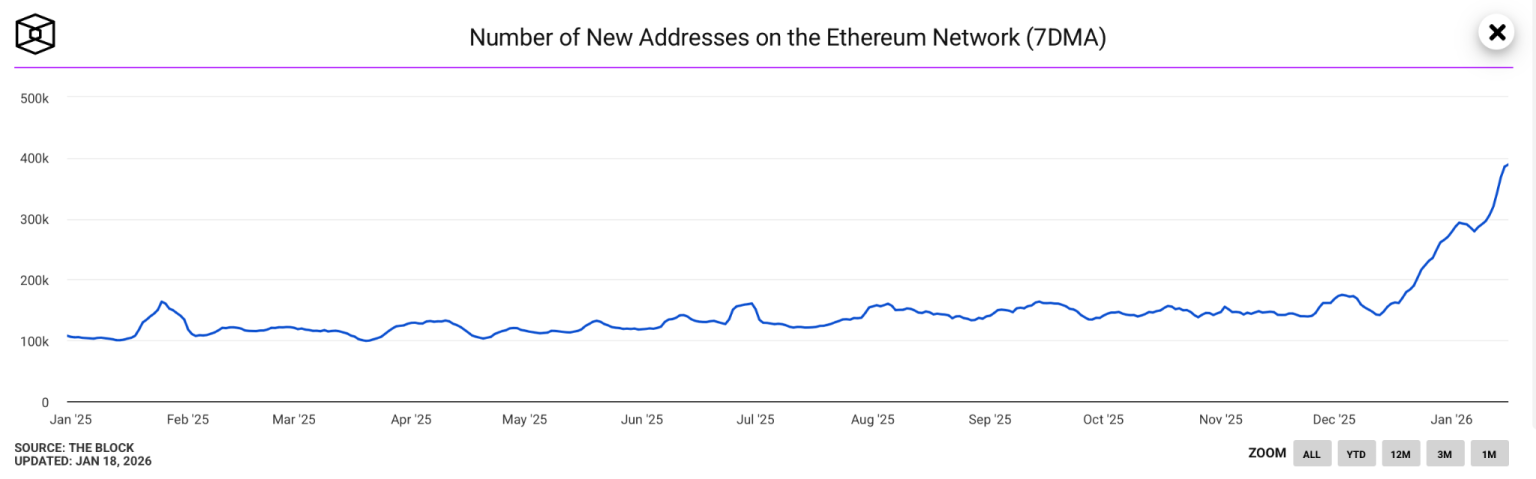

Beyond staking, Ethereum network usage has also picked up. The seven-day moving average of new Ethereum addresses has risen sharply entering January 2026, reaching the highest levels observed in recent months. Daily new addresses are currently ranging between 110,000 and 160,000, reflecting steady baseline adoption during the ongoing price consolidation.

Source: The Block

In late December and early January, address creation briefly spiked toward 400,000 per day, a level historically associated with periods of heightened network engagement. While increased address activity has previously coincided with stronger market phases, it primarily signals growing participation rather than immediate price direction.

Price Consolidation Amid Mixed Signals

ETH is currently trading within a relatively narrow range, roughly between $3,150 and $3,300, as buyers and sellers remain active near established support and resistance levels. Volatility has declined, compressing price action and reflecting uncertainty across the broader cryptocurrencies market.

The contrast between strong staking participation and muted price action highlights the complex forces shaping Ethereum’s market. While reduced liquid supply and rising network engagement may support longer-term fundamentals, near-term price behavior continues to be influenced by macro conditions, liquidity, and overall risk sentiment across crypto markets.